What is Global Wafer End Effectors Market?

The Global Wafer End Effectors Market refers to the industry focused on the production and distribution of specialized tools used in the semiconductor manufacturing process. These tools, known as wafer end effectors, are essential for handling delicate silicon wafers during various stages of semiconductor fabrication. The market encompasses a wide range of end effectors designed to operate in different environments, such as atmospheric and vacuum conditions. These tools are crucial for ensuring the precision and efficiency of wafer handling, which directly impacts the quality and yield of semiconductor devices. The market is driven by the increasing demand for advanced electronic devices, the miniaturization of semiconductor components, and the need for high-precision manufacturing processes. As the semiconductor industry continues to evolve, the Global Wafer End Effectors Market is expected to grow, driven by technological advancements and the rising adoption of automation in semiconductor fabrication facilities.

Metal Wafer End Effector, Ceramic Wafer End Effector, Carbon Composite (CFRP) End Effectors in the Global Wafer End Effectors Market:

Metal Wafer End Effectors, Ceramic Wafer End Effectors, and Carbon Composite (CFRP) End Effectors are three primary types of tools used in the Global Wafer End Effectors Market. Metal wafer end effectors are typically made from stainless steel or aluminum and are known for their durability and strength. They are commonly used in environments where robustness and resistance to wear and tear are crucial. These end effectors are designed to handle wafers with precision, minimizing the risk of damage during the handling process. Ceramic wafer end effectors, on the other hand, are made from materials such as alumina or zirconia. They are highly resistant to heat and chemical corrosion, making them ideal for use in high-temperature and chemically aggressive environments. Ceramic end effectors offer excellent dimensional stability and are less likely to contaminate the wafers, which is critical in maintaining the purity of semiconductor devices. Carbon Composite (CFRP) End Effectors are made from carbon fiber-reinforced polymers, which provide a unique combination of lightweight and high strength. These end effectors are particularly useful in applications where minimizing the weight of the handling tool is essential to reduce the load on robotic arms and improve overall system efficiency. CFRP end effectors also offer excellent vibration damping properties, which help in maintaining the stability and precision of wafer handling. Each type of end effector has its specific advantages and is chosen based on the requirements of the semiconductor manufacturing process. The choice of material and design of the end effector plays a crucial role in ensuring the efficiency, reliability, and quality of wafer handling operations in the semiconductor industry.

Atmospheric Wafer Robot, Vacuum Wafer Robot in the Global Wafer End Effectors Market:

The usage of Global Wafer End Effectors Market in Atmospheric Wafer Robots and Vacuum Wafer Robots is essential for the efficient handling of silicon wafers in different environments. Atmospheric wafer robots operate in environments where the pressure is similar to the ambient atmosphere. These robots are used in various stages of semiconductor manufacturing, such as wafer loading, unloading, and transfer between different processing equipment. The end effectors used in atmospheric wafer robots are designed to handle wafers with high precision and minimal contact to avoid contamination and damage. They are typically equipped with sensors and alignment mechanisms to ensure accurate positioning and handling of the wafers. Vacuum wafer robots, on the other hand, operate in low-pressure environments, such as vacuum chambers used in processes like chemical vapor deposition (CVD) and physical vapor deposition (PVD). The end effectors used in vacuum wafer robots must be designed to withstand the harsh conditions of the vacuum environment, including extreme temperatures and the absence of air. These end effectors are often made from materials that are resistant to outgassing and can maintain their structural integrity under vacuum conditions. The design of vacuum end effectors also includes features to minimize particle generation and ensure the cleanliness of the wafers. Both atmospheric and vacuum wafer robots play a critical role in the semiconductor manufacturing process, and the choice of end effectors is crucial for ensuring the efficiency and reliability of wafer handling operations. The Global Wafer End Effectors Market provides a wide range of solutions to meet the specific requirements of these robots, enabling semiconductor manufacturers to achieve high precision and yield in their production processes.

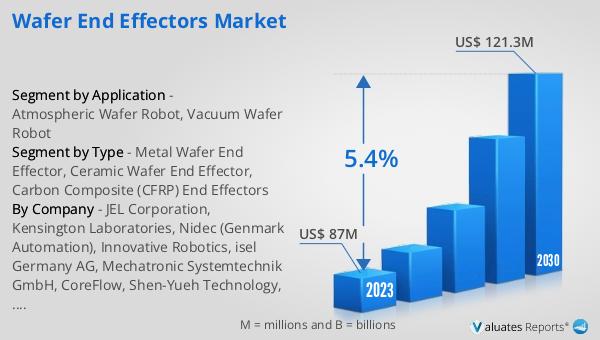

Global Wafer End Effectors Market Outlook:

The global Wafer End Effectors market was valued at US$ 87 million in 2023 and is anticipated to reach US$ 121.3 million by 2030, witnessing a CAGR of 5.4% during the forecast period 2024-2030. This market outlook highlights the steady growth and increasing demand for wafer end effectors in the semiconductor industry. The projected growth is driven by several factors, including the rising adoption of advanced electronic devices, the miniaturization of semiconductor components, and the need for high-precision manufacturing processes. As the semiconductor industry continues to evolve, the demand for efficient and reliable wafer handling solutions is expected to increase. The Global Wafer End Effectors Market is poised to benefit from technological advancements and the growing trend towards automation in semiconductor fabrication facilities. The market's growth trajectory indicates a positive outlook for manufacturers and suppliers of wafer end effectors, as they continue to innovate and develop new solutions to meet the evolving needs of the semiconductor industry.

| Report Metric | Details |

| Report Name | Wafer End Effectors Market |

| Accounted market size in 2023 | US$ 87 million |

| Forecasted market size in 2030 | US$ 121.3 million |

| CAGR | 5.4% |

| Base Year | 2023 |

| Forecasted years | 2024 - 2030 |

| Segment by Type |

|

| Segment by Application |

|

| Production by Region |

|

| Consumption by Region |

|

| By Company | JEL Corporation, Kensington Laboratories, Nidec (Genmark Automation), Innovative Robotics, isel Germany AG, Mechatronic Systemtechnik GmbH, CoreFlow, Shen-Yueh Technology, Coorstek, NGK SPARK PLUG, ASUZAC Fine Ceramics, Astel Srl - Semisyn division, CeramTec, Mindox Techno, Kyocera, Morgan Advanced Materials, Japan Fine Ceramics Co., Ltd. (JFC), 3M, Ferrotec, St.Cera Co., Ltd, SANWA ENGINEERING CORP., Shanghai Companion, Sanzer (Shanghai) New Materials Technology, Niterra Group |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |