What is Global Training CRM Software Market?

The Global Training CRM Software Market is a dynamic and evolving sector that focuses on providing customer relationship management (CRM) solutions specifically tailored for training and educational purposes. This market encompasses software tools designed to help organizations manage interactions with their clients, streamline administrative processes, and enhance the overall training experience. These CRM systems are crucial for training providers, educational institutions, and corporate training departments as they offer functionalities such as scheduling, enrollment management, communication tools, and performance tracking. By leveraging these tools, organizations can improve their operational efficiency, personalize learning experiences, and ultimately increase customer satisfaction. The market is driven by the growing demand for efficient training management solutions, the increasing adoption of digital learning platforms, and the need for organizations to maintain competitive advantage through continuous learning and development. As technology continues to advance, the Global Training CRM Software Market is expected to expand, offering more sophisticated and integrated solutions to meet the diverse needs of its users.

Cloud-based, On Premise in the Global Training CRM Software Market:

In the Global Training CRM Software Market, solutions are typically categorized into two main deployment models: cloud-based and on-premise. Cloud-based CRM solutions are hosted on the vendor's servers and accessed via the internet, offering flexibility and scalability. These solutions are particularly appealing to organizations that require remote access, as they allow users to connect from anywhere with an internet connection. Cloud-based systems are often subscription-based, reducing the need for significant upfront investment in hardware and infrastructure. This model is ideal for organizations that prioritize cost-effectiveness, ease of use, and the ability to quickly scale operations as needed. Additionally, cloud-based solutions often come with automatic updates and maintenance, ensuring that users always have access to the latest features and security enhancements. On the other hand, on-premise CRM solutions are installed locally on an organization's own servers and computers. This model provides greater control over data and customization, making it suitable for organizations with specific security requirements or those that need to integrate the CRM system with other on-site applications. While on-premise solutions may require a larger initial investment and ongoing maintenance, they offer the advantage of complete data ownership and the ability to tailor the system to meet unique business needs. Organizations that choose on-premise solutions often have dedicated IT teams to manage the infrastructure and ensure system reliability. Both deployment models have their own set of advantages and challenges, and the choice between cloud-based and on-premise solutions largely depends on an organization's specific requirements, budget, and IT capabilities. As the Global Training CRM Software Market continues to grow, vendors are increasingly offering hybrid solutions that combine the benefits of both models, providing organizations with greater flexibility and choice. These hybrid solutions allow organizations to leverage the scalability and accessibility of the cloud while maintaining control over sensitive data and critical applications on-premise. This approach is particularly beneficial for organizations that operate in highly regulated industries or those with complex IT environments. Ultimately, the decision between cloud-based and on-premise CRM solutions should be guided by an organization's strategic goals, operational needs, and long-term vision for growth and innovation.

Large Enterprises, SMEs in the Global Training CRM Software Market:

The usage of Global Training CRM Software Market solutions varies significantly between large enterprises and small to medium-sized enterprises (SMEs), reflecting their distinct operational needs and resource capabilities. Large enterprises often have complex organizational structures and diverse training requirements, necessitating robust CRM systems that can handle high volumes of data and support extensive user bases. These organizations typically benefit from CRM solutions that offer advanced analytics, integration capabilities with other enterprise systems, and customizable features to address specific business processes. For large enterprises, CRM software is instrumental in managing large-scale training programs, tracking employee progress, and ensuring compliance with industry standards. The ability to centralize training data and automate administrative tasks allows these organizations to optimize resource allocation and improve overall training effectiveness. In contrast, SMEs generally have more limited resources and simpler training needs, making cost-effective and user-friendly CRM solutions a priority. Cloud-based CRM systems are particularly popular among SMEs due to their affordability, ease of implementation, and minimal IT infrastructure requirements. These solutions enable SMEs to efficiently manage client interactions, streamline enrollment processes, and enhance communication with trainees. By leveraging CRM software, SMEs can improve customer satisfaction, increase retention rates, and gain valuable insights into training outcomes. Despite their differences, both large enterprises and SMEs share a common goal of enhancing the quality and efficiency of their training programs. As the Global Training CRM Software Market continues to evolve, vendors are increasingly offering solutions that cater to the unique needs of both segments, providing scalable and customizable options that support growth and innovation. Whether through cloud-based or on-premise deployments, CRM software plays a crucial role in helping organizations of all sizes achieve their training objectives and maintain a competitive edge in the marketplace.

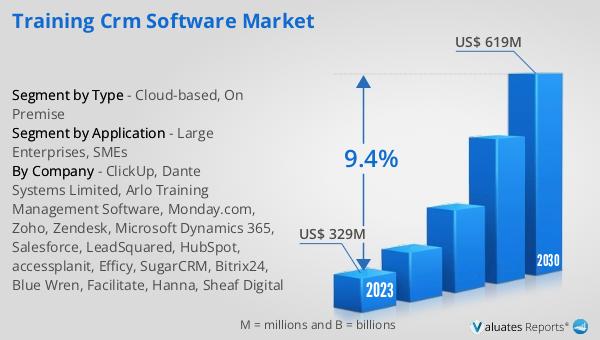

Global Training CRM Software Market Outlook:

The outlook for the Global Training CRM Software Market indicates a promising growth trajectory, with projections suggesting an increase from $361 million in 2024 to $671 million by 2031. This growth, at a compound annual growth rate (CAGR) of 9.4% from 2025 to 2031, is driven by the expansion of critical product segments and the diversification of end-use applications. The market's upward trend reflects the increasing demand for efficient and effective training management solutions across various industries. As organizations continue to recognize the value of investing in employee development and customer education, the need for sophisticated CRM systems that can support these initiatives becomes more pronounced. The market's growth is also fueled by technological advancements, such as artificial intelligence and machine learning, which are enhancing the capabilities of CRM software and enabling more personalized and data-driven training experiences. Additionally, the shift towards digital learning platforms and the growing emphasis on remote and hybrid work environments are contributing to the market's expansion. As a result, the Global Training CRM Software Market is poised to play a pivotal role in shaping the future of training and development, offering innovative solutions that empower organizations to achieve their strategic goals and drive long-term success.

| Report Metric | Details |

| Report Name | Training CRM Software Market |

| Accounted market size in 2024 | US$ 361 million |

| Forecasted market size in 2031 | US$ 671 million |

| CAGR | 9.4% |

| Base Year | 2024 |

| Forecasted years | 2025 - 2031 |

| Segment by Type |

|

| Segment by Application |

|

| Sales by Region |

|

| By Company | ClickUp, Dante Systems Limited, Arlo Training Management Software, Monday.com, Zoho, Zendesk, Microsoft Dynamics 365, Salesforce, LeadSquared, HubSpot, accessplanit, Efficy, SugarCRM, Bitrix24, Blue Wren, Facilitate, Hanna, Sheaf Digital |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |