What is Global DDIC Wafer Foundry Market?

The Global DDIC Wafer Foundry Market is a specialized segment within the semiconductor industry that focuses on the production of wafers used in display driver integrated circuits (DDICs). These circuits are crucial components in the manufacturing of display panels for various electronic devices, including televisions, smartphones, tablets, and monitors. The foundry market involves the fabrication of these wafers, which are thin slices of semiconductor material, typically silicon, used to create integrated circuits. The demand for DDIC wafers is driven by the growing consumer electronics market, which requires high-quality displays with improved resolution and performance. As technology advances, the need for more sophisticated and efficient DDICs increases, pushing foundries to innovate and enhance their production capabilities. The market is characterized by rapid technological advancements, competitive pricing, and the need for continuous investment in research and development to meet the evolving demands of the electronics industry. Foundries must also navigate challenges such as supply chain disruptions and fluctuating raw material costs. Overall, the Global DDIC Wafer Foundry Market plays a vital role in the electronics supply chain, enabling the production of advanced display technologies that power modern digital devices.

45nm and Below, 65/55nm, 90nm, 130/110nm, 150 nm and Above in the Global DDIC Wafer Foundry Market:

In the Global DDIC Wafer Foundry Market, various process nodes are utilized to manufacture display driver integrated circuits, each offering distinct advantages and applications. The 45nm and below process node represents the cutting-edge of semiconductor manufacturing technology. This node is characterized by its ability to produce highly efficient and compact circuits, which are essential for high-performance displays in premium electronic devices. The smaller node size allows for increased transistor density, leading to improved power efficiency and faster processing speeds. As a result, 45nm and below wafers are often used in high-end smartphones and tablets where performance and battery life are critical. Moving to the 65/55nm node, this process is widely adopted for its balance between performance and cost-effectiveness. It is commonly used in mid-range devices where manufacturers seek to provide good performance without the high costs associated with the latest technology. The 65/55nm node offers a reliable solution for producing DDICs that deliver satisfactory display quality and power efficiency for a broad range of consumer electronics. The 90nm node, while older, remains relevant in the market due to its cost advantages and sufficient performance for certain applications. It is often employed in devices where cutting-edge performance is not the primary requirement, such as basic smartphones, feature phones, and some industrial applications. The 90nm process provides a stable and mature manufacturing option that can meet the needs of less demanding display technologies. The 130/110nm node is another mature technology that continues to find use in specific segments of the market. It is particularly suitable for applications where cost is a significant factor, and the performance requirements are moderate. This node is often used in automotive displays, basic consumer electronics, and other applications where the latest technology is not necessary. Finally, the 150nm and above nodes represent the oldest technologies still in use within the DDIC wafer foundry market. These nodes are typically employed in legacy systems and applications where the cost is the primary concern, and performance demands are minimal. They are often found in industrial equipment, older consumer electronics, and other niche markets where the latest advancements are not required. Each of these process nodes plays a crucial role in the Global DDIC Wafer Foundry Market, catering to different segments of the electronics industry and enabling the production of a wide range of display technologies.

Large Size Display (TV), Small and Medium Size Display in the Global DDIC Wafer Foundry Market:

The Global DDIC Wafer Foundry Market is integral to the production of display technologies used in various applications, including large-size displays like televisions and small to medium-size displays found in smartphones and tablets. In the realm of large-size displays, such as televisions, the demand for high-quality DDIC wafers is driven by the consumer's desire for enhanced viewing experiences. Televisions require display driver integrated circuits that can support high resolutions, vibrant colors, and fast refresh rates to deliver stunning picture quality. The foundry market caters to these needs by providing advanced wafers that enable the production of DDICs capable of driving large panels efficiently. As televisions continue to evolve with features like 4K and 8K resolutions, the demand for sophisticated DDICs increases, pushing foundries to innovate and improve their manufacturing processes. In the small and medium-size display segment, which includes devices like smartphones, tablets, and laptops, the requirements for DDIC wafers are slightly different. These devices prioritize power efficiency, compactness, and high performance to ensure long battery life and seamless user experiences. The foundry market addresses these needs by producing wafers that allow for the creation of DDICs with high transistor density and low power consumption. As a result, manufacturers can produce displays that are not only visually impressive but also energy-efficient, extending the battery life of portable devices. The versatility of the Global DDIC Wafer Foundry Market allows it to cater to the diverse needs of both large and small display applications, ensuring that consumers have access to high-quality visual experiences across a range of devices.

Global DDIC Wafer Foundry Market Outlook:

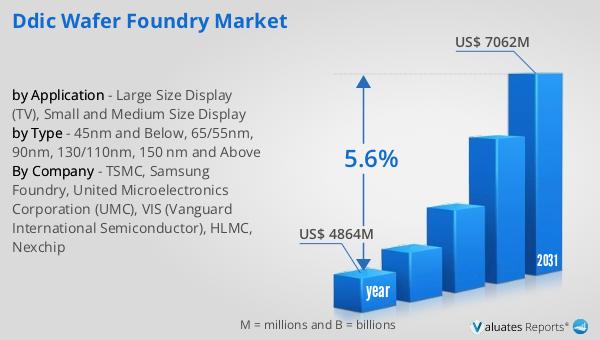

In 2024, the global market for DDIC Wafer Foundry was valued at approximately $4,864 million. Looking ahead, this market is expected to grow significantly, reaching an estimated size of $7,062 million by 2031. This growth trajectory represents a compound annual growth rate (CAGR) of 5.6% over the forecast period. This upward trend is indicative of the increasing demand for advanced display technologies across various sectors, including consumer electronics, automotive, and industrial applications. The market's expansion is driven by the continuous advancements in semiconductor manufacturing processes, which enable the production of more efficient and powerful display driver integrated circuits. As the demand for high-resolution displays and energy-efficient devices continues to rise, the DDIC Wafer Foundry Market is poised to play a crucial role in meeting these needs. The projected growth also reflects the industry's ability to adapt to changing consumer preferences and technological advancements, ensuring that it remains a vital component of the global electronics supply chain.

| Report Metric | Details |

| Report Name | DDIC Wafer Foundry Market |

| Accounted market size in year | US$ 4864 million |

| Forecasted market size in 2031 | US$ 7062 million |

| CAGR | 5.6% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| by Type |

|

| by Application |

|

| Production by Region |

|

| Consumption by Region |

|

| By Company | TSMC, Samsung Foundry, United Microelectronics Corporation (UMC), VIS (Vanguard International Semiconductor), HLMC, Nexchip |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |