What is Global Radial Head Prostheses Market?

The Global Radial Head Prostheses Market is a specialized segment within the broader orthopedic devices industry, focusing on the development and distribution of prosthetic implants designed to replace the radial head of the elbow joint. This market is driven by the increasing prevalence of elbow injuries and conditions such as fractures, arthritis, and degenerative joint diseases, which necessitate surgical intervention and the use of prosthetic solutions. Radial head prostheses are crucial in restoring the function and stability of the elbow joint, allowing patients to regain mobility and reduce pain. The market encompasses a range of products, including various sizes and types of implants, to cater to the diverse needs of patients and healthcare providers. Technological advancements and innovations in materials and design have significantly improved the performance and longevity of these prostheses, further fueling market growth. Additionally, the rising awareness about the benefits of early surgical intervention and the availability of advanced healthcare infrastructure in developed regions contribute to the expanding demand for radial head prostheses. As the global population ages and the incidence of joint-related ailments increases, the Global Radial Head Prostheses Market is poised for continued growth and development.

Below 20 mm, 20 - 25 mm, Above 25 mm in the Global Radial Head Prostheses Market:

In the Global Radial Head Prostheses Market, the classification based on size is crucial for addressing the specific anatomical and clinical needs of patients. The size categories, namely Below 20 mm, 20 - 25 mm, and Above 25 mm, are designed to accommodate the varying dimensions of the radial head in different individuals. The Below 20 mm category is typically used for smaller patients, including women and younger individuals, where the radial head is naturally smaller. These prostheses are engineered to provide a snug fit and ensure optimal joint function without causing undue stress on the surrounding bone and tissues. The 20 - 25 mm category represents the most common size range, catering to the average adult population. This size is often preferred due to its versatility and ability to fit a wide range of patients, making it a staple in orthopedic surgeries. Prostheses in this category are designed to mimic the natural anatomy of the elbow joint, providing stability and a full range of motion. The Above 25 mm category is reserved for larger patients, often males, who have a naturally larger radial head. These prostheses are crafted to provide the necessary support and alignment for larger anatomical structures, ensuring that the joint functions efficiently post-surgery. Each size category is meticulously designed to address specific clinical scenarios, taking into account factors such as bone quality, the extent of joint damage, and the patient's overall health. The choice of size is critical in ensuring the success of the surgical procedure and the long-term outcomes for the patient. Surgeons must carefully assess the patient's anatomy and select the appropriate prosthesis size to achieve the best possible results. The availability of multiple size options in the Global Radial Head Prostheses Market underscores the industry's commitment to personalized patient care and the advancement of orthopedic treatment methodologies. As the market continues to evolve, manufacturers are likely to focus on further refining these size categories, incorporating advanced materials and design features to enhance the performance and durability of radial head prostheses.

Uncemented, Cemented in the Global Radial Head Prostheses Market:

The usage of Global Radial Head Prostheses Market products can be broadly categorized into two types: Uncemented and Cemented prostheses. Uncemented prostheses are designed to be press-fitted into the bone without the use of bone cement. These implants rely on the natural growth of bone tissue to secure the prosthesis in place, promoting biological fixation. This type of prosthesis is often preferred for younger patients with good bone quality, as it allows for natural bone integration and potentially longer-lasting results. The uncemented approach is advantageous in that it reduces the risk of complications associated with bone cement, such as cement leakage or allergic reactions. Additionally, uncemented prostheses can be easier to revise or replace if necessary, as they do not require the removal of cemented material. On the other hand, Cemented prostheses are fixed in place using bone cement, providing immediate stability and fixation. This type of prosthesis is often used in older patients or those with compromised bone quality, where the natural bone may not be strong enough to support an uncemented implant. Cemented prostheses offer the advantage of immediate weight-bearing and joint function, which can be crucial for patients requiring rapid recovery and rehabilitation. The choice between uncemented and cemented prostheses depends on various factors, including the patient's age, bone quality, and the surgeon's preference and expertise. Both types of prostheses have their own set of benefits and limitations, and the decision must be tailored to the individual patient's needs and clinical circumstances. The Global Radial Head Prostheses Market continues to innovate in both uncemented and cemented categories, with manufacturers focusing on improving the materials and design of these implants to enhance their performance and longevity. As the market evolves, the development of hybrid prostheses that combine the benefits of both uncemented and cemented approaches may offer new possibilities for patient care and surgical outcomes.

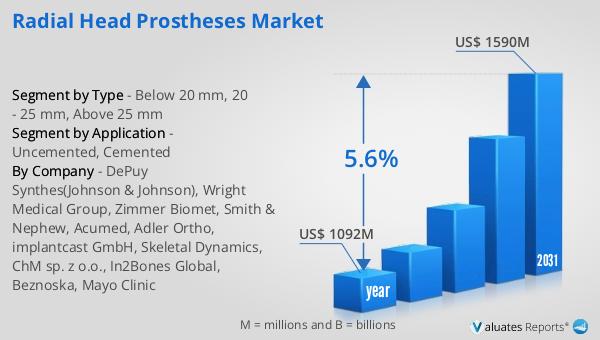

Global Radial Head Prostheses Market Outlook:

The global market for Radial Head Prostheses was valued at $1,092 million in 2024 and is anticipated to grow to a revised size of $1,590 million by 2031, reflecting a compound annual growth rate (CAGR) of 5.6% during the forecast period. The market is dominated by the top five manufacturers, which include DePuy Synthes, Johnson & Johnson, Wright Medical Group, Zimmer Biomet, Smith & Nephew, and Acumed, collectively holding a market share exceeding 70%. Among these, DePuy Synthes, a subsidiary of Johnson & Johnson, stands out as the largest manufacturer, commanding a market share of over 70%. North America emerges as the most significant consumer market for radial head prostheses, accounting for more than 40% of the global market share. In terms of product type, the 20 - 25 mm size category holds a substantial market share, exceeding 45%. When considering the application field, the uncemented industrial segment surpasses a 70% market share. These figures underscore the market's robust growth trajectory and the pivotal role of leading manufacturers and regions in shaping its future.

| Report Metric | Details |

| Report Name | Radial Head Prostheses Market |

| Accounted market size in year | US$ 1092 million |

| Forecasted market size in 2031 | US$ 1590 million |

| CAGR | 5.6% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| Segment by Type |

|

| Segment by Application |

|

| Consumption by Region |

|

| By Company | DePuy Synthes(Johnson & Johnson), Wright Medical Group, Zimmer Biomet, Smith & Nephew, Acumed, Adler Ortho, implantcast GmbH, Skeletal Dynamics, ChM sp. z o.o., In2Bones Global, Beznoska, Mayo Clinic |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |