What is Intellectual Property Insurance - Global Market?

Intellectual Property Insurance is a specialized form of insurance designed to protect businesses and individuals from the financial risks associated with intellectual property (IP) disputes. This type of insurance covers legal costs and potential damages that may arise from claims of IP infringement, such as copyright, patent, trademark, design rights, and trade secrets. The global market for Intellectual Property Insurance is gaining traction as businesses increasingly recognize the value of their intellectual assets and the potential threats posed by infringement claims. With the rise of innovation and technology, companies are more vulnerable to IP disputes, making this insurance a crucial component of risk management strategies. The market is characterized by a growing demand for comprehensive coverage options that cater to the diverse needs of businesses across various industries. As companies expand globally, the complexity of IP laws and the potential for cross-border disputes further drive the need for robust IP insurance solutions. This market is expected to continue its growth trajectory as more businesses seek to safeguard their intellectual assets and mitigate the financial impact of IP litigation.

Corporate Intellectual Property Insurance, Personal Intellectual Property Insurance in the Intellectual Property Insurance - Global Market:

Corporate Intellectual Property Insurance is tailored to meet the needs of businesses, providing coverage for legal expenses and potential damages arising from IP disputes. This type of insurance is essential for companies that rely heavily on their intellectual assets, such as technology firms, pharmaceutical companies, and creative industries. Corporate IP insurance policies typically cover a range of IP rights, including patents, trademarks, copyrights, and trade secrets. These policies help businesses manage the financial risks associated with defending against infringement claims or pursuing legal action against infringers. By securing corporate IP insurance, companies can protect their innovations, brand reputation, and competitive advantage in the market. On the other hand, Personal Intellectual Property Insurance is designed for individuals, such as inventors, authors, and artists, who own valuable intellectual property. This insurance provides coverage for legal costs and potential damages in the event of IP disputes, allowing individuals to protect their creative works and inventions. Personal IP insurance is particularly beneficial for freelancers and small business owners who may not have the financial resources to defend their IP rights in court. Both corporate and personal IP insurance play a crucial role in safeguarding intellectual assets and ensuring that businesses and individuals can continue to innovate and create without the fear of costly legal battles. As the global market for Intellectual Property Insurance continues to grow, insurers are developing more tailored and flexible policies to meet the diverse needs of their clients. This includes offering coverage for emerging areas of IP, such as digital content and software, as well as providing risk management services to help businesses and individuals proactively protect their intellectual assets. The increasing complexity of IP laws and the rise of cross-border disputes further underscore the importance of having comprehensive IP insurance coverage. By investing in IP insurance, businesses and individuals can focus on what they do best—innovating and creating—while having peace of mind knowing that their intellectual assets are protected.

Copyright, Patents, Trademarks, Design Rights, Trade Secrets in the Intellectual Property Insurance - Global Market:

Intellectual Property Insurance plays a vital role in protecting various forms of intellectual property, including copyrights, patents, trademarks, design rights, and trade secrets. Copyright insurance provides coverage for legal expenses and potential damages arising from claims of copyright infringement. This is particularly important for creators of original works, such as authors, musicians, and filmmakers, who need to protect their creative output from unauthorized use or reproduction. Patent insurance, on the other hand, covers the costs associated with defending against patent infringement claims or pursuing legal action against infringers. This type of insurance is crucial for companies that invest heavily in research and development, as it helps safeguard their innovations and maintain their competitive edge in the market. Trademark insurance protects businesses from the financial risks associated with trademark disputes, such as claims of trademark infringement or dilution. This insurance is essential for companies that rely on their brand identity to differentiate themselves from competitors and build customer loyalty. Design rights insurance provides coverage for legal expenses and potential damages related to disputes over the unique appearance of a product or design. This type of insurance is particularly important for industries such as fashion, automotive, and consumer electronics, where design plays a critical role in product differentiation and market success. Lastly, trade secrets insurance offers protection for businesses that rely on confidential information, such as formulas, processes, or customer lists, to maintain their competitive advantage. This insurance covers the costs associated with defending against claims of trade secret misappropriation or pursuing legal action against those who unlawfully disclose or use confidential information. By providing coverage for these various forms of intellectual property, IP insurance helps businesses and individuals protect their valuable assets and mitigate the financial impact of IP disputes. As the global market for Intellectual Property Insurance continues to evolve, insurers are developing more comprehensive and tailored policies to address the unique needs of different industries and types of intellectual property. This includes offering coverage for emerging areas of IP, such as digital content and software, as well as providing risk management services to help businesses and individuals proactively protect their intellectual assets. By investing in IP insurance, businesses and individuals can focus on innovation and creativity, knowing that their intellectual property is safeguarded against potential legal challenges.

Intellectual Property Insurance - Global Market Outlook:

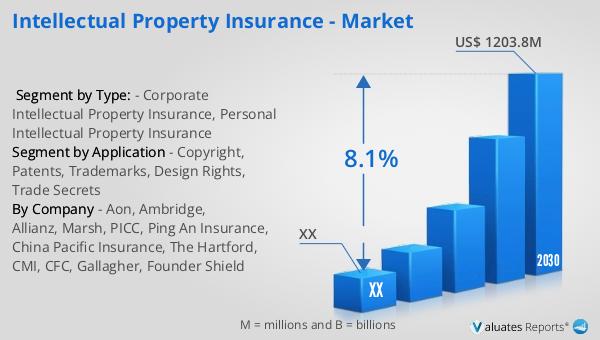

The global market for Intellectual Property Insurance was valued at approximately $716 million in 2023. This market is projected to grow significantly, reaching an estimated size of $1,203.8 million by 2030. This growth represents a compound annual growth rate (CAGR) of 8.1% during the forecast period from 2024 to 2030. The increasing awareness of the importance of intellectual property protection, coupled with the rising number of IP disputes, is driving the demand for IP insurance worldwide. Businesses and individuals are recognizing the need to safeguard their intellectual assets from potential legal challenges and financial losses. As a result, the market for IP insurance is expanding, with insurers offering more comprehensive and tailored coverage options to meet the diverse needs of their clients. The growth of the global IP insurance market is also fueled by the increasing complexity of IP laws and the rise of cross-border disputes, which require businesses to have robust risk management strategies in place. As companies continue to innovate and expand globally, the demand for IP insurance is expected to rise, making it an essential component of any comprehensive risk management plan. By investing in IP insurance, businesses and individuals can protect their valuable intellectual assets and ensure their continued success in an increasingly competitive and litigious environment.

| Report Metric | Details |

| Report Name | Intellectual Property Insurance - Market |

| Forecasted market size in 2030 | US$ 1203.8 million |

| CAGR | 8.1% |

| Forecasted years | 2024 - 2030 |

| Segment by Type: |

|

| Segment by Application |

|

| By Region |

|

| By Company | Aon, Ambridge, Allianz, Marsh, PICC, Ping An Insurance, China Pacific Insurance, The Hartford, CMI, CFC, Gallagher, Founder Shield |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |