What is Global Recon Software for the Financial Service Market?

Global Recon Software for the Financial Service Market is a specialized tool designed to streamline and automate the reconciliation process within financial institutions. Reconciliation is a critical task in the financial sector, involving the comparison of internal financial records with external statements to ensure accuracy and consistency. This software aids in identifying discrepancies, reducing manual errors, and enhancing operational efficiency. By automating these processes, financial institutions can save time and resources, allowing them to focus on more strategic tasks. The software is equipped with features such as transaction matching, exception management, and reporting, which are essential for maintaining financial integrity. It is particularly beneficial in handling large volumes of transactions, which are common in the financial services industry. The global market for this software is expanding as more financial institutions recognize the need for efficient reconciliation processes to comply with regulatory requirements and improve financial transparency. As the financial landscape becomes increasingly complex, the demand for robust reconciliation solutions continues to grow, making Global Recon Software an indispensable tool for financial service providers worldwide.

Cloud Based, On Premise in the Global Recon Software for the Financial Service Market:

Cloud-based and on-premise solutions are two primary deployment models for Global Recon Software in the financial services market. Cloud-based solutions offer flexibility and scalability, allowing financial institutions to access reconciliation tools via the internet. This model is particularly advantageous for organizations looking to reduce IT infrastructure costs and improve accessibility. With cloud-based recon software, updates and maintenance are managed by the service provider, ensuring that the software is always up-to-date with the latest features and security protocols. This model supports remote work environments, enabling employees to access the software from anywhere, which is increasingly important in today's digital age. On the other hand, on-premise solutions involve installing the software on the organization's own servers. This model provides greater control over data and security, which is crucial for financial institutions handling sensitive information. On-premise solutions are often preferred by larger organizations with the resources to manage their own IT infrastructure. They offer customization options that can be tailored to the specific needs of the organization. However, they require a significant upfront investment in hardware and ongoing maintenance costs. Despite these differences, both deployment models aim to enhance the efficiency and accuracy of financial reconciliation processes. Financial institutions must carefully consider their specific needs, resources, and security requirements when choosing between cloud-based and on-premise recon software solutions. As the financial services industry continues to evolve, the choice between these models will depend on factors such as organizational size, budget, and strategic goals. Ultimately, both cloud-based and on-premise solutions play a vital role in helping financial institutions maintain accurate financial records and comply with regulatory standards.

Banks, Insurance, Retail, Government, Others in the Global Recon Software for the Financial Service Market:

Global Recon Software is utilized across various sectors within the financial services market, including banks, insurance companies, retail businesses, government agencies, and others. In banks, the software is essential for managing the vast number of transactions that occur daily. It helps in reconciling accounts, ensuring that all transactions are accurately recorded and any discrepancies are promptly addressed. This is crucial for maintaining customer trust and complying with regulatory requirements. In the insurance sector, recon software aids in the reconciliation of premium payments, claims, and other financial transactions. It ensures that all financial records are accurate and up-to-date, which is vital for risk management and financial reporting. Retail businesses use recon software to manage transactions across multiple sales channels, ensuring that all sales and returns are accurately recorded. This helps in maintaining accurate inventory records and financial statements. Government agencies utilize recon software to manage public funds and ensure transparency in financial reporting. It aids in the reconciliation of budget allocations, expenditures, and revenues, ensuring that public funds are used efficiently and effectively. Other sectors, such as investment firms and non-profit organizations, also benefit from recon software by ensuring accurate financial reporting and compliance with industry regulations. Overall, Global Recon Software plays a critical role in enhancing the accuracy and efficiency of financial processes across various sectors, helping organizations maintain financial integrity and transparency.

Global Recon Software for the Financial Service Market Outlook:

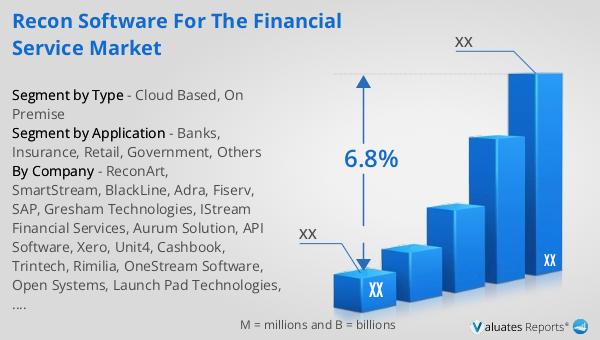

In 2024, the global market size for Recon Software in the Financial Service sector was valued at approximately US$ 778 million, with projections indicating a growth to around US$ 1225 million by 2031. This growth is expected to occur at a compound annual growth rate (CAGR) of 6.8% from 2025 to 2031. Among the different types of recon software, on-premise solutions are the most prevalent, accounting for about 56% of the global market share. This preference is likely due to the enhanced control and security that on-premise solutions offer, which are critical for financial institutions handling sensitive data. Geographically, North America has been the leading sales region for Recon Software in the Financial Service market, capturing approximately 41% of the market share in recent years. Europe follows as the second-largest market, with a share of about 30%. This regional dominance can be attributed to the advanced financial infrastructure and stringent regulatory requirements in these areas. Key players in the Recon Software market include companies like ReconArt, Adra, IStream Financial Services, Aurum Solution, API Software, Cashbook, Rimilia, Open Systems, and Launch Pad Technologies. Together, these companies hold about 62% of the market share, highlighting their significant influence and contribution to the industry's growth.

| Report Metric | Details |

| Report Name | Recon Software for the Financial Service Market |

| CAGR | 6.8% |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | ReconArt, SmartStream, BlackLine, Adra, Fiserv, SAP, Gresham Technologies, IStream Financial Services, Aurum Solution, API Software, Xero, Unit4, Cashbook, Trintech, Rimilia, OneStream Software, Open Systems, Launch Pad Technologies, Oracle |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |