What is Global Ceramic Ferrule Sales Market?

The Global Ceramic Ferrule Sales Market is a specialized segment within the broader industrial and telecommunications sectors, focusing on the production and distribution of ceramic ferrules. These small, cylindrical components are crucial in fiber optic technology, serving as alignment sleeves that ensure precise connections between optical fibers. The market's growth is driven by the increasing demand for high-speed internet and data transmission, which relies heavily on fiber optic networks. Ceramic ferrules are preferred for their durability, thermal stability, and resistance to wear and tear, making them ideal for maintaining the integrity of fiber optic connections. As industries worldwide continue to digitize and expand their communication infrastructures, the demand for reliable and efficient components like ceramic ferrules is expected to rise. This market is characterized by a mix of established manufacturers and emerging players, all striving to innovate and improve the performance of their products to meet the evolving needs of their customers. The global reach of this market is evident as it caters to various regions, each with its unique demands and technological advancements.

in the Global Ceramic Ferrule Sales Market:

In the Global Ceramic Ferrule Sales Market, various types of ceramic ferrules are utilized by customers based on their specific needs and applications. The most common types include LC, SC, ST, and FC ceramic ferrules, each designed to cater to different fiber optic connector standards. LC ceramic ferrules are widely used due to their compact size and high-density applications, making them ideal for modern data centers and telecommunication networks where space is a premium. SC ceramic ferrules, known for their snap-in connector design, provide a secure and reliable connection, often used in cable TV and local area networks. ST ceramic ferrules, with their twist-on mechanism, are favored in industrial settings where robust and durable connections are necessary. FC ceramic ferrules, featuring a screw-on design, are typically used in high-vibration environments due to their secure fit. Each type of ferrule is crafted to meet specific performance criteria, such as insertion loss and return loss, ensuring optimal signal transmission. The choice of ferrule type often depends on the specific requirements of the application, including the type of fiber optic cable used, the environmental conditions, and the desired level of performance. Customers in the telecommunications industry, for instance, may prioritize ferrules that offer low insertion loss and high return loss to maintain signal integrity over long distances. In contrast, industrial customers might focus on ferrules that provide robust mechanical stability and resistance to harsh environmental conditions. The diversity in ferrule types allows manufacturers to cater to a wide range of applications, from high-speed internet and data transmission to specialized industrial and military applications. As technology continues to evolve, the demand for more advanced and efficient ceramic ferrules is expected to grow, driving innovation and competition within the market. Manufacturers are continually investing in research and development to enhance the performance and reliability of their products, ensuring they meet the ever-changing needs of their customers. This dynamic market landscape presents both challenges and opportunities for companies operating in the Global Ceramic Ferrule Sales Market, as they strive to maintain a competitive edge and capture a larger share of the market.

in the Global Ceramic Ferrule Sales Market:

The Global Ceramic Ferrule Sales Market finds applications across a wide range of industries, each leveraging the unique properties of ceramic ferrules to enhance their operations. In the telecommunications sector, ceramic ferrules are integral to the development and maintenance of fiber optic networks, which form the backbone of modern communication systems. These networks rely on ceramic ferrules to ensure precise alignment and connection of optical fibers, enabling high-speed data transmission and reliable internet connectivity. As the demand for faster and more reliable communication networks continues to grow, the use of ceramic ferrules in this sector is expected to increase. In addition to telecommunications, ceramic ferrules are also used in the medical industry, particularly in medical imaging and diagnostic equipment. The precision and reliability of ceramic ferrules make them ideal for applications where accurate data transmission is critical. For instance, in endoscopic procedures, ceramic ferrules help ensure the accurate transmission of visual data from the endoscope to the display monitor, aiding in accurate diagnosis and treatment. The automotive industry is another significant user of ceramic ferrules, particularly in advanced driver-assistance systems (ADAS) and other in-vehicle communication systems. These systems rely on fiber optic technology to transmit data quickly and accurately, enhancing vehicle safety and performance. Ceramic ferrules play a crucial role in maintaining the integrity of these systems, ensuring they function reliably under various driving conditions. Furthermore, the aerospace and defense industries utilize ceramic ferrules in communication and navigation systems, where reliability and precision are paramount. The harsh environmental conditions encountered in these industries require components that can withstand extreme temperatures and mechanical stress, making ceramic ferrules an ideal choice. As industries continue to innovate and adopt new technologies, the applications for ceramic ferrules are expected to expand, driving further growth in the Global Ceramic Ferrule Sales Market.

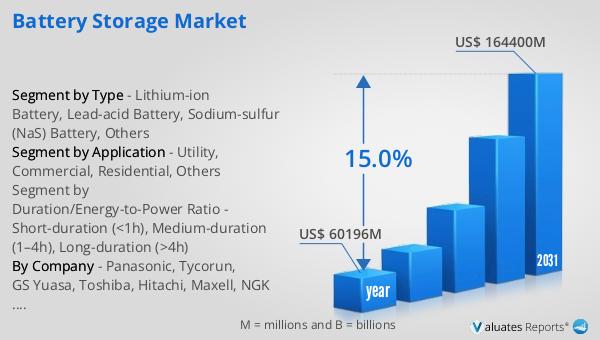

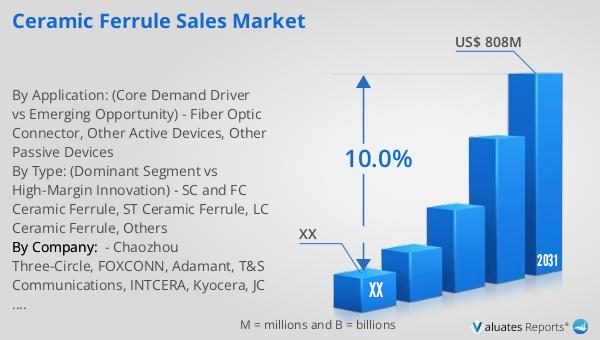

Global Ceramic Ferrule Sales Market Outlook:

The outlook for the Global Ceramic Ferrule Sales Market indicates a promising growth trajectory. In 2024, the market was valued at approximately $418 million, and projections suggest that by 2031, it will reach an adjusted size of $808 million. This growth is expected to occur at a compound annual growth rate (CAGR) of 10.0% during the forecast period from 2025 to 2031. A significant factor contributing to this growth is the dominance of the top five manufacturers, who collectively hold over 60% of the market share. This concentration of market power underscores the competitive nature of the industry, where leading companies leverage their expertise and resources to maintain their market positions. Among the various product segments, LC ceramic ferrules stand out as the largest, accounting for more than 49% of the market share. This dominance can be attributed to the widespread adoption of LC connectors in high-density applications, such as data centers and telecommunications networks, where space efficiency and performance are critical. The market's growth is further fueled by the increasing demand for high-speed internet and data transmission, which relies heavily on fiber optic technology. As industries continue to digitize and expand their communication infrastructures, the need for reliable and efficient components like ceramic ferrules is expected to rise. This dynamic market landscape presents both challenges and opportunities for companies operating in the Global Ceramic Ferrule Sales Market, as they strive to maintain a competitive edge and capture a larger share of the market.

| Report Metric | Details |

| Report Name | Ceramic Ferrule Sales Market |

| Forecasted market size in 2031 | US$ 808 million |

| CAGR | 10.0% |

| Forecasted years | 2025 - 2031 |

| By Type: (Dominant Segment vs High-Margin Innovation) |

|

| By Application: (Core Demand Driver vs Emerging Opportunity) |

|

| By Region |

|

| By Company: | Chaozhou Three-Circle, FOXCONN, Adamant, T&S Communications, INTCERA, Kyocera, JC COM, Shenzhen Yida, SEIKOH GIKEN, Thorlabs, Ningbo Yunsheng, LEAD Fiber Optics, Ningbo CXM, Shenzhen WAHLEEN, Huangshi Sunshine, Kunshan Ensure, KSI, Swiss Jewel, BO LAI TE, SINO OPTIC, Kientec Systems |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |