What is Global Hexagonal Diffractive Microlens Arrays Market?

The Global Hexagonal Diffractive Microlens Arrays Market is a specialized segment within the broader optics and photonics industry. These microlens arrays are composed of tiny, hexagonally arranged lenses that diffract light in specific ways to enhance optical performance. They are used in various applications, from improving image quality in cameras to enhancing the efficiency of light collection in sensors. The hexagonal arrangement allows for a compact design, maximizing the number of lenses in a given area, which is particularly beneficial in miniaturized devices. This market is driven by the increasing demand for high-performance optical components in industries such as consumer electronics, automotive, and biomedical devices. As technology advances, the need for more sophisticated optical solutions grows, making hexagonal diffractive microlens arrays an essential component in modern optical systems. The market is characterized by continuous innovation, with companies investing in research and development to improve the efficiency and functionality of these arrays. As a result, the Global Hexagonal Diffractive Microlens Arrays Market is poised for significant growth, driven by technological advancements and the expanding application of these arrays in various industries.

Fused Silica Type, Polymer Type, Glass Type in the Global Hexagonal Diffractive Microlens Arrays Market:

In the Global Hexagonal Diffractive Microlens Arrays Market, different materials are used to manufacture these arrays, each offering unique properties and benefits. Fused silica is one of the most commonly used materials due to its excellent optical transparency and thermal stability. It is highly resistant to thermal shock and can withstand high temperatures, making it ideal for applications that require durability and precision. Fused silica microlens arrays are often used in high-performance optical systems where clarity and stability are paramount. Polymer-based microlens arrays, on the other hand, offer flexibility and cost-effectiveness. Polymers can be easily molded into complex shapes, allowing for the production of customized microlens arrays tailored to specific applications. They are lightweight and can be produced in large volumes, making them suitable for consumer electronics and other mass-market applications. However, polymers may not offer the same level of thermal stability as fused silica, which can limit their use in high-temperature environments. Glass-type microlens arrays provide a balance between the properties of fused silica and polymers. They offer good optical clarity and can be manufactured with high precision. Glass is also more durable than polymers, making it suitable for applications that require a longer lifespan. However, glass microlens arrays can be more expensive to produce than polymer ones, which can be a consideration for cost-sensitive applications. Each material type has its advantages and limitations, and the choice of material often depends on the specific requirements of the application. For instance, in applications where thermal stability and optical clarity are critical, fused silica may be the preferred choice. In contrast, for applications where cost and flexibility are more important, polymer-based microlens arrays may be more suitable. The diversity of materials available in the Global Hexagonal Diffractive Microlens Arrays Market allows manufacturers to tailor their products to meet the specific needs of different industries, driving innovation and growth in this dynamic market.

Consumer Electronics, Automotive Electronics, Biomedical Devices, Industrial Machinery, Photonics Products, Aerospace & Defense, Others in the Global Hexagonal Diffractive Microlens Arrays Market:

The Global Hexagonal Diffractive Microlens Arrays Market finds applications across a wide range of industries, each leveraging the unique properties of these arrays to enhance their products and technologies. In consumer electronics, microlens arrays are used to improve the performance of cameras and displays. They enhance image quality by increasing light collection efficiency and reducing optical aberrations, resulting in sharper and more vibrant images. This is particularly important in smartphones and digital cameras, where space is limited, and performance is critical. In automotive electronics, microlens arrays are used in advanced driver-assistance systems (ADAS) and head-up displays (HUDs). They help improve the accuracy and reliability of sensors and cameras, enhancing safety and user experience. In biomedical devices, microlens arrays are used in imaging systems and diagnostic equipment. They enable high-resolution imaging and precise light control, which are essential for accurate diagnostics and research. In industrial machinery, microlens arrays are used in laser systems and optical sensors. They enhance the precision and efficiency of these systems, improving productivity and reducing costs. In photonics products, microlens arrays are used to manipulate light in various ways, enabling the development of innovative optical devices. In aerospace and defense, microlens arrays are used in imaging and targeting systems. They enhance the performance of these systems, providing better accuracy and reliability in challenging environments. Other applications include telecommunications, where microlens arrays are used to improve signal quality and transmission efficiency. The versatility and performance of hexagonal diffractive microlens arrays make them an essential component in many modern technologies, driving demand and growth in the market.

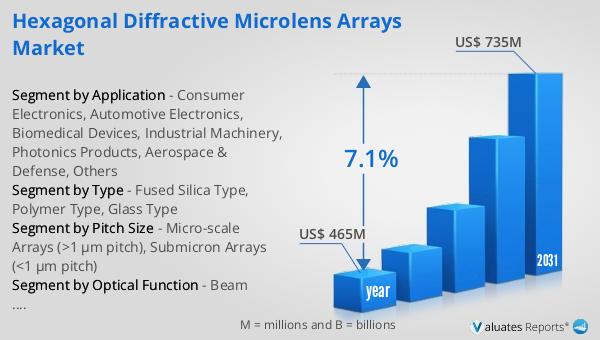

Global Hexagonal Diffractive Microlens Arrays Market Outlook:

The global market for Hexagonal Diffractive Microlens Arrays was valued at $465 million in 2024 and is expected to grow significantly in the coming years. By 2031, it is projected to reach a revised size of $735 million, reflecting a compound annual growth rate (CAGR) of 7.1% during the forecast period. This growth is driven by the increasing demand for advanced optical components across various industries. As technology continues to evolve, the need for more sophisticated optical solutions becomes more pronounced, and hexagonal diffractive microlens arrays are well-positioned to meet this demand. The market's expansion is also supported by ongoing research and development efforts aimed at improving the performance and functionality of these arrays. Companies are investing in new materials and manufacturing techniques to enhance the efficiency and versatility of microlens arrays, further fueling market growth. Additionally, the growing adoption of microlens arrays in emerging applications, such as augmented reality and virtual reality, is expected to contribute to the market's expansion. As a result, the Global Hexagonal Diffractive Microlens Arrays Market is poised for robust growth, driven by technological advancements and the increasing application of these arrays in various industries.

| Report Metric | Details |

| Report Name | Hexagonal Diffractive Microlens Arrays Market |

| Accounted market size in year | US$ 465 million |

| Forecasted market size in 2031 | US$ 735 million |

| CAGR | 7.1% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| Segment by Type |

|

| Segment by Optical Function |

|

| Segment by Pitch Size |

|

| Segment by Application |

|

| Production by Region |

|

| Consumption by Region |

|

| By Company | Holographix, NIL Technology, Avantier, AGC Group, Leister Group, Focuslight, Holo/Or, temicon, SUSS MicroOptics, Nalux, Nissei Technology, HOLOEYE Photonics, ORAFOL Fresnel Optics, Syntec Optics, Coligh Optics, Chineselens Optics, PowerPhotonic, INGENERIC, Teledyne, NSG Group |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |