What is Blockchain in BFSI - Global Market?

Blockchain technology is revolutionizing the Banking, Financial Services, and Insurance (BFSI) sector on a global scale. At its core, blockchain is a decentralized digital ledger that records transactions across multiple computers in a way that ensures the data is secure, transparent, and tamper-proof. In the BFSI sector, blockchain is being used to streamline processes, reduce fraud, and enhance security. By eliminating the need for intermediaries, blockchain can significantly reduce transaction costs and time. This technology is particularly beneficial for cross-border transactions, where traditional methods can be slow and expensive. Additionally, blockchain's immutable nature ensures that once a transaction is recorded, it cannot be altered, providing a high level of trust and integrity. As the BFSI sector continues to evolve, the adoption of blockchain technology is expected to grow, offering new opportunities for innovation and efficiency.

Platform, Services in the Blockchain in BFSI - Global Market:

In the global market, blockchain platforms and services are becoming increasingly integral to the BFSI sector. Platforms based on blockchain technology provide the infrastructure needed for developing and deploying decentralized applications. These platforms offer a range of features, including smart contract functionality, which allows for the automation of complex processes without the need for intermediaries. This can lead to significant cost savings and increased efficiency. Services based on blockchain in the BFSI sector include everything from identity verification to fraud detection. For instance, blockchain can be used to create a secure and immutable record of a customer's identity, reducing the risk of identity theft and fraud. Additionally, blockchain's transparency and traceability make it an ideal tool for compliance and regulatory reporting. Financial institutions can use blockchain to create a transparent audit trail, ensuring that they meet regulatory requirements while also reducing the risk of errors and fraud. Furthermore, blockchain can be used to streamline the process of clearing and settling transactions. By providing a single, shared ledger, blockchain can eliminate the need for multiple reconciliations, reducing the time and cost associated with these processes. This is particularly beneficial for cross-border transactions, where traditional methods can be slow and expensive. In addition to these benefits, blockchain can also enhance security in the BFSI sector. By using cryptographic techniques, blockchain ensures that data is secure and cannot be tampered with. This is particularly important in the BFSI sector, where the security of customer data is paramount. Overall, the adoption of blockchain platforms and services in the BFSI sector is expected to continue to grow, offering new opportunities for innovation and efficiency.

Banking, NBFCs in the Blockchain in BFSI - Global Market:

Blockchain technology is being used in various ways within the BFSI sector, particularly in banking and Non-Banking Financial Companies (NBFCs). In the banking sector, blockchain is being used to streamline processes and reduce costs. For example, blockchain can be used to automate the process of clearing and settling transactions, reducing the time and cost associated with these processes. This is particularly beneficial for cross-border transactions, where traditional methods can be slow and expensive. Additionally, blockchain can be used to enhance security in the banking sector. By using cryptographic techniques, blockchain ensures that data is secure and cannot be tampered with. This is particularly important in the banking sector, where the security of customer data is paramount. In addition to these benefits, blockchain can also be used to improve compliance and regulatory reporting. By providing a transparent and immutable audit trail, blockchain can help banks meet regulatory requirements while also reducing the risk of errors and fraud. In the NBFC sector, blockchain is being used to enhance efficiency and reduce costs. For example, blockchain can be used to automate the process of loan origination and servicing, reducing the time and cost associated with these processes. Additionally, blockchain can be used to enhance security in the NBFC sector. By using cryptographic techniques, blockchain ensures that data is secure and cannot be tampered with. This is particularly important in the NBFC sector, where the security of customer data is paramount. Overall, the adoption of blockchain technology in the BFSI sector is expected to continue to grow, offering new opportunities for innovation and efficiency.

Blockchain in BFSI - Global Market Outlook:

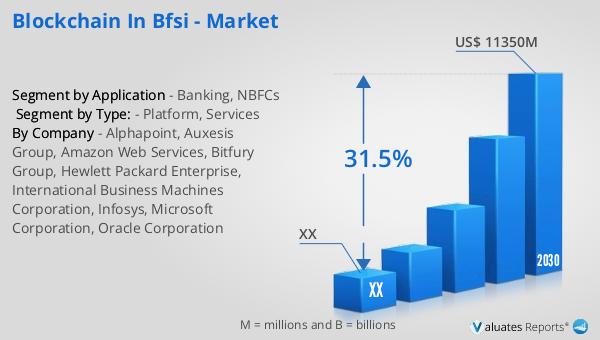

The global market for blockchain in the BFSI sector was valued at approximately $1,688 million in 2023. This market is projected to expand significantly, reaching an estimated size of $11,350 million by 2030, with a compound annual growth rate (CAGR) of 31.5% during the forecast period from 2024 to 2030. This rapid growth is indicative of the increasing adoption and integration of blockchain technology within the BFSI sector. The Global Mobile Economy Development Report 2023, released by GSMA Intelligence, highlighted that by the end of 2022, the number of global mobile users had surpassed 5.4 billion. This surge in mobile users is likely to further drive the demand for blockchain solutions in the BFSI sector, as financial institutions seek to leverage this technology to enhance their digital offerings and improve customer experiences. As the market continues to evolve, blockchain is expected to play a crucial role in transforming the BFSI sector, offering new opportunities for innovation and efficiency.

| Report Metric | Details |

| Report Name | Blockchain in BFSI - Market |

| Forecasted market size in 2030 | US$ 11350 million |

| CAGR | 31.5% |

| Forecasted years | 2024 - 2030 |

| Segment by Type: |

|

| Segment by Application |

|

| By Region |

|

| By Company | Alphapoint, Auxesis Group, Amazon Web Services, Bitfury Group, Hewlett Packard Enterprise, International Business Machines Corporation, Infosys, Microsoft Corporation, Oracle Corporation |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |