What is Global Oil and Gas Separator Sales Market?

The Global Oil and Gas Separator Sales Market is a crucial segment within the broader oil and gas industry, focusing on the equipment used to separate various components from crude oil and natural gas. These separators are essential for refining processes, as they help in isolating oil, gas, and water from the extracted raw materials. The market for these separators is driven by the increasing demand for energy and the need for efficient extraction and processing methods. As the global population continues to grow, so does the demand for energy, leading to more exploration and production activities. This, in turn, fuels the need for advanced separation technologies to ensure that the extracted resources are processed efficiently and meet quality standards. The market is characterized by technological advancements, with companies investing in research and development to create more efficient and environmentally friendly separators. Additionally, the market is influenced by regulatory standards that require companies to minimize environmental impact, further driving innovation in separator technology. Overall, the Global Oil and Gas Separator Sales Market plays a vital role in ensuring the efficient and sustainable production of oil and gas resources.

in the Global Oil and Gas Separator Sales Market:

In the Global Oil and Gas Separator Sales Market, various types of separators are utilized by different customers based on their specific needs and operational requirements. The primary types of separators include horizontal, vertical, and spherical separators, each designed to handle different volumes and types of fluids. Horizontal separators are the most commonly used due to their efficiency in handling large volumes of oil and gas. They are particularly effective in separating gas from liquids and are often used in onshore and offshore production facilities. These separators are favored for their ability to handle high gas-to-oil ratios and are typically employed in situations where space is limited, such as offshore platforms. Vertical separators, on the other hand, are used when the gas-to-oil ratio is low, and the separation of water from oil is a priority. They are ideal for handling foamy crudes and are often used in onshore production sites where space is not a constraint. Spherical separators are less common but are used in specific applications where compactness and ease of transport are essential. They are typically employed in smaller production facilities or in situations where the production rates are low. Each type of separator has its advantages and limitations, and the choice of separator depends on factors such as the composition of the extracted fluids, the production rate, and the available space for installation. Customers in the oil and gas industry select separators based on these criteria to ensure optimal performance and efficiency in their operations. Additionally, advancements in technology have led to the development of more sophisticated separators that offer enhanced performance and environmental benefits. For instance, some modern separators are equipped with advanced control systems that allow for real-time monitoring and adjustment of separation processes, leading to improved efficiency and reduced environmental impact. As the industry continues to evolve, the demand for innovative and efficient separators is expected to grow, driving further advancements in separator technology. Overall, the Global Oil and Gas Separator Sales Market offers a range of options for customers, each designed to meet specific operational needs and contribute to the efficient and sustainable production of oil and gas resources.

in the Global Oil and Gas Separator Sales Market:

The Global Oil and Gas Separator Sales Market finds applications across various segments of the oil and gas industry, each requiring specific separation solutions to optimize their operations. One of the primary applications is in upstream oil and gas production, where separators are used to process the raw materials extracted from the earth. In this context, separators play a crucial role in ensuring that the extracted oil and gas are free from impurities such as water and sediments, which can affect the quality and marketability of the final product. By efficiently separating these components, separators help in enhancing the overall efficiency of the production process and reducing operational costs. Another significant application is in midstream operations, where separators are used in the transportation and storage of oil and gas. In this phase, separators help in maintaining the quality of the transported materials by removing any residual impurities that may have been introduced during extraction or transportation. This ensures that the oil and gas meet the required quality standards before reaching the downstream processing facilities. In downstream operations, separators are used in refineries to further purify the oil and gas, ensuring that they meet the stringent quality standards required for consumer use. This includes the removal of any remaining impurities and the separation of different hydrocarbon fractions to produce various petroleum products such as gasoline, diesel, and jet fuel. Additionally, separators are used in the treatment of produced water, a byproduct of oil and gas extraction, to remove oil and other contaminants before the water is discharged or reused. This application is particularly important in ensuring compliance with environmental regulations and minimizing the environmental impact of oil and gas operations. Overall, the Global Oil and Gas Separator Sales Market serves a wide range of applications across the oil and gas industry, each contributing to the efficient and sustainable production, transportation, and processing of oil and gas resources.

Global Oil and Gas Separator Sales Market Outlook:

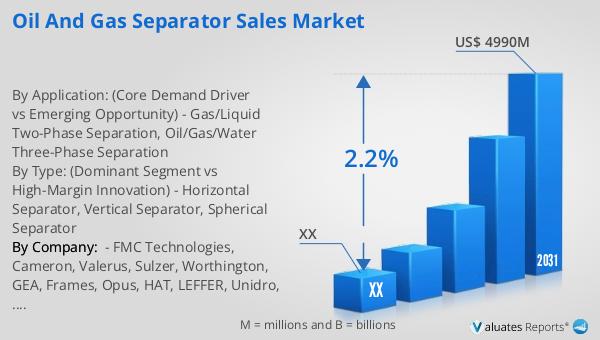

The global Oil and Gas Separator market was valued at approximately US$ 4,295 million in 2024, and it is projected to grow to an adjusted size of around US$ 4,990 million by 2031. This growth is expected to occur at a compound annual growth rate (CAGR) of 2.2% during the forecast period from 2025 to 2031. The market is dominated by the top five manufacturers, who collectively hold a market share exceeding 35%. Among the various types of separators available, the horizontal separator segment is the largest, accounting for over 65% of the market share. This dominance can be attributed to the efficiency and versatility of horizontal separators in handling large volumes of oil and gas, making them a preferred choice for many operators in the industry. The market's growth is driven by the increasing demand for energy and the need for efficient extraction and processing methods. As the global population continues to grow, so does the demand for energy, leading to more exploration and production activities. This, in turn, fuels the need for advanced separation technologies to ensure that the extracted resources are processed efficiently and meet quality standards. The market is characterized by technological advancements, with companies investing in research and development to create more efficient and environmentally friendly separators. Additionally, the market is influenced by regulatory standards that require companies to minimize environmental impact, further driving innovation in separator technology. Overall, the Global Oil and Gas Separator Sales Market plays a vital role in ensuring the efficient and sustainable production of oil and gas resources.

| Report Metric | Details |

| Report Name | Oil and Gas Separator Sales Market |

| Forecasted market size in 2031 | US$ 4990 million |

| CAGR | 2.2% |

| Forecasted years | 2025 - 2031 |

| By Type: (Dominant Segment vs High-Margin Innovation) |

|

| By Application: (Core Demand Driver vs Emerging Opportunity) |

|

| By Region |

|

| By Company: | FMC Technologies, Cameron, Valerus, Sulzer, Worthington, GEA, Frames, Opus, HAT, LEFFER, Unidro, Twister, Surface Equipment, ACS Manufacturing, Lanpec, HBP, Ruiji Greatec |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |