What is Global Styrene-Isoprene-Styrene Block Copolymer (SIS) Market?

The Global Styrene-Isoprene-Styrene Block Copolymer (SIS) Market is a significant segment within the broader polymer industry, characterized by its unique properties and versatile applications. SIS is a type of thermoplastic elastomer, which means it combines the elastic properties of rubber with the processability of plastics. This material is composed of styrene and isoprene blocks, which provide it with excellent elasticity, transparency, and resistance to wear and tear. These properties make SIS highly desirable in various industries, including adhesives, sealants, and coatings. The market for SIS is driven by its demand in manufacturing pressure-sensitive adhesives, which are used in tapes, labels, and medical products. Additionally, SIS is utilized in modifying plastics and asphalt, enhancing their performance characteristics. The global market for SIS is expanding due to increasing industrial applications and the growing need for high-performance materials. As industries continue to innovate and seek materials that offer both flexibility and durability, the demand for SIS is expected to rise, making it a crucial component in the development of advanced products across multiple sectors.

Styrene Content, below 20%, Styrene Content, above 20% in the Global Styrene-Isoprene-Styrene Block Copolymer (SIS) Market:

Styrene content in Styrene-Isoprene-Styrene Block Copolymer (SIS) plays a crucial role in determining the material's properties and applications. When the styrene content is below 20%, the SIS exhibits enhanced elasticity and flexibility, making it ideal for applications that require a high degree of stretchability and resilience. This lower styrene content results in a softer material, which is particularly beneficial in the production of pressure-sensitive adhesives. These adhesives are used in a variety of products, such as tapes and labels, where a strong yet flexible bond is essential. The lower styrene content also contributes to the material's transparency, which is a desirable attribute in applications where aesthetic appeal is important. On the other hand, when the styrene content is above 20%, the SIS becomes more rigid and durable. This higher styrene content enhances the material's strength and resistance to environmental factors, making it suitable for more demanding applications. For instance, in the modification of plastics and asphalt, a higher styrene content provides the necessary toughness and stability required for these materials to perform effectively under stress. The increased rigidity also makes SIS with higher styrene content suitable for use in automotive and construction industries, where materials are subjected to harsh conditions and must maintain their integrity over time. The choice between lower and higher styrene content in SIS depends largely on the specific requirements of the application. Industries that prioritize flexibility and transparency may opt for SIS with styrene content below 20%, while those that require enhanced strength and durability may prefer SIS with styrene content above 20%. This versatility in styrene content allows manufacturers to tailor the properties of SIS to meet the diverse needs of different applications, thereby expanding its utility across various sectors. As the global market for SIS continues to grow, understanding the impact of styrene content on the material's properties will be essential for manufacturers and end-users alike. By selecting the appropriate styrene content, companies can optimize the performance of SIS in their products, ensuring that they meet the specific demands of their respective industries. This adaptability makes SIS a valuable material in the development of innovative solutions that require a balance of flexibility, strength, and durability.

Pressure Sensitive Adhesives, Plastic and Asphalt Modification, Others in the Global Styrene-Isoprene-Styrene Block Copolymer (SIS) Market:

The Global Styrene-Isoprene-Styrene Block Copolymer (SIS) Market finds extensive usage in several key areas, including pressure-sensitive adhesives, plastic and asphalt modification, and other applications. In the realm of pressure-sensitive adhesives, SIS is highly valued for its ability to provide strong adhesion while maintaining flexibility. This makes it an ideal choice for products such as tapes, labels, and medical adhesives, where a reliable bond is crucial. The elasticity of SIS ensures that these adhesives can conform to various surfaces, providing a secure attachment without compromising on ease of removal. Additionally, the transparency of SIS enhances the aesthetic appeal of adhesive products, making them suitable for applications where appearance is important. In the modification of plastics, SIS is used to improve the impact resistance and flexibility of plastic materials. By incorporating SIS into plastic formulations, manufacturers can produce products that are more durable and capable of withstanding mechanical stress. This is particularly beneficial in the automotive and consumer goods industries, where plastic components are often subjected to rigorous use. The addition of SIS enhances the performance of these materials, ensuring that they meet the demanding requirements of modern applications. Similarly, in asphalt modification, SIS plays a crucial role in enhancing the properties of asphalt mixtures. The inclusion of SIS in asphalt formulations improves the material's elasticity and resistance to deformation, making it more suitable for use in road construction and maintenance. This results in longer-lasting road surfaces that can better withstand the stresses of traffic and environmental conditions. The use of SIS in asphalt modification is particularly important in regions with extreme weather conditions, where traditional asphalt may fail to perform adequately. Beyond these primary applications, SIS is also utilized in a variety of other industries. Its unique combination of properties makes it suitable for use in the production of footwear, where comfort and durability are essential. Additionally, SIS is used in the manufacture of toys, where its non-toxic nature and flexibility make it a safe and reliable material. The versatility of SIS extends to the packaging industry as well, where it is used to create flexible and durable packaging solutions. As the demand for high-performance materials continues to grow, the usage of SIS in these diverse applications is expected to increase, further solidifying its position in the global market.

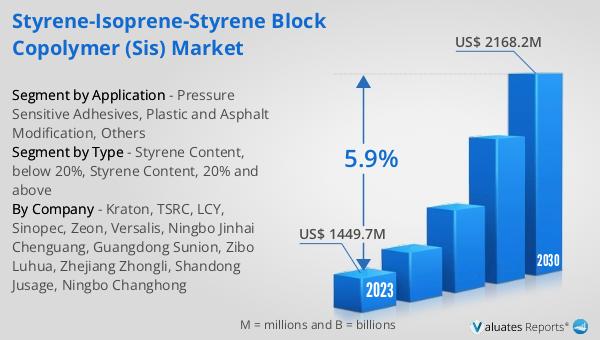

Global Styrene-Isoprene-Styrene Block Copolymer (SIS) Market Outlook:

The global market for Styrene-Isoprene-Styrene Block Copolymer (SIS) was valued at approximately $1,787 million in 2024, and it is anticipated to expand to a revised size of around $2,619 million by 2031, reflecting a compound annual growth rate (CAGR) of 5.7% over the forecast period. In China, isoprene is primarily utilized for the production of isoprene rubber and SIS, with isoprene rubber consumption accounting for about 25% and SIS consumption making up approximately 54%. This indicates a significant demand for SIS in the region, driven by its extensive applications across various industries. The growth in the SIS market can be attributed to the increasing need for high-performance materials that offer a balance of flexibility, strength, and durability. As industries continue to innovate and develop new products, the demand for SIS is expected to rise, further contributing to the market's expansion. The versatility of SIS, combined with its unique properties, makes it a valuable material in the development of advanced solutions that meet the evolving needs of modern applications. This growth trajectory highlights the importance of SIS in the global market and underscores its potential for continued success in the coming years.

| Report Metric | Details |

| Report Name | Styrene-Isoprene-Styrene Block Copolymer (SIS) Market |

| Accounted market size in year | US$ 1787 million |

| Forecasted market size in 2031 | US$ 2619 million |

| CAGR | 5.7% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| by Type |

|

| by Application |

|

| Production by Region |

|

| Consumption by Region |

|

| By Company | Kraton, TSRC, LCY, Sinopec, Zeon, Versalis (Eni), Ningbo Jinhai Chenguang, Guangdong Sunion, Zibo Luhua, Zhejiang Zhongli, Shandong Jusage, Ningbo Changhong |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |