What is Global Artificial Intelligence In Insurtech Market?

The Global Artificial Intelligence in Insurtech Market represents a transformative shift in the insurance industry, leveraging advanced AI technologies to enhance various aspects of insurance operations. This market encompasses the integration of AI-driven solutions in insurance technology, aiming to streamline processes, improve customer experiences, and optimize risk management. Insurtech, a blend of insurance and technology, is revolutionizing traditional insurance practices by incorporating AI tools such as machine learning, natural language processing, and predictive analytics. These technologies enable insurers to automate claims processing, personalize customer interactions, and detect fraudulent activities more efficiently. The global reach of AI in insurtech signifies its widespread adoption across different regions, driven by the increasing demand for digital transformation in the insurance sector. As insurers strive to remain competitive and meet evolving customer expectations, the adoption of AI technologies becomes imperative. The market's growth is fueled by the need for cost-effective solutions, enhanced operational efficiency, and improved decision-making capabilities. Overall, the Global Artificial Intelligence in Insurtech Market is poised to reshape the insurance landscape, offering innovative solutions that cater to the dynamic needs of both insurers and policyholders.

Service, Product in the Global Artificial Intelligence In Insurtech Market:

In the Global Artificial Intelligence in Insurtech Market, services and products play a crucial role in driving the adoption of AI technologies within the insurance industry. Service-based offerings in this market include AI-powered platforms and solutions that assist insurers in automating various processes, such as underwriting, claims management, and customer service. These services leverage machine learning algorithms to analyze vast amounts of data, enabling insurers to make informed decisions and improve operational efficiency. For instance, AI-driven chatbots and virtual assistants are increasingly being used to enhance customer interactions, providing real-time assistance and personalized recommendations. Additionally, AI services facilitate fraud detection by analyzing patterns and anomalies in claims data, reducing the risk of fraudulent activities. On the product side, AI technologies are being integrated into insurance products to offer more tailored and dynamic coverage options. Insurers are utilizing AI to develop personalized insurance policies that cater to individual customer needs, taking into account factors such as lifestyle, health, and risk profiles. This level of customization not only enhances customer satisfaction but also enables insurers to accurately assess and price risks. Furthermore, AI-powered predictive analytics tools are being employed to forecast future trends and risks, allowing insurers to proactively adjust their offerings and pricing strategies. The integration of AI in insurance products also extends to the development of usage-based insurance models, where premiums are determined based on real-time data collected from IoT devices and telematics. This approach provides customers with more flexible and cost-effective insurance options, aligning premiums with actual usage and behavior. Overall, the service and product offerings in the Global Artificial Intelligence in Insurtech Market are driving innovation and efficiency, enabling insurers to deliver more value to their customers while optimizing their operations.

Property & Casualty, Health & Life, Mobility Insurance, Others in the Global Artificial Intelligence In Insurtech Market:

The application of Global Artificial Intelligence in Insurtech Market spans across various insurance domains, including Property & Casualty, Health & Life, Mobility Insurance, and others, each benefiting from the transformative capabilities of AI technologies. In the Property & Casualty sector, AI is revolutionizing the way insurers assess and manage risks. By leveraging machine learning algorithms and predictive analytics, insurers can analyze historical data and identify patterns that indicate potential risks, such as natural disasters or property damage. This enables insurers to offer more accurate pricing and coverage options, ultimately reducing the likelihood of financial losses. Additionally, AI-powered tools are being used to streamline claims processing, allowing insurers to quickly assess damages and expedite settlements, enhancing customer satisfaction. In the Health & Life insurance domain, AI is playing a pivotal role in personalizing insurance offerings and improving customer experiences. Insurers are utilizing AI to analyze health data and lifestyle information, enabling them to offer tailored policies that align with individual health profiles and risk factors. This level of personalization not only enhances customer satisfaction but also promotes healthier lifestyles by incentivizing policyholders to adopt healthier habits. Moreover, AI-driven predictive analytics are being used to identify potential health risks and provide proactive interventions, ultimately reducing healthcare costs for both insurers and policyholders. In the realm of Mobility Insurance, AI technologies are transforming the way insurers assess and price risks associated with vehicles and drivers. By leveraging telematics and IoT devices, insurers can collect real-time data on driving behavior, vehicle usage, and environmental conditions. This data is then analyzed using AI algorithms to determine risk profiles and offer usage-based insurance models that align premiums with actual driving habits. This approach not only provides customers with more flexible and cost-effective insurance options but also encourages safer driving practices. Beyond these specific domains, AI is also being applied in other areas of insurance, such as commercial insurance and specialty lines. In commercial insurance, AI is being used to assess risks associated with businesses and industries, enabling insurers to offer more accurate coverage options and pricing strategies. In specialty lines, AI is being employed to analyze niche markets and develop tailored insurance products that cater to unique customer needs. Overall, the usage of AI in the Global Artificial Intelligence in Insurtech Market is driving innovation and efficiency across various insurance domains, enabling insurers to deliver more value to their customers while optimizing their operations.

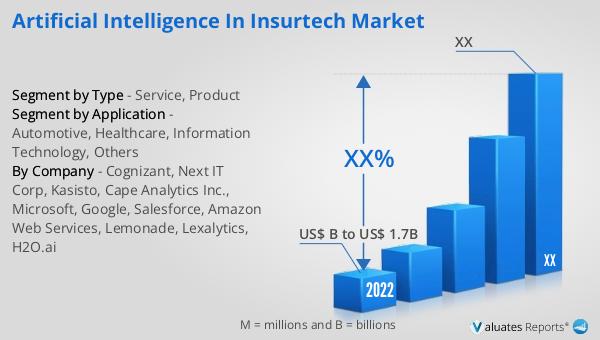

Global Artificial Intelligence In Insurtech Market Outlook:

The global market for Artificial Intelligence in Insurtech was valued at $6,477 million in 2024, and it is anticipated to expand significantly, reaching an estimated $25,250 million by 2031. This growth trajectory reflects a robust compound annual growth rate (CAGR) of 21.3% over the forecast period. The substantial increase in market size underscores the growing importance and adoption of AI technologies within the insurance sector. As insurers increasingly recognize the potential of AI to enhance operational efficiency, improve customer experiences, and optimize risk management, the demand for AI-driven solutions continues to rise. The market's expansion is driven by the need for cost-effective and innovative solutions that address the evolving needs of both insurers and policyholders. The integration of AI technologies in insurtech is enabling insurers to automate processes, personalize customer interactions, and detect fraudulent activities more efficiently. This not only enhances customer satisfaction but also reduces operational costs and improves decision-making capabilities. As the market continues to evolve, the adoption of AI in insurtech is expected to reshape the insurance landscape, offering innovative solutions that cater to the dynamic needs of the industry. Overall, the Global Artificial Intelligence in Insurtech Market is poised for significant growth, driven by the increasing demand for digital transformation and the need for more efficient and effective insurance solutions.

| Report Metric | Details |

| Report Name | Artificial Intelligence In Insurtech Market |

| Accounted market size in year | US$ 6477 million |

| Forecasted market size in 2031 | US$ 25250 million |

| CAGR | 21.3% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| Segment by Type |

|

| Segment by Process-based |

|

| Segment by Technology |

|

| Segment by Deployment |

|

| Segment by Application |

|

| By Region |

|

| By Company | Acko General Insurance, Quantemplate Limited, Neos Insurance, Shift Technology, Akur8, ZestyAI, Lexalytics, H2O.ai, FurtherAI, Federato, AI Insurance (Platform), Cape Analytics Inc., Quantexa, Cognizant |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |