What is Global Commercial Payment Cards Sales Market?

The Global Commercial Payment Cards Sales Market refers to the worldwide industry focused on the sale and use of payment cards specifically designed for business transactions. These cards, which include credit, debit, and prepaid cards, are utilized by companies to manage their financial operations more efficiently. They offer businesses a convenient and secure way to handle expenses, streamline payments, and improve cash flow management. The market encompasses a wide range of products and services provided by financial institutions and card issuers to meet the diverse needs of businesses across different sectors. As businesses continue to expand globally, the demand for commercial payment cards is increasing, driven by the need for efficient financial management tools. This market is characterized by technological advancements, such as contactless payments and mobile integration, which enhance the user experience and provide added security. Additionally, the market is influenced by regulatory changes and economic factors that impact business spending and financial practices. Overall, the Global Commercial Payment Cards Sales Market plays a crucial role in facilitating business transactions and supporting the financial infrastructure of companies worldwide.

in the Global Commercial Payment Cards Sales Market:

The Global Commercial Payment Cards Sales Market is diverse, offering various types of cards tailored to meet the specific needs of different customers. One of the most common types is the commercial credit card, which allows businesses to make purchases on credit and pay off the balance over time. These cards often come with features such as rewards programs, expense tracking, and spending limits, making them ideal for managing business expenses. Another popular type is the commercial debit card, which enables businesses to make purchases directly from their bank accounts. This type of card is favored by companies that prefer to avoid debt and maintain strict control over their spending. Prepaid commercial cards are also widely used, particularly by businesses that need to distribute funds to employees or contractors. These cards can be loaded with a specific amount of money and used for various purposes, such as travel expenses or project-related costs. Additionally, there are specialized commercial cards designed for specific industries or purposes. For example, fuel cards are used by transportation companies to manage fuel expenses, while procurement cards are used by businesses to streamline the purchasing process for goods and services. Virtual commercial cards are another innovative option, providing businesses with a secure and convenient way to make online payments without the need for a physical card. These cards are particularly useful for companies that conduct a significant amount of business online or need to manage multiple transactions simultaneously. Furthermore, some commercial payment cards offer additional features such as fraud protection, detailed reporting, and integration with accounting software, enhancing their appeal to businesses seeking comprehensive financial management solutions. The choice of card type often depends on the size of the business, its financial goals, and the specific needs of its operations. Large corporations may opt for cards with extensive features and higher credit limits, while small businesses might prioritize simplicity and cost-effectiveness. Ultimately, the variety of commercial payment cards available in the market ensures that businesses of all sizes and industries can find a solution that aligns with their financial strategies and operational requirements.

in the Global Commercial Payment Cards Sales Market:

The Global Commercial Payment Cards Sales Market serves a wide range of applications, each catering to different aspects of business operations. One of the primary applications is expense management, where businesses use commercial payment cards to streamline the process of tracking and controlling expenses. By using these cards, companies can easily monitor spending, categorize expenses, and generate detailed reports, which helps in budgeting and financial planning. Another significant application is travel and entertainment (T&E) management. Businesses often issue commercial payment cards to employees for covering travel-related expenses such as flights, hotels, and meals. This not only simplifies the reimbursement process but also provides companies with greater visibility into travel spending patterns. Additionally, commercial payment cards are used for procurement and purchasing. Companies utilize these cards to buy goods and services from suppliers, enabling them to take advantage of discounts, negotiate better terms, and improve cash flow management. The cards also facilitate online transactions, making it easier for businesses to purchase software, subscriptions, and other digital products. Furthermore, commercial payment cards are employed in payroll management, particularly for distributing funds to employees or contractors who do not have traditional bank accounts. This application is especially beneficial for businesses with a large number of temporary or freelance workers. Another emerging application is in the realm of digital payments and e-commerce. As more businesses shift to online platforms, commercial payment cards provide a secure and efficient way to handle transactions, reducing the risk of fraud and enhancing customer trust. Additionally, these cards are used in supply chain management, where they help businesses manage payments to vendors and suppliers, ensuring timely delivery of goods and services. Overall, the versatility of commercial payment cards makes them an indispensable tool for businesses looking to optimize their financial operations and improve efficiency across various applications.

Global Commercial Payment Cards Sales Market Outlook:

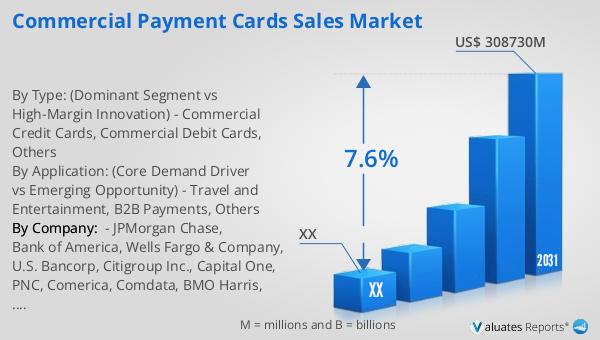

In 2024, the global Commercial Payment Cards market was valued at approximately $186.2 billion. Looking ahead, this market is projected to grow significantly, reaching an estimated size of $308.73 billion by 2031. This growth trajectory represents a compound annual growth rate (CAGR) of 7.6% during the forecast period from 2025 to 2031. Such robust growth can be attributed to several factors, including the increasing adoption of digital payment solutions by businesses worldwide and the continuous advancements in payment technologies. The market is also characterized by a competitive landscape, with the top five manufacturers holding a combined market share of over 15%. This indicates a moderately concentrated market where a few key players have a significant influence. These leading companies are likely to continue driving innovation and expanding their product offerings to capture a larger share of the growing market. As businesses increasingly recognize the benefits of commercial payment cards in streamlining financial operations and enhancing security, the demand for these solutions is expected to rise. Additionally, the ongoing trend towards globalization and the expansion of businesses into new markets further fuel the need for efficient and reliable payment solutions. Overall, the global Commercial Payment Cards market is poised for substantial growth, driven by technological advancements, changing business needs, and the increasing importance of digital financial management tools.

| Report Metric | Details |

| Report Name | Commercial Payment Cards Sales Market |

| Forecasted market size in 2031 | US$ 308730 million |

| CAGR | 7.6% |

| Forecasted years | 2025 - 2031 |

| By Type: (Dominant Segment vs High-Margin Innovation) |

|

| By Application: (Core Demand Driver vs Emerging Opportunity) |

|

| By Region |

|

| By Company: | JPMorgan Chase, Bank of America, Wells Fargo & Company, U.S. Bancorp, Citigroup Inc., Capital One, PNC, Comerica, Comdata, BMO Harris, American Express, China UnionPay, Discover Financial Services, JCB, Barclays, Airplus International |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |