What is Global Automotive-grade SiC Devices (Discrete) Market?

The Global Automotive-grade SiC Devices (Discrete) Market refers to the market for silicon carbide (SiC) devices specifically designed for automotive applications. These devices are known for their high efficiency, high thermal conductivity, and ability to operate at high temperatures and voltages, making them ideal for use in electric vehicles (EVs) and hybrid electric vehicles (HEVs). The market includes various types of discrete SiC devices such as MOSFETs, diodes, JFETs, and FETs, which are used in different automotive systems to improve performance and efficiency. The increasing demand for EVs and HEVs, driven by the need for cleaner and more efficient transportation solutions, is a major factor contributing to the growth of this market. Additionally, advancements in SiC technology and the growing adoption of SiC devices in automotive applications are expected to further drive market growth.

SiC MOSFET Discrete, SiC Diode Discrete (SiC SBD), Others (SiC JFETs & FETs) in the Global Automotive-grade SiC Devices (Discrete) Market:

SiC MOSFET Discrete devices are a type of silicon carbide transistor that offers superior performance compared to traditional silicon-based MOSFETs. They are known for their high efficiency, fast switching speeds, and ability to operate at high temperatures and voltages. These characteristics make SiC MOSFETs ideal for use in automotive applications such as electric traction inverters, on-board chargers (OBC), and DC/DC converters. SiC Diode Discrete devices, also known as SiC Schottky Barrier Diodes (SBD), are another type of SiC device used in automotive applications. They offer low forward voltage drop, high switching speed, and high thermal conductivity, making them suitable for use in power conversion and rectification applications in EVs and HEVs. Other types of SiC devices used in the automotive market include SiC JFETs (Junction Field-Effect Transistors) and SiC FETs (Field-Effect Transistors). SiC JFETs are known for their high efficiency and fast switching speeds, while SiC FETs offer high thermal conductivity and the ability to operate at high temperatures and voltages. These devices are used in various automotive applications to improve performance and efficiency, reduce energy losses, and enhance the overall reliability of the vehicle's electrical systems. The adoption of SiC devices in the automotive market is driven by the need for more efficient and reliable power electronics solutions, as well as the increasing demand for EVs and HEVs. As the automotive industry continues to evolve and the demand for cleaner and more efficient transportation solutions grows, the use of SiC devices in automotive applications is expected to increase significantly.

Main Inverter (Electric Traction), OBC, DC/DC Converter for EV/HEV in the Global Automotive-grade SiC Devices (Discrete) Market:

The usage of Global Automotive-grade SiC Devices (Discrete) Market in Main Inverter (Electric Traction), OBC, and DC/DC Converter for EV/HEV is crucial for enhancing the performance and efficiency of electric and hybrid vehicles. In the Main Inverter, which is responsible for converting the DC power from the battery to AC power to drive the electric motor, SiC MOSFETs and SiC Diodes play a vital role. These devices offer high efficiency, fast switching speeds, and the ability to operate at high temperatures and voltages, which helps in reducing energy losses and improving the overall performance of the inverter. The use of SiC devices in the Main Inverter also contributes to reducing the size and weight of the inverter, which is essential for improving the overall efficiency and range of the vehicle. In the On-Board Charger (OBC), which is responsible for converting the AC power from the grid to DC power to charge the vehicle's battery, SiC MOSFETs and SiC Diodes are used to improve the efficiency and reduce the charging time. The high efficiency and fast switching speeds of SiC devices help in reducing energy losses during the charging process, which results in faster charging times and improved overall efficiency of the OBC. Additionally, the ability of SiC devices to operate at high temperatures and voltages allows for the design of more compact and lightweight OBCs, which is essential for improving the overall efficiency and range of the vehicle. In the DC/DC Converter, which is responsible for converting the DC power from the battery to the required voltage levels for various electrical systems in the vehicle, SiC MOSFETs and SiC Diodes are used to improve the efficiency and reduce energy losses. The high efficiency and fast switching speeds of SiC devices help in reducing energy losses during the power conversion process, which results in improved overall efficiency of the DC/DC Converter. Additionally, the ability of SiC devices to operate at high temperatures and voltages allows for the design of more compact and lightweight DC/DC Converters, which is essential for improving the overall efficiency and range of the vehicle. The adoption of SiC devices in these key automotive applications is driven by the need for more efficient and reliable power electronics solutions, as well as the increasing demand for EVs and HEVs. As the automotive industry continues to evolve and the demand for cleaner and more efficient transportation solutions grows, the use of SiC devices in automotive applications is expected to increase significantly.

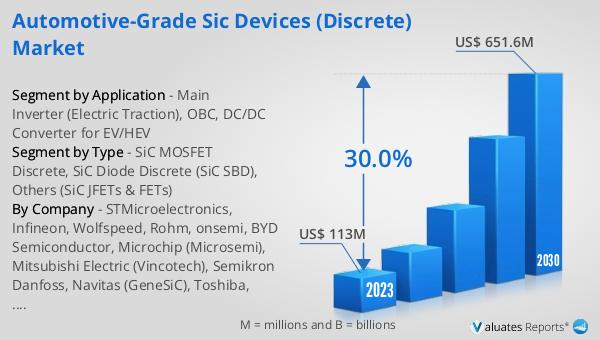

Global Automotive-grade SiC Devices (Discrete) Market Outlook:

The global Automotive-grade SiC Devices (Discrete) market was valued at US$ 113 million in 2023 and is anticipated to reach US$ 651.6 million by 2030, witnessing a compound annual growth rate (CAGR) of 30.0% during the forecast period from 2024 to 2030. The market is highly competitive, with the top three players holding a share of over 70 percent, and the top five players holding a share of over 80 percent. This indicates a high level of market concentration, with a few key players dominating the market. The rapid growth of the market is driven by the increasing demand for electric vehicles (EVs) and hybrid electric vehicles (HEVs), as well as advancements in SiC technology and the growing adoption of SiC devices in automotive applications. The high efficiency, fast switching speeds, and ability to operate at high temperatures and voltages make SiC devices ideal for use in various automotive applications, including electric traction inverters, on-board chargers (OBC), and DC/DC converters. As the automotive industry continues to evolve and the demand for cleaner and more efficient transportation solutions grows, the use of SiC devices in automotive applications is expected to increase significantly, driving the growth of the global Automotive-grade SiC Devices (Discrete) market.

| Report Metric | Details |

| Report Name | Automotive-grade SiC Devices (Discrete) Market |

| Accounted market size in 2023 | US$ 113 million |

| Forecasted market size in 2030 | US$ 651.6 million |

| CAGR | 30.0% |

| Base Year | 2023 |

| Forecasted years | 2024 - 2030 |

| Segment by Type |

|

| Segment by Application |

|

| Production by Region |

|

| Consumption by Region |

|

| By Company | STMicroelectronics, Infineon, Wolfspeed, Rohm, onsemi, BYD Semiconductor, Microchip (Microsemi), Mitsubishi Electric (Vincotech), Semikron Danfoss, Navitas (GeneSiC), Toshiba, San'an Optoelectronics, CETC 55, BASiC Semiconductor, Bosch, Zhuzhou CRRC Times Electric, Guangdong AccoPower Semiconductor |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |