What is Global Wafer Shipment Containers Market?

The Global Wafer Shipment Containers Market is a specialized segment within the semiconductor industry, focusing on the transportation and storage of semiconductor wafers. These containers are crucial for maintaining the integrity and quality of wafers during transit from manufacturing facilities to various processing plants. Wafers, being extremely delicate and sensitive to contamination, require robust and reliable packaging solutions. The market for wafer shipment containers is driven by the increasing demand for semiconductors across various industries, including electronics, automotive, and telecommunications. As technology advances, the need for more sophisticated and high-capacity wafers grows, further propelling the demand for efficient shipment containers. These containers are designed to protect wafers from physical damage, contamination, and environmental factors such as humidity and temperature fluctuations. The market is characterized by continuous innovation, with manufacturers striving to develop containers that offer enhanced protection and efficiency. The growth of the semiconductor industry, coupled with the increasing complexity of wafer designs, is expected to drive the demand for wafer shipment containers in the coming years. The market is also influenced by regional manufacturing trends, with key players focusing on expanding their presence in high-demand areas.

FOUP, FOSB in the Global Wafer Shipment Containers Market:

Front Opening Unified Pods (FOUP) and Front Opening Shipping Boxes (FOSB) are integral components of the Global Wafer Shipment Containers Market, each serving distinct roles in the handling and transportation of semiconductor wafers. FOUPs are specialized containers designed to hold and transport wafers within semiconductor fabrication facilities. They are engineered to provide a controlled environment that minimizes contamination and mechanical damage to the wafers. FOUPs are typically used in cleanroom environments and are compatible with automated material handling systems, which are essential in modern semiconductor manufacturing processes. These containers are made from high-grade materials that ensure durability and protection against electrostatic discharge, which can damage sensitive semiconductor components. The design of FOUPs allows for easy integration with robotic systems, facilitating efficient wafer handling and reducing the risk of human error. On the other hand, FOSBs are primarily used for the transportation of wafers between different facilities or from suppliers to manufacturers. They are designed to provide robust protection against physical shocks and environmental factors during transit. FOSBs are typically larger than FOUPs and are constructed to withstand the rigors of shipping and handling. They are equipped with features such as shock absorbers and secure locking mechanisms to ensure the safe transport of wafers over long distances. The use of FOSBs is critical in maintaining the quality and integrity of wafers as they move through the supply chain. Both FOUPs and FOSBs play a vital role in the semiconductor manufacturing process, ensuring that wafers are protected from contamination and damage at every stage of production and transportation. The demand for these containers is driven by the increasing complexity of semiconductor devices and the need for higher levels of precision and reliability in wafer handling. As the semiconductor industry continues to evolve, the design and functionality of FOUPs and FOSBs are expected to advance, offering even greater levels of protection and efficiency. Manufacturers are investing in research and development to create containers that meet the stringent requirements of modern semiconductor manufacturing, including the ability to handle larger wafer sizes and more complex device architectures. The market for FOUPs and FOSBs is also influenced by regional manufacturing trends, with key players focusing on expanding their presence in high-demand areas. As the global demand for semiconductors continues to rise, the importance of reliable and efficient wafer shipment containers like FOUPs and FOSBs cannot be overstated. These containers are essential for ensuring the smooth operation of semiconductor manufacturing processes and the delivery of high-quality products to end-users.

300 mm Wafer, 200 mm Wafer in the Global Wafer Shipment Containers Market:

The Global Wafer Shipment Containers Market plays a crucial role in the handling and transportation of 300 mm and 200 mm wafers, which are widely used in the semiconductor industry. The 300 mm wafer, being larger in size, offers significant advantages in terms of cost efficiency and production capacity. However, its larger size also presents challenges in terms of handling and transportation. Wafer shipment containers designed for 300 mm wafers are engineered to provide maximum protection against physical damage and contamination. These containers are equipped with advanced features such as shock absorbers and secure locking mechanisms to ensure the safe transport of wafers over long distances. The use of 300 mm wafers is prevalent in the production of high-performance semiconductor devices, and the demand for these wafers is driven by the increasing need for advanced electronic products. The Global Wafer Shipment Containers Market is expected to witness significant growth as the demand for 300 mm wafers continues to rise. On the other hand, 200 mm wafers are still widely used in the production of various semiconductor devices, particularly in applications where cost efficiency is a primary concern. The handling and transportation of 200 mm wafers require specialized containers that offer robust protection against contamination and mechanical damage. These containers are designed to accommodate the smaller size of 200 mm wafers while providing the same level of protection and efficiency as those used for larger wafers. The demand for 200 mm wafers is driven by the production of a wide range of electronic devices, including consumer electronics, automotive components, and industrial equipment. The Global Wafer Shipment Containers Market is expected to continue to grow as the demand for 200 mm wafers remains strong. The market for wafer shipment containers is characterized by continuous innovation, with manufacturers striving to develop containers that offer enhanced protection and efficiency for both 300 mm and 200 mm wafers. The growth of the semiconductor industry, coupled with the increasing complexity of wafer designs, is expected to drive the demand for wafer shipment containers in the coming years. The market is also influenced by regional manufacturing trends, with key players focusing on expanding their presence in high-demand areas. As the global demand for semiconductors continues to rise, the importance of reliable and efficient wafer shipment containers cannot be overstated. These containers are essential for ensuring the smooth operation of semiconductor manufacturing processes and the delivery of high-quality products to end-users.

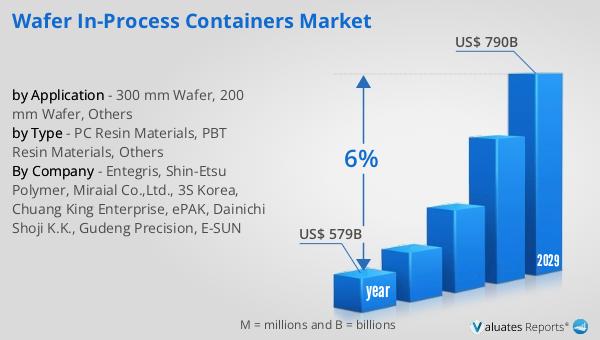

Global Wafer Shipment Containers Market Outlook:

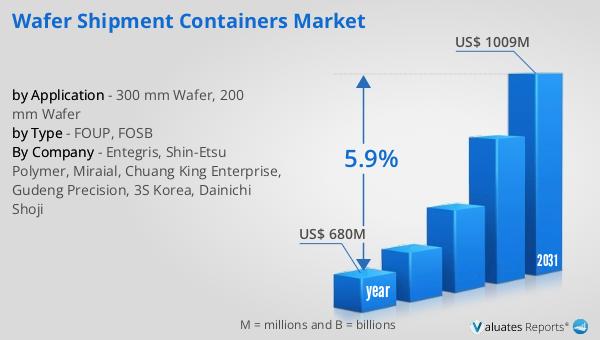

In 2024, the worldwide market for Wafer Shipment Containers was estimated to be worth approximately $680 million. By 2031, this market is anticipated to expand to a revised valuation of $1009 million, reflecting a compound annual growth rate (CAGR) of 5.9% throughout the forecast period. Taiwan emerges as the leading consumer region for wafer cassettes, holding a consumption market share of nearly 19.75% as of 2022. This indicates Taiwan's significant role in the global semiconductor supply chain, driven by its robust manufacturing capabilities and technological advancements. Furthermore, the market is highly consolidated, with the top five companies globally commanding a substantial 96.32% of the total market share. This concentration underscores the dominance of a few key players in the industry, who are likely leveraging their technological expertise, extensive distribution networks, and strategic partnerships to maintain their competitive edge. The growth trajectory of the Wafer Shipment Containers Market is indicative of the increasing demand for semiconductors across various sectors, including electronics, automotive, and telecommunications. As the semiconductor industry continues to evolve, the need for efficient and reliable wafer shipment solutions will remain critical, driving further innovation and development in this market segment.

| Report Metric | Details |

| Report Name | Wafer Shipment Containers Market |

| Accounted market size in year | US$ 680 million |

| Forecasted market size in 2031 | US$ 1009 million |

| CAGR | 5.9% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| by Type |

|

| by Application |

|

| Production by Region |

|

| Consumption by Region |

|

| By Company | Entegris, Shin-Etsu Polymer, Miraial, Chuang King Enterprise, Gudeng Precision, 3S Korea, Dainichi Shoji |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |