What is Green Insurance - Global Market?

Green insurance is an innovative concept in the global market that focuses on providing coverage for environmentally friendly practices and sustainable initiatives. This type of insurance is designed to support businesses and individuals who are committed to reducing their environmental impact and promoting sustainability. Green insurance policies can cover a wide range of areas, including renewable energy projects, energy-efficient buildings, and eco-friendly transportation. By offering financial protection and incentives for green practices, these insurance products encourage more companies to adopt sustainable methods, ultimately contributing to a healthier planet. The global market for green insurance is growing as more businesses recognize the importance of sustainability and seek to mitigate environmental risks. This growth is driven by increasing awareness of climate change, stricter environmental regulations, and a shift in consumer preferences towards eco-friendly products and services. As a result, green insurance is becoming an essential component of risk management strategies for businesses across various industries, helping them to not only protect their assets but also enhance their reputation as environmentally responsible entities.

Pollution Legal Liability Insurance, Contractors Pollution Liability Insurance in the Green Insurance - Global Market:

Pollution Legal Liability Insurance (PLLI) and Contractors Pollution Liability Insurance (CPLI) are two critical components of the green insurance market, each serving distinct purposes in managing environmental risks. Pollution Legal Liability Insurance is designed to protect businesses from the financial consequences of pollution-related incidents. This type of insurance covers the costs associated with cleaning up pollution, legal defense expenses, and third-party claims for bodily injury or property damage resulting from pollution. PLLI is particularly important for industries that handle hazardous materials or operate in environmentally sensitive areas, as it provides a safety net against unforeseen environmental liabilities. On the other hand, Contractors Pollution Liability Insurance is tailored specifically for contractors and construction companies. This insurance covers pollution incidents that occur during construction projects, such as accidental spills or emissions. CPLI is essential for contractors who work on projects that involve the use of potentially harmful substances or activities that could lead to environmental contamination. By providing coverage for pollution-related risks, both PLLI and CPLI help businesses manage their environmental responsibilities and protect their financial interests. These insurance products are becoming increasingly important as environmental regulations become more stringent and the potential for costly pollution incidents rises. In the context of the global green insurance market, PLLI and CPLI play a vital role in promoting sustainable practices and encouraging businesses to adopt environmentally responsible approaches. By offering financial protection against pollution-related risks, these insurance products incentivize companies to invest in cleaner technologies and processes, ultimately contributing to a more sustainable future. As the demand for green insurance continues to grow, insurers are developing more comprehensive and tailored products to meet the specific needs of different industries. This evolution in the insurance market reflects a broader trend towards sustainability and environmental stewardship, as businesses and consumers alike recognize the importance of protecting the planet for future generations. In summary, Pollution Legal Liability Insurance and Contractors Pollution Liability Insurance are essential components of the green insurance market, providing crucial coverage for businesses facing environmental risks. These insurance products not only help companies manage their environmental responsibilities but also encourage the adoption of sustainable practices, contributing to the overall growth and development of the green insurance market.

Mining, Metallurgy, Automotive, Chemical Industry, Others in the Green Insurance - Global Market:

Green insurance plays a significant role in various industries, including mining, metallurgy, automotive, and the chemical industry, by providing coverage for environmentally sustainable practices and mitigating environmental risks. In the mining industry, green insurance can cover the costs associated with environmental restoration and rehabilitation efforts, ensuring that mining companies adhere to environmental regulations and minimize their impact on the surrounding ecosystem. This type of insurance also provides financial protection against potential liabilities arising from pollution or environmental damage caused by mining activities. In the metallurgy industry, green insurance supports companies in adopting cleaner production methods and reducing emissions. By offering coverage for investments in energy-efficient technologies and pollution control measures, green insurance encourages metallurgical companies to minimize their environmental footprint and comply with stringent environmental standards. In the automotive industry, green insurance is increasingly important as manufacturers strive to develop eco-friendly vehicles and reduce emissions. This insurance can cover the costs of research and development for sustainable technologies, as well as provide protection against potential liabilities related to environmental regulations. By supporting the transition to cleaner transportation options, green insurance helps automotive companies meet consumer demand for environmentally responsible products. In the chemical industry, green insurance plays a crucial role in managing the risks associated with the production and handling of hazardous materials. This insurance provides coverage for pollution incidents, cleanup costs, and third-party claims, helping chemical companies mitigate their environmental impact and comply with regulatory requirements. By incentivizing the adoption of safer and more sustainable practices, green insurance contributes to the overall reduction of environmental risks in the chemical industry. Beyond these specific industries, green insurance is also applicable to a wide range of other sectors, including agriculture, construction, and energy. By providing financial protection and incentives for sustainable practices, green insurance encourages businesses across various industries to adopt environmentally responsible approaches, ultimately contributing to a more sustainable global economy. As the demand for green insurance continues to grow, insurers are developing more specialized products to address the unique needs of different industries, further promoting the adoption of sustainable practices and the reduction of environmental risks.

Green Insurance - Global Market Outlook:

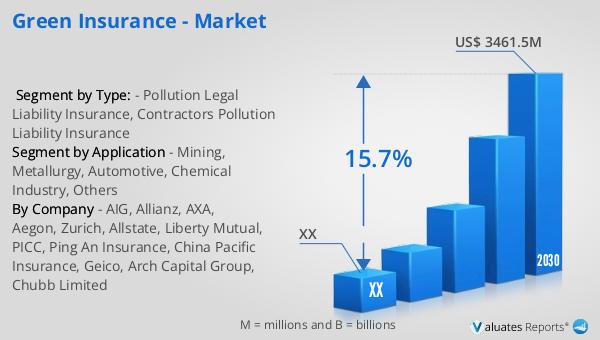

The global market for green insurance was valued at approximately $1,088 million in 2023, and it is projected to expand significantly, reaching an estimated size of $3,461.5 million by 2030. This growth represents a compound annual growth rate (CAGR) of 15.7% during the forecast period from 2024 to 2030. The North American segment of the green insurance market was also valued at a substantial amount in 2023, with expectations of continued growth through 2030. Although specific figures for the North American market are not provided, it is anticipated to follow a similar upward trajectory, driven by increasing awareness of environmental issues and the adoption of sustainable practices across various industries. The robust growth of the green insurance market is fueled by several factors, including heightened awareness of climate change, stricter environmental regulations, and a growing consumer preference for eco-friendly products and services. As businesses and individuals become more conscious of their environmental impact, the demand for insurance products that support sustainable practices is expected to rise. This trend is further supported by advancements in technology and innovation, which enable insurers to develop more comprehensive and tailored green insurance products to meet the diverse needs of different industries. As the market continues to evolve, green insurance is poised to play an increasingly important role in promoting sustainability and environmental stewardship on a global scale.

| Report Metric | Details |

| Report Name | Green Insurance - Market |

| Forecasted market size in 2030 | US$ 3461.5 million |

| CAGR | 15.7% |

| Forecasted years | 2024 - 2030 |

| Segment by Type: |

|

| Segment by Application |

|

| By Region |

|

| By Company | AIG, Allianz, AXA, Aegon, Zurich, Allstate, Liberty Mutual, PICC, Ping An Insurance, China Pacific Insurance, Geico, Arch Capital Group, Chubb Limited |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |