What is Psoriasis Biologics Drugs - Global Market?

Psoriasis biologics drugs represent a significant segment within the global pharmaceutical market, focusing on the treatment of psoriasis, a chronic autoimmune condition characterized by red, scaly patches on the skin. These biologic drugs are derived from living organisms and are designed to target specific parts of the immune system that drive inflammation and psoriasis symptoms. Unlike traditional systemic drugs that affect the entire immune system, biologics offer a more targeted approach, potentially reducing side effects and improving patient outcomes. The global market for psoriasis biologics is driven by increasing awareness of psoriasis as a serious health condition, advancements in biotechnology, and the growing prevalence of psoriasis worldwide. As more patients seek effective treatments, the demand for biologics continues to rise, supported by ongoing research and development efforts aimed at improving drug efficacy and safety. The market is also influenced by regulatory approvals, patent expirations, and the introduction of biosimilars, which offer more affordable options for patients. Overall, the psoriasis biologics drugs market is a dynamic and evolving sector, playing a crucial role in the broader pharmaceutical landscape.

TNF-α Inhibitor, IL-12/23 Target Drug, IL-17 Target Drug in the Psoriasis Biologics Drugs - Global Market:

TNF-α inhibitors, IL-12/23 target drugs, and IL-17 target drugs are key categories within the psoriasis biologics drugs market, each offering unique mechanisms of action to manage psoriasis symptoms. TNF-α inhibitors, such as etanercept, infliximab, and adalimumab, work by blocking tumor necrosis factor-alpha (TNF-α), a cytokine involved in systemic inflammation. These drugs have been instrumental in reducing the severity of psoriasis by interrupting the inflammatory cascade that leads to skin lesions. Patients using TNF-α inhibitors often experience significant improvements in skin clearance and quality of life. However, these drugs may also suppress the immune system, increasing the risk of infections, which necessitates careful monitoring by healthcare providers. IL-12/23 target drugs, like ustekinumab, focus on inhibiting the interleukins 12 and 23, which are proteins that play a crucial role in the inflammatory process of psoriasis. By targeting these specific interleukins, IL-12/23 inhibitors can effectively reduce the symptoms of moderate to severe psoriasis, offering an alternative for patients who may not respond well to TNF-α inhibitors. These drugs are generally well-tolerated, with a favorable safety profile, making them a popular choice among dermatologists. IL-17 target drugs, including secukinumab and ixekizumab, represent another innovative approach in psoriasis treatment. These biologics specifically inhibit interleukin-17, a cytokine that contributes to the inflammatory response in psoriasis. IL-17 inhibitors have shown remarkable efficacy in achieving rapid and sustained skin clearance, often outperforming other biologics in clinical trials. The introduction of IL-17 inhibitors has expanded the therapeutic options available to patients, particularly those with difficult-to-treat psoriasis. Despite their effectiveness, these drugs also carry potential risks, such as increased susceptibility to infections, which must be balanced against their benefits. The development and commercialization of these biologics have been driven by extensive research and clinical trials, underscoring the commitment of pharmaceutical companies to address the unmet needs of psoriasis patients. As the understanding of psoriasis pathophysiology continues to evolve, the market for TNF-α inhibitors, IL-12/23 target drugs, and IL-17 target drugs is expected to grow, offering hope for improved patient outcomes and quality of life.

Hospital Pharmacies, Retail Pharmacies, Online Pharmacies in the Psoriasis Biologics Drugs - Global Market:

Psoriasis biologics drugs are distributed through various channels, including hospital pharmacies, retail pharmacies, and online pharmacies, each playing a vital role in ensuring patient access to these essential medications. Hospital pharmacies are a primary distribution point for biologics, particularly for patients receiving treatment in a clinical setting. These pharmacies are equipped to handle the storage and administration requirements of biologics, which often need to be refrigerated and administered via injection. Hospital pharmacists work closely with healthcare providers to manage patient treatment plans, monitor drug interactions, and provide education on the proper use of biologics. This setting is particularly important for patients with severe psoriasis who may require more intensive management and monitoring. Retail pharmacies also play a crucial role in the distribution of psoriasis biologics, offering convenience and accessibility for patients who manage their condition on an outpatient basis. These pharmacies provide a point of contact for patients to refill prescriptions, access pharmacist consultations, and receive guidance on medication adherence. Retail pharmacists are instrumental in educating patients about potential side effects and the importance of following prescribed treatment regimens to achieve optimal outcomes. Online pharmacies have emerged as a growing distribution channel for psoriasis biologics, driven by the increasing demand for convenience and the rise of digital health solutions. These platforms offer patients the ability to order medications from the comfort of their homes, often with the added benefit of home delivery services. Online pharmacies can enhance medication adherence by providing reminders and educational resources, helping patients stay informed about their treatment. However, the online distribution of biologics requires stringent regulatory oversight to ensure the authenticity and safety of medications, as well as secure handling and delivery processes to maintain drug efficacy. Each distribution channel has its unique advantages and challenges, but collectively, they contribute to the broader goal of improving access to psoriasis biologics and supporting patient-centered care. As the market for psoriasis biologics continues to expand, the role of these distribution channels will remain critical in meeting the diverse needs of patients worldwide.

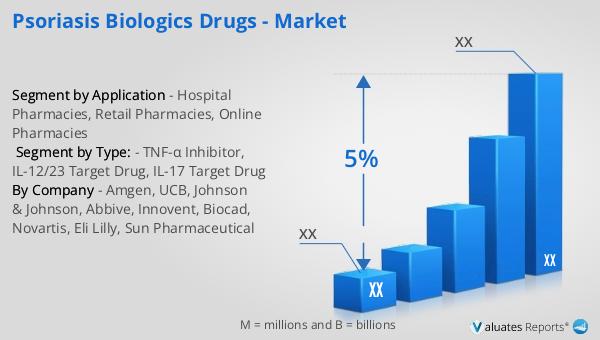

Psoriasis Biologics Drugs - Global Market Outlook:

The global pharmaceutical market was valued at approximately 1,475 billion USD in 2022, reflecting its expansive growth and significance in the healthcare industry. This market is projected to grow at a compound annual growth rate (CAGR) of 5% over the next six years, indicating a steady increase in demand for pharmaceutical products and innovations. In comparison, the chemical drug market, a subset of the broader pharmaceutical industry, has shown a notable increase from 1,005 billion USD in 2018 to 1,094 billion USD in 2022. This growth highlights the ongoing importance of chemical drugs in the treatment of various health conditions, despite the rising prominence of biologics and other advanced therapies. The expansion of the pharmaceutical market is driven by several factors, including an aging global population, increasing prevalence of chronic diseases, and advancements in drug development technologies. Additionally, the growing focus on personalized medicine and targeted therapies is reshaping the landscape of pharmaceutical research and development. As the market continues to evolve, pharmaceutical companies are investing in innovative solutions to meet the changing needs of patients and healthcare systems worldwide. This dynamic environment presents both opportunities and challenges for stakeholders, as they navigate regulatory complexities, competitive pressures, and the demand for cost-effective treatments. Overall, the global pharmaceutical market remains a vital component of the healthcare ecosystem, contributing to improved patient outcomes and quality of life.

| Report Metric | Details |

| Report Name | Psoriasis Biologics Drugs - Market |

| CAGR | 5% |

| Segment by Type: |

|

| Segment by Application |

|

| By Region |

|

| By Company | Amgen, UCB, Johnson & Johnson, Abbive, Innovent, Biocad, Novartis, Eli Lilly, Sun Pharmaceutical |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |