What is Global Anodic Aluminum Oxide (AAO) Wafer Market?

The Global Anodic Aluminum Oxide (AAO) Wafer Market is a specialized segment within the broader materials industry, focusing on the production and application of anodic aluminum oxide wafers. These wafers are known for their unique porous structure, which is achieved through an electrochemical process that anodizes aluminum. This process results in a highly ordered nanoporous structure, making AAO wafers particularly valuable in various high-tech applications. They are widely used in fields such as electronics, photonics, and biotechnology due to their excellent thermal stability, mechanical strength, and ability to be precisely engineered at the nanoscale. The market for AAO wafers is driven by the increasing demand for advanced materials in these sectors, as they offer significant advantages in terms of performance and efficiency. As industries continue to push the boundaries of technology, the demand for materials like AAO wafers is expected to grow, making this market an exciting area of development and innovation. The global reach of this market is evident as it caters to a wide range of industries across different regions, highlighting its importance in the modern technological landscape.

4 Inch, 6 Inch, 8 Inch, Others in the Global Anodic Aluminum Oxide (AAO) Wafer Market:

In the Global Anodic Aluminum Oxide (AAO) Wafer Market, the categorization based on wafer size is crucial, with 4-inch, 6-inch, 8-inch, and other sizes being the primary segments. Each size serves different applications and industries, reflecting the diverse needs of the market. The 4-inch AAO wafers are the most prevalent, holding a significant share of the market. These wafers are often used in applications where smaller, more precise components are required, such as in certain types of sensors and microelectromechanical systems (MEMS). Their smaller size allows for greater precision and control in manufacturing processes, making them ideal for high-tech applications that demand accuracy and reliability. The 6-inch AAO wafers, on the other hand, are commonly used in semiconductor manufacturing. As the semiconductor industry continues to grow, driven by the demand for more powerful and efficient electronic devices, the need for 6-inch wafers is expected to increase. These wafers provide a balance between size and cost, making them a popular choice for many manufacturers. The 8-inch AAO wafers are typically used in larger-scale industrial applications. Their larger size allows for the production of bigger components, which are often required in industries such as automotive and aerospace. These wafers are also used in the production of certain types of solar cells, where their size and structural properties can enhance the efficiency of energy conversion. Other sizes of AAO wafers are also available, catering to niche applications that require specific dimensions or properties. These may include custom sizes for specialized research and development projects or unique industrial applications. The diversity in wafer sizes within the AAO market reflects the wide range of applications and industries that rely on these advanced materials. Each size offers distinct advantages, allowing manufacturers and researchers to choose the most appropriate option for their specific needs. As technology continues to evolve, the demand for different sizes of AAO wafers is likely to change, driven by new innovations and applications. This dynamic nature of the market underscores the importance of flexibility and adaptability in the production and application of AAO wafers.

Packaging & Foundry, IDM Enterprise in the Global Anodic Aluminum Oxide (AAO) Wafer Market:

The usage of Global Anodic Aluminum Oxide (AAO) Wafer Market in areas such as Packaging & Foundry and IDM Enterprise is significant, reflecting the versatility and adaptability of these materials. In the Packaging & Foundry sector, AAO wafers are primarily used for their excellent thermal and mechanical properties. They are often employed in the production of advanced packaging solutions, where their ability to withstand high temperatures and mechanical stress is crucial. This makes them ideal for use in environments where durability and reliability are paramount, such as in the packaging of electronic components. The foundry industry also benefits from the unique properties of AAO wafers, as they can be used in the production of molds and other components that require high precision and stability. In the IDM (Integrated Device Manufacturer) Enterprise sector, AAO wafers play a critical role in the manufacturing of semiconductor devices. Their nanoporous structure allows for precise control over the deposition of materials, making them ideal for use in the production of advanced electronic components. This is particularly important in the IDM sector, where the ability to produce high-performance, reliable devices is essential. The use of AAO wafers in this sector is driven by the need for materials that can support the development of increasingly complex and powerful electronic devices. The versatility of AAO wafers in these areas highlights their importance in the modern technological landscape. Their ability to be tailored to specific applications makes them a valuable resource for industries looking to push the boundaries of what is possible with advanced materials. As technology continues to advance, the demand for materials like AAO wafers is expected to grow, driven by the need for more efficient, reliable, and high-performance solutions. This underscores the importance of continued research and development in the field of AAO wafers, as new applications and innovations continue to emerge.

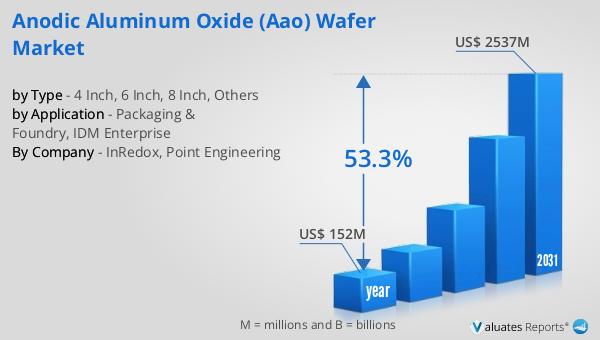

Global Anodic Aluminum Oxide (AAO) Wafer Market Outlook:

The global market for Anodic Aluminum Oxide (AAO) Wafer was valued at $111 million in 2024 and is anticipated to expand to a revised size of $561 million by 2031, reflecting a robust compound annual growth rate (CAGR) of 26.4% during the forecast period. North America stands out as the leading producer of AAO wafers, accounting for over 51% of the market share. This dominance is attributed to the region's advanced technological infrastructure and strong presence of key industry players. In terms of product segmentation, the 4-inch wafer is the largest segment, holding a share of over 34%. This size is particularly favored for its precision and suitability for high-tech applications, making it a popular choice among manufacturers. When it comes to application, the packaging and foundry sector emerges as the largest, with a share exceeding 77%. This highlights the significant role that AAO wafers play in these industries, driven by their unique properties and ability to enhance the performance and reliability of various components. The market outlook for AAO wafers is promising, with continued growth expected as industries increasingly adopt these advanced materials to meet the demands of modern technology.

| Report Metric | Details |

| Report Name | Anodic Aluminum Oxide (AAO) Wafer Market |

| Accounted market size in year | US$ 111 million |

| Forecasted market size in 2031 | US$ 561 million |

| CAGR | 26.4% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| by Type |

|

| by Application |

|

| Production by Region |

|

| Consumption by Region |

|

| By Company | InRedox, Point Engineering |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |