What is Global R&D Tax Credit Services Market?

The Global R&D Tax Credit Services Market is a specialized sector that focuses on helping businesses maximize their research and development (R&D) tax credits. These services are crucial for companies that invest heavily in innovation, as they provide financial incentives to offset the costs associated with R&D activities. The market encompasses a range of services, including consulting, compliance, and advisory services, which assist businesses in identifying eligible R&D activities, calculating the potential tax credits, and ensuring compliance with relevant tax laws and regulations. By leveraging these services, companies can significantly reduce their tax liabilities, freeing up capital to reinvest in further innovation and growth. The market is driven by the increasing emphasis on innovation across various industries and the growing complexity of tax regulations, which necessitate expert guidance to navigate effectively. As businesses strive to remain competitive in a rapidly evolving global landscape, the demand for R&D tax credit services is expected to continue to grow, offering significant opportunities for service providers in this space.

Large Enterprise, SMEs in the Global R&D Tax Credit Services Market:

In the Global R&D Tax Credit Services Market, both large enterprises and small and medium-sized enterprises (SMEs) play pivotal roles, albeit with different dynamics and needs. Large enterprises, with their substantial resources and extensive R&D activities, are significant players in this market. They often have dedicated teams or departments focused on innovation and development, which makes them prime candidates for R&D tax credits. These enterprises typically engage in complex and large-scale R&D projects that require substantial investment. As a result, they stand to benefit significantly from R&D tax credits, which can offset a considerable portion of their R&D expenditures. The complexity and scale of their operations often necessitate the use of specialized R&D tax credit services to ensure compliance and maximize their tax benefits. These services help large enterprises navigate the intricate web of tax regulations and ensure that they are claiming all eligible credits. On the other hand, SMEs, while smaller in scale, are equally important to the R&D Tax Credit Services Market. These businesses often operate with limited resources and may not have dedicated R&D departments. However, they are often highly innovative and agile, making significant contributions to technological advancements and industry innovations. For SMEs, R&D tax credits can be a vital source of funding, enabling them to invest in new projects and technologies that they might not otherwise afford. The challenge for SMEs lies in the complexity of the tax credit application process, which can be daunting without expert assistance. R&D tax credit services provide these smaller enterprises with the necessary support to identify eligible activities, compile the required documentation, and submit accurate claims. This support is crucial for SMEs, as it allows them to focus on their core business activities while ensuring they are not missing out on valuable tax incentives. The market dynamics between large enterprises and SMEs in the R&D Tax Credit Services Market are characterized by a balance of scale and agility. Large enterprises benefit from their extensive resources and established processes, while SMEs leverage their flexibility and innovative spirit. Both types of businesses contribute to the overall growth and development of the market, driving demand for specialized services that cater to their unique needs. As the global economy continues to evolve, the importance of R&D tax credits in fostering innovation and competitiveness cannot be overstated. Both large enterprises and SMEs will continue to seek out these services to enhance their R&D efforts and maintain their competitive edge in the market.

Information Technology, Chemical Industry, Electronic Industry, Transportation Equipment, Scientific Research and Development Services, Machinery, Finance and Insurance, Others in the Global R&D Tax Credit Services Market:

The Global R&D Tax Credit Services Market finds application across a diverse range of industries, each leveraging these services to enhance their innovation capabilities and financial efficiency. In the Information Technology sector, companies invest heavily in developing new software, hardware, and digital solutions. R&D tax credit services help these firms identify eligible projects and streamline the process of claiming tax credits, thereby reducing their overall tax burden and freeing up resources for further innovation. Similarly, the Chemical Industry, known for its intensive research and development activities, benefits significantly from these services. Companies in this sector engage in the development of new compounds, materials, and processes, all of which can qualify for R&D tax credits. By utilizing specialized services, chemical companies can ensure compliance with complex tax regulations and maximize their eligible credits. The Electronic Industry, with its rapid pace of technological advancement, also relies heavily on R&D tax credit services. Companies in this sector are constantly innovating, developing new electronic devices and components. R&D tax credits provide a financial cushion that supports ongoing research efforts, enabling these companies to stay competitive in a fast-evolving market. In the Transportation Equipment sector, R&D tax credit services play a crucial role in supporting the development of new vehicles, components, and technologies. Companies in this industry invest in research to improve fuel efficiency, safety, and performance, all of which can qualify for tax credits. By leveraging these services, transportation equipment manufacturers can optimize their tax strategies and reinvest savings into further innovation. Scientific Research and Development Services, as a sector, inherently involves extensive R&D activities. Companies in this field are often at the forefront of innovation, developing new technologies and solutions across various domains. R&D tax credit services help these firms navigate the complexities of tax regulations, ensuring they receive the maximum benefits for their research efforts. The Machinery industry, which includes the development of new machinery and equipment, also benefits from R&D tax credit services. Companies in this sector invest in research to enhance the efficiency, performance, and sustainability of their products. By utilizing these services, machinery manufacturers can reduce their tax liabilities and reinvest savings into further research and development. In the Finance and Insurance sector, R&D tax credit services are used to support the development of new financial products, technologies, and solutions. Companies in this industry invest in research to improve customer experiences, enhance security, and streamline operations. R&D tax credits provide a financial incentive that supports these efforts, enabling firms to innovate and remain competitive. Other industries, including those not explicitly mentioned, also benefit from R&D tax credit services. These services provide a valuable tool for companies across various sectors to enhance their innovation capabilities, reduce their tax liabilities, and reinvest savings into further research and development. As the global economy continues to evolve, the importance of R&D tax credits in fostering innovation and competitiveness across industries cannot be overstated.

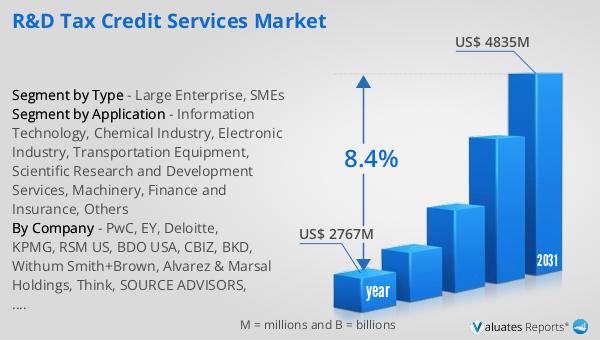

Global R&D Tax Credit Services Market Outlook:

The global market for R&D Tax Credit Services was valued at $2,767 million in 2024 and is anticipated to grow significantly, reaching an estimated size of $4,835 million by 2031. This growth trajectory represents a compound annual growth rate (CAGR) of 8.4% over the forecast period. Within this market, large enterprises hold a dominant position, accounting for over 70% of the market share. This is largely due to their extensive R&D activities and the substantial resources they allocate towards innovation. Large enterprises often have the infrastructure and expertise to engage in complex R&D projects, making them prime candidates for R&D tax credits. On the other hand, small and medium-sized enterprises (SMEs) make up nearly 30% of the market. While smaller in scale, SMEs are crucial contributors to innovation and technological advancement. They often rely on R&D tax credits as a vital source of funding to support their research efforts. The disparity in market share between large enterprises and SMEs highlights the different dynamics and needs within the R&D Tax Credit Services Market. As the market continues to grow, both large enterprises and SMEs will play essential roles in driving innovation and competitiveness across various industries.

| Report Metric | Details |

| Report Name | R&D Tax Credit Services Market |

| Accounted market size in year | US$ 2767 million |

| Forecasted market size in 2031 | US$ 4835 million |

| CAGR | 8.4% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | PwC, EY, Deloitte, KPMG, RSM US, BDO USA, CBIZ, BKD, Withum Smith+Brown, Alvarez & Marsal Holdings, Think, SOURCE ADVISORS, Anchin, Global Tax Management, Engineered Tax Services, RKL, Hull & Knarr, KBKG, Clarus Credits, Tri-Merit |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |