What is Global Fab-Lite Market?

The Global Fab-Lite Market refers to a segment of the semiconductor industry where companies adopt a "fab-lite" model, meaning they outsource a significant portion of their manufacturing processes to external foundries while maintaining some in-house production capabilities. This approach allows companies to focus on design and innovation without the heavy capital investment required for full-scale semiconductor fabrication facilities. The fab-lite model is particularly advantageous in a rapidly evolving market, as it provides flexibility and scalability, enabling companies to respond quickly to changes in demand and technology. By leveraging external foundries, fab-lite companies can access advanced manufacturing technologies and processes without the need for continuous investment in their own facilities. This model is increasingly popular among semiconductor companies looking to optimize their operations and reduce costs while maintaining a competitive edge in the global market. The fab-lite approach is a strategic compromise between the fabless model, where companies rely entirely on external foundries, and the integrated device manufacturer (IDM) model, where companies own and operate their own fabrication facilities.

Fabless to Fab-Lite, IDM to Fab-Lite in the Global Fab-Lite Market:

The transition from fabless to fab-lite and IDM to fab-lite in the Global Fab-Lite Market represents a strategic shift in how semiconductor companies manage their production processes. Fabless companies, which traditionally rely entirely on external foundries for manufacturing, are increasingly adopting the fab-lite model to gain more control over certain aspects of production. This shift allows them to maintain some in-house capabilities, such as critical process steps or specialized technologies, while still benefiting from the cost efficiencies and advanced technologies offered by external foundries. By adopting a fab-lite approach, fabless companies can enhance their supply chain resilience and reduce dependency on third-party manufacturers, which is crucial in times of supply chain disruptions or capacity constraints. On the other hand, Integrated Device Manufacturers (IDMs), which have historically owned and operated their own fabrication facilities, are also transitioning to a fab-lite model. This shift is driven by the need to optimize capital expenditure and focus on core competencies such as design and innovation. By outsourcing non-core manufacturing processes to external foundries, IDMs can reduce operational costs and allocate resources more efficiently. The fab-lite model allows IDMs to maintain a balance between in-house production and outsourcing, enabling them to leverage the strengths of both approaches. This transition is particularly relevant in the context of the increasing complexity and cost of semiconductor manufacturing, where advanced process nodes and technologies require significant investment. By adopting a fab-lite model, IDMs can access cutting-edge manufacturing capabilities without the need for continuous investment in their own facilities. This strategic shift is also driven by the growing demand for specialized and customized semiconductor solutions, which require a flexible and agile manufacturing approach. The fab-lite model provides the necessary flexibility to adapt to changing market demands and technological advancements, allowing companies to remain competitive in a dynamic industry. Overall, the transition from fabless to fab-lite and IDM to fab-lite reflects a broader trend in the semiconductor industry towards more flexible and cost-effective manufacturing strategies. By adopting a fab-lite approach, companies can optimize their operations, reduce costs, and enhance their ability to innovate and respond to market changes.

Analog IC, Micro IC, Logic IC, Discrete IC, Sensors IC, Memory IC, Optoelectronics in the Global Fab-Lite Market:

The Global Fab-Lite Market plays a crucial role in the production of various types of integrated circuits (ICs), including Analog ICs, Micro ICs, Logic ICs, Discrete ICs, Sensors ICs, Memory ICs, and Optoelectronics. In the realm of Analog ICs, the fab-lite model allows companies to leverage external foundries' advanced process technologies to produce high-performance analog components used in applications such as power management, signal processing, and communication systems. By outsourcing certain manufacturing processes, companies can focus on designing innovative analog solutions that meet the specific needs of their customers. For Micro ICs, which are essential for microcontrollers and microprocessors, the fab-lite approach provides the flexibility to scale production according to demand fluctuations. This is particularly important in industries such as automotive and consumer electronics, where demand can vary significantly. Logic ICs, which are used in digital circuits, benefit from the fab-lite model by accessing cutting-edge manufacturing technologies that enable higher performance and lower power consumption. This is crucial in applications such as data centers, smartphones, and artificial intelligence, where efficiency and performance are paramount. Discrete ICs, which include components like diodes and transistors, also benefit from the fab-lite approach by allowing companies to optimize production costs and focus on developing specialized solutions for specific applications. In the field of Sensors ICs, the fab-lite model enables companies to produce a wide range of sensor technologies, from temperature and pressure sensors to image and motion sensors. By outsourcing certain manufacturing processes, companies can access advanced sensor technologies and rapidly bring new products to market. Memory ICs, which are critical for data storage and retrieval, benefit from the fab-lite model by allowing companies to access advanced memory technologies and optimize production costs. This is particularly important in applications such as smartphones, computers, and data centers, where memory performance and capacity are critical. Finally, in the realm of Optoelectronics, the fab-lite model enables companies to produce components such as LEDs, photodetectors, and laser diodes, which are essential for applications in lighting, communication, and sensing. By leveraging external foundries' advanced manufacturing capabilities, companies can produce high-performance optoelectronic components that meet the demands of various industries. Overall, the Global Fab-Lite Market provides the flexibility and scalability needed to produce a wide range of ICs, enabling companies to meet the diverse needs of their customers and remain competitive in a rapidly evolving industry.

Global Fab-Lite Market Outlook:

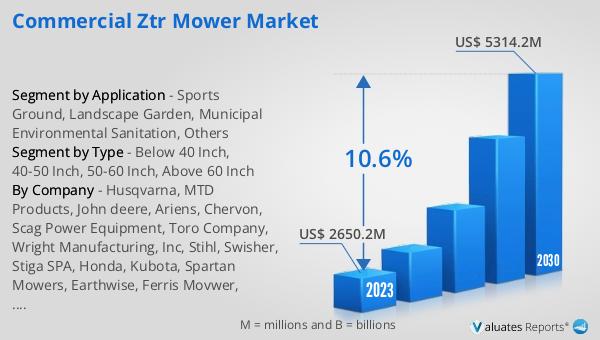

The global market for Fab-Lite was valued at approximately $348.06 billion in 2024, with projections indicating that it will grow to a revised size of around $510.64 billion by 2031. This growth represents a compound annual growth rate (CAGR) of 5.7% over the forecast period. In 2023, STMicroelectronics outsourced about 20% of its total silicon production value to external foundries, highlighting the strategic importance of the fab-lite model in optimizing production processes and reducing costs. Similarly, Microchip Technology reported that approximately 63% of its sales in 2023 were derived from products manufactured at outside wafer foundries. This significant reliance on external manufacturing partners underscores the growing trend towards fab-lite strategies among semiconductor companies. By adopting a fab-lite approach, companies like STMicroelectronics and Microchip Technology can focus on their core competencies, such as design and innovation, while leveraging the advanced manufacturing capabilities of external foundries. This strategic shift allows them to remain competitive in a dynamic market, where technological advancements and changing customer demands require a flexible and agile manufacturing approach. The fab-lite model provides the necessary balance between in-house production and outsourcing, enabling companies to optimize their operations and enhance their ability to innovate and respond to market changes.

| Report Metric | Details |

| Report Name | Fab-Lite Market |

| Accounted market size in year | US$ 348060 million |

| Forecasted market size in 2031 | US$ 510640 million |

| CAGR | 5.7% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | Maxscend Microelectronics Company Limited, GalaxyCore, Hot Chip Technology, Suzhou Yuanxin Microelectronics Technology, Renesas, Navitas, Texas Instruments (TI), STMicroelectronics, Sony Semiconductor Solutions Corporation (SSS), Infineon, NXP, Microchip Technology, Onsemi, Toshiba, Analog Devices, Inc. (ADI) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |