What is Global Oil and Gas Wireless Automation Market?

The Global Oil and Gas Wireless Automation Market refers to the integration of wireless technologies in the oil and gas industry to enhance operational efficiency, safety, and productivity. This market encompasses a range of wireless solutions that facilitate real-time data transmission, remote monitoring, and control of various processes in oil and gas exploration, production, and distribution. Wireless automation technologies are increasingly being adopted due to their ability to reduce the need for extensive cabling, lower installation and maintenance costs, and provide flexibility in harsh and remote environments. These technologies include Wi-Fi, Bluetooth, Zigbee, cellular networks, and other mesh networks, each offering unique advantages in terms of range, data transfer speed, and energy consumption. The adoption of wireless automation in the oil and gas sector is driven by the need for improved operational efficiency, enhanced safety measures, and the ability to make data-driven decisions in real-time. As the industry continues to face challenges such as fluctuating oil prices, regulatory pressures, and the need for sustainable practices, wireless automation provides a viable solution to optimize operations and maintain competitiveness in the global market.

Wi-Fi, Bluetooth and Bluetooth Low Energy (BLE), Zigbee and Other Mesh Networks, Cellular (LTE, 5G), Other in the Global Oil and Gas Wireless Automation Market:

Wi-Fi, Bluetooth, Bluetooth Low Energy (BLE), Zigbee, and other mesh networks, along with cellular technologies like LTE and 5G, play pivotal roles in the Global Oil and Gas Wireless Automation Market. Wi-Fi is widely used for its high-speed data transfer capabilities, making it suitable for applications requiring large data volumes, such as video surveillance and real-time data analytics. Its ability to cover extensive areas makes it ideal for onshore facilities where infrastructure can support its deployment. Bluetooth and BLE, on the other hand, are preferred for short-range communication, offering low power consumption and cost-effectiveness. BLE is particularly advantageous in sensor networks where devices need to operate for extended periods without frequent battery replacements. Zigbee and other mesh networks are designed for low-power, low-data-rate applications, making them suitable for monitoring and control systems in remote and harsh environments. These networks can form self-healing, scalable systems that ensure reliable communication even if some nodes fail, which is crucial in offshore platforms where maintenance can be challenging. Cellular technologies like LTE and 5G provide wide-area coverage and high-speed connectivity, enabling seamless communication between onshore and offshore facilities. The advent of 5G is expected to revolutionize the industry by offering ultra-reliable low-latency communication, supporting applications such as autonomous drilling and real-time remote operations. Other wireless technologies, such as satellite communication, are also employed in the oil and gas sector, particularly for offshore operations where terrestrial networks are unavailable. These technologies ensure continuous connectivity and data exchange, which are vital for maintaining operational efficiency and safety. The integration of these wireless technologies in the oil and gas industry not only enhances operational capabilities but also supports the industry's digital transformation efforts, enabling the adoption of advanced technologies such as the Internet of Things (IoT), artificial intelligence (AI), and machine learning (ML) for predictive maintenance, asset management, and process optimization. As the industry continues to evolve, the role of wireless automation technologies will become increasingly significant in driving innovation and sustainability.

Onshore, Offshore in the Global Oil and Gas Wireless Automation Market:

The usage of Global Oil and Gas Wireless Automation Market technologies in onshore and offshore operations is transforming the industry by enhancing efficiency, safety, and sustainability. Onshore operations benefit significantly from wireless automation technologies due to the vast infrastructure and complex processes involved. Wireless solutions enable real-time monitoring and control of equipment, reducing the need for manual inspections and minimizing downtime. For instance, Wi-Fi and cellular networks facilitate seamless communication and data exchange between field devices and central control systems, allowing operators to make informed decisions quickly. Bluetooth and BLE are used in sensor networks to monitor equipment health and environmental conditions, providing critical data for predictive maintenance and reducing the risk of equipment failure. Zigbee and other mesh networks are employed in remote areas where traditional communication infrastructure is lacking, ensuring reliable data transmission and control. In offshore operations, wireless automation technologies are crucial due to the challenging and hazardous environment. The deployment of wireless solutions reduces the need for extensive cabling, which is costly and difficult to maintain in offshore platforms. Cellular technologies like LTE and 5G provide robust connectivity for remote monitoring and control, enabling operators to manage offshore facilities from onshore control centers. This capability is particularly important for ensuring safety and efficiency in operations such as drilling, production, and transportation of oil and gas. Zigbee and mesh networks are used to create resilient communication systems that can withstand harsh environmental conditions and ensure continuous data flow. Satellite communication is also employed in offshore operations to maintain connectivity in areas where terrestrial networks are unavailable. The integration of wireless automation technologies in both onshore and offshore operations supports the industry's digital transformation efforts, enabling the adoption of advanced technologies such as IoT, AI, and ML for enhanced operational efficiency and sustainability. As the industry faces increasing pressure to reduce environmental impact and improve safety, wireless automation provides a viable solution to achieve these goals while maintaining competitiveness in the global market.

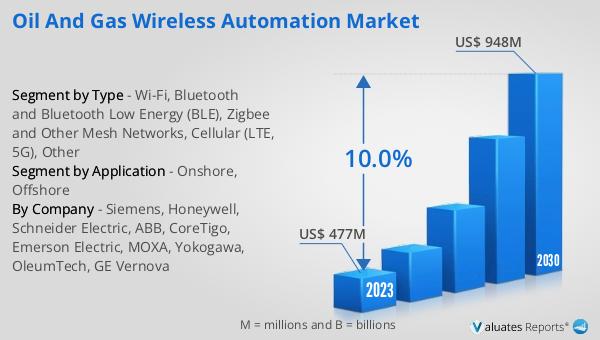

Global Oil and Gas Wireless Automation Market Outlook:

The global Oil and Gas Wireless Automation market is anticipated to experience significant growth, expanding from an estimated $535 million in 2024 to approximately $1,033 million by 2031. This growth trajectory, marked by a compound annual growth rate (CAGR) of 10.0% from 2025 to 2031, is driven by the increasing adoption of wireless automation technologies across various product segments and end-use applications. The market's expansion is fueled by the industry's need to enhance operational efficiency, safety, and sustainability in the face of fluctuating oil prices, regulatory pressures, and the demand for cleaner energy solutions. Wireless automation technologies offer a cost-effective and flexible solution to these challenges, enabling real-time data transmission, remote monitoring, and control of processes in both onshore and offshore operations. The integration of advanced wireless technologies such as Wi-Fi, Bluetooth, Zigbee, LTE, and 5G is transforming the oil and gas industry, supporting the adoption of digital transformation initiatives and advanced technologies like IoT, AI, and ML. As the industry continues to evolve, the role of wireless automation will become increasingly significant in driving innovation and maintaining competitiveness in the global market.

| Report Metric | Details |

| Report Name | Oil and Gas Wireless Automation Market |

| Accounted market size in 2024 | US$ 535 in million |

| Forecasted market size in 2031 | US$ 1033 million |

| CAGR | 10.0% |

| Base Year | 2024 |

| Forecasted years | 2025 - 2031 |

| Segment by Type |

|

| Segment by Application |

|

| Sales by Region |

|

| By Company | Siemens, Honeywell, Schneider Electric, ABB, CoreTigo, Emerson Electric, MOXA, Yokogawa, OleumTech, GE Vernova |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |