What is Global Uncooled Thermal Infrared Imager Market?

The Global Uncooled Thermal Infrared Imager Market refers to the industry focused on the production and distribution of thermal imaging devices that do not require cooling to function. These imagers are pivotal in detecting infrared radiation, which is emitted by all objects based on their temperature. Unlike cooled thermal imagers, uncooled versions are more compact, cost-effective, and require less maintenance, making them highly desirable across various sectors. They are widely used in applications ranging from military and defense to automotive and smart home technologies. The market is driven by advancements in technology, increasing demand for surveillance and security, and the growing adoption of thermal imaging in new areas like healthcare and industrial inspection. As industries continue to recognize the benefits of thermal imaging, the demand for uncooled thermal infrared imagers is expected to grow, offering enhanced capabilities in detecting heat signatures without the need for complex cooling systems. This market is characterized by continuous innovation, with manufacturers striving to improve the resolution, sensitivity, and affordability of these devices to cater to a broader range of applications and industries.

Vanadium Oxide (VOx), Amorphous Silicon (A-Si) in the Global Uncooled Thermal Infrared Imager Market:

Vanadium Oxide (VOx) and Amorphous Silicon (A-Si) are two prominent materials used in the manufacturing of uncooled thermal infrared imagers, each offering distinct advantages and characteristics. Vanadium Oxide (VOx) is a widely used material in the production of microbolometer detectors, which are the core components of uncooled thermal imagers. VOx-based detectors are known for their high sensitivity and stability, making them ideal for applications requiring precise temperature measurements. The material's ability to change resistance with temperature variations allows for accurate detection of infrared radiation, which is crucial in applications such as surveillance, firefighting, and industrial inspection. VOx detectors are also favored for their fast response time and durability, which enhance the performance of thermal imagers in dynamic environments. On the other hand, Amorphous Silicon (A-Si) is another material used in the fabrication of microbolometers. A-Si-based detectors are appreciated for their cost-effectiveness and ease of manufacturing, which make them suitable for mass production. Although they may not match the sensitivity levels of VOx detectors, A-Si detectors offer sufficient performance for many applications, particularly where cost is a significant consideration. The choice between VOx and A-Si often depends on the specific requirements of the application, such as the need for high sensitivity, cost constraints, and environmental conditions. In the Global Uncooled Thermal Infrared Imager Market, both VOx and A-Si technologies play crucial roles in meeting the diverse needs of end-users. Manufacturers continue to invest in research and development to enhance the performance of these materials, aiming to improve the resolution, sensitivity, and overall efficiency of thermal imagers. As the demand for thermal imaging technology grows across various sectors, the competition between VOx and A-Si-based detectors is likely to intensify, driving further innovation and advancements in the field. The ongoing development of these materials is expected to contribute significantly to the expansion of the Global Uncooled Thermal Infrared Imager Market, providing users with more options and better-performing devices for their specific needs.

Military and Defense, Automotive, Smart Home, Medical, Others in the Global Uncooled Thermal Infrared Imager Market:

The Global Uncooled Thermal Infrared Imager Market finds extensive usage across several key areas, including Military and Defense, Automotive, Smart Home, Medical, and others. In the Military and Defense sector, uncooled thermal imagers are indispensable tools for surveillance, target acquisition, and night vision. They enable military personnel to detect and identify threats in complete darkness or through smoke and fog, providing a tactical advantage in various combat scenarios. The ability to operate without cooling systems makes these imagers more reliable and easier to maintain in harsh environments, which is crucial for military applications. In the Automotive industry, uncooled thermal imagers are increasingly being integrated into advanced driver-assistance systems (ADAS) to enhance vehicle safety. They help in detecting pedestrians, animals, and other obstacles on the road, especially in low-light conditions, thereby reducing the risk of accidents. The adoption of thermal imaging technology in vehicles is expected to grow as manufacturers strive to improve safety features and comply with stringent regulations. In the Smart Home sector, uncooled thermal imagers are used for security and energy management. They can detect intruders by sensing body heat and monitor energy efficiency by identifying heat leaks in buildings. This technology is becoming more popular among homeowners looking to enhance security and reduce energy costs. In the Medical field, thermal imagers are used for non-invasive diagnostics and monitoring. They can detect temperature variations in the human body, which can be indicative of various medical conditions. This application is particularly useful in detecting fevers, inflammation, and circulatory issues. The ability to provide real-time, contactless temperature measurements makes thermal imagers valuable tools in healthcare settings. Beyond these areas, uncooled thermal imagers are also used in industrial inspection, firefighting, and wildlife monitoring, among others. Their versatility and ability to provide accurate thermal data make them essential tools in a wide range of applications. As technology continues to advance, the usage of uncooled thermal imagers is expected to expand further, offering new opportunities and benefits across different sectors.

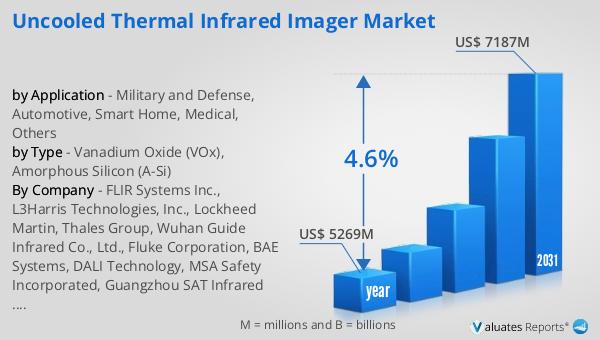

Global Uncooled Thermal Infrared Imager Market Outlook:

In 2024, the global market for Uncooled Thermal Infrared Imagers was valued at approximately $5,269 million. Looking ahead, this market is anticipated to grow, reaching an estimated value of $7,187 million by 2031. This growth trajectory represents a compound annual growth rate (CAGR) of 4.6% over the forecast period. The steady increase in market size underscores the rising demand for thermal imaging technology across various industries. Factors contributing to this growth include technological advancements, increased adoption in emerging applications, and the need for enhanced security and surveillance solutions. As industries continue to recognize the benefits of uncooled thermal imagers, such as their cost-effectiveness, reliability, and versatility, the market is poised for sustained expansion. The projected growth also reflects the ongoing efforts of manufacturers to innovate and improve the performance of thermal imagers, making them more accessible and appealing to a broader range of users. As a result, the Global Uncooled Thermal Infrared Imager Market is expected to play a significant role in shaping the future of thermal imaging technology, offering new opportunities and driving advancements in various sectors.

| Report Metric | Details |

| Report Name | Uncooled Thermal Infrared Imager Market |

| Accounted market size in year | US$ 5269 million |

| Forecasted market size in 2031 | US$ 7187 million |

| CAGR | 4.6% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| by Type |

|

| by Application |

|

| Production by Region |

|

| Consumption by Region |

|

| By Company | FLIR Systems Inc., L3Harris Technologies, Inc., Lockheed Martin, Thales Group, Wuhan Guide Infrared Co., Ltd., Fluke Corporation, BAE Systems, DALI Technology, MSA Safety Incorporated, Guangzhou SAT Infrared Technology Co., Ltd., Elbit Systems, Testo SE & Co. KGaA, Hikvision, NEC Corporation, Fotric Inc., Bullard, Keysight Technologies, Inc. |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |