What is Global Anticorrosive Waterborne Coatings Sales Market?

The Global Anticorrosive Waterborne Coatings Sales Market is a specialized segment within the broader coatings industry, focusing on products designed to prevent corrosion in various environments. These coatings are waterborne, meaning they use water as a solvent, which makes them more environmentally friendly compared to solvent-based coatings. The primary function of these coatings is to protect metal surfaces from rust and degradation caused by exposure to moisture, chemicals, and other corrosive elements. This market is driven by the increasing demand for sustainable and eco-friendly solutions in industries such as construction, automotive, and marine. The coatings are applied to a wide range of surfaces, including steel and concrete, to extend their lifespan and maintain their structural integrity. The market is characterized by continuous innovation, with manufacturers developing advanced formulations that offer enhanced performance and durability. As industries worldwide prioritize sustainability and regulatory compliance, the demand for anticorrosive waterborne coatings is expected to grow, making it a vital component of modern industrial practices.

in the Global Anticorrosive Waterborne Coatings Sales Market:

In the Global Anticorrosive Waterborne Coatings Sales Market, various types of coatings are utilized by customers based on their specific needs and applications. One of the most prominent types is epoxy coatings, which are known for their excellent adhesion, chemical resistance, and durability. Epoxy coatings are widely used in industrial and marine environments where surfaces are exposed to harsh conditions. They form a tough, protective layer that can withstand abrasion and impact, making them ideal for heavy-duty applications. Another popular type is polyurethane coatings, which offer superior UV resistance and flexibility. These coatings are often used in outdoor applications where exposure to sunlight and temperature fluctuations is a concern. Polyurethane coatings provide a glossy finish and are resistant to chipping and cracking, making them suitable for automotive and architectural applications. Acrylic coatings are also a significant segment within this market. They are valued for their quick-drying properties and ease of application. Acrylic coatings are often used in residential and commercial buildings for both protective and decorative purposes. They offer good weather resistance and are available in a wide range of colors and finishes. Zinc-rich coatings are another type used in the anticorrosive waterborne coatings market. These coatings contain a high percentage of zinc dust, which provides cathodic protection to metal surfaces. Zinc-rich coatings are commonly used in the construction and infrastructure sectors to protect steel structures from corrosion. They are particularly effective in environments with high humidity and salt exposure, such as coastal areas. In addition to these, there are hybrid coatings that combine the properties of different types of coatings to offer enhanced performance. For example, epoxy-polyurethane hybrid coatings provide the toughness of epoxy with the UV resistance of polyurethane. These coatings are used in applications where both chemical resistance and weatherability are required. The choice of coating type depends on several factors, including the environment in which the coating will be used, the type of substrate, and the desired aesthetic and performance characteristics. Customers in the Global Anticorrosive Waterborne Coatings Sales Market have a wide range of options to choose from, allowing them to select the most suitable product for their specific needs. As technology advances, new formulations and types of coatings continue to emerge, offering improved performance and sustainability.

in the Global Anticorrosive Waterborne Coatings Sales Market:

The Global Anticorrosive Waterborne Coatings Sales Market serves a diverse range of applications across various industries, each with its unique requirements and challenges. One of the primary applications is in the construction industry, where these coatings are used to protect steel and concrete structures from corrosion. Buildings, bridges, and other infrastructure are constantly exposed to environmental elements that can lead to deterioration. Anticorrosive waterborne coatings provide a protective barrier that extends the lifespan of these structures and reduces maintenance costs. In the automotive industry, these coatings are used to protect vehicles from rust and corrosion. The underbody and other metal components of vehicles are particularly susceptible to corrosion due to exposure to road salts, moisture, and chemicals. Waterborne coatings offer an eco-friendly solution that not only protects the vehicle but also enhances its appearance with a smooth, glossy finish. The marine industry is another significant user of anticorrosive waterborne coatings. Ships, boats, and offshore structures are exposed to harsh marine environments that can cause rapid corrosion. These coatings provide long-lasting protection against saltwater, UV radiation, and other corrosive elements, ensuring the safety and durability of marine vessels and structures. In the industrial sector, anticorrosive waterborne coatings are used to protect machinery, equipment, and storage tanks from corrosion. These coatings are essential in industries such as oil and gas, chemical processing, and manufacturing, where equipment is exposed to aggressive chemicals and extreme conditions. By preventing corrosion, these coatings help maintain the efficiency and reliability of industrial operations. Additionally, the energy sector, including renewable energy installations like wind turbines and solar panels, utilizes these coatings to protect metal components from corrosion. As the demand for clean energy grows, the need for durable and sustainable protective coatings becomes increasingly important. Overall, the applications of anticorrosive waterborne coatings are vast and varied, reflecting the diverse needs of industries seeking to protect their assets and ensure long-term performance.

Global Anticorrosive Waterborne Coatings Sales Market Outlook:

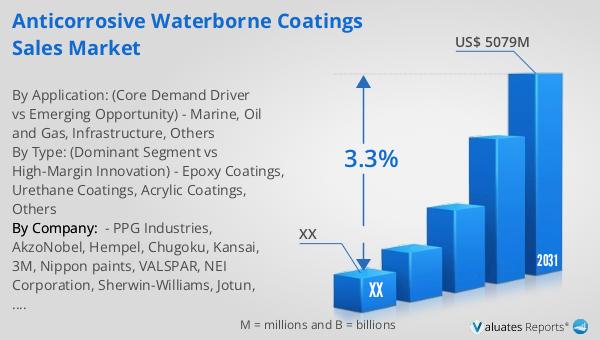

In 2024, the global market for Anticorrosive Waterborne Coatings was valued at approximately $4.06 billion. Projections indicate that by 2031, this market will expand to an estimated $5.079 billion, reflecting a compound annual growth rate (CAGR) of 3.3% during the forecast period from 2025 to 2031. This growth is driven by increasing demand for environmentally friendly and sustainable coating solutions across various industries. The market is dominated by the top five manufacturers, who collectively hold over 35% of the market share, indicating a competitive landscape with significant influence from leading players. Among the different product types, epoxy coatings stand out as the largest segment, accounting for more than 50% of the market share. This dominance is attributed to the superior protective qualities of epoxy coatings, which are highly valued in industrial and marine applications for their durability and resistance to harsh environmental conditions. As industries continue to prioritize sustainability and regulatory compliance, the demand for anticorrosive waterborne coatings is expected to grow, making it a vital component of modern industrial practices. The market's steady growth trajectory underscores the increasing importance of these coatings in protecting valuable assets and infrastructure from corrosion.

| Report Metric | Details |

| Report Name | Anticorrosive Waterborne Coatings Sales Market |

| Forecasted market size in 2031 | US$ 5079 million |

| CAGR | 3.3% |

| Forecasted years | 2025 - 2031 |

| By Type: (Dominant Segment vs High-Margin Innovation) |

|

| By Application: (Core Demand Driver vs Emerging Opportunity) |

|

| By Region |

|

| By Company: | PPG Industries, AkzoNobel, Hempel, Chugoku, Kansai, 3M, Nippon paints, VALSPAR, NEI Corporation, Sherwin-Williams, Jotun, DuPont, Rust-OLEUW9100, Jointas, Yunhu, Jiabaoli, Lanling, Jinda, Jinyu, Hongshi |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |