What is Multivendor ATM Software - Global Market?

Multivendor ATM software is a specialized technology that allows different types of automated teller machines (ATMs) from various manufacturers to operate using a single software platform. This software is designed to enhance the functionality and efficiency of ATMs by enabling them to perform a wide range of transactions and services beyond traditional cash dispensing. By supporting multiple vendors, this software provides banks and financial institutions with the flexibility to integrate and manage ATMs from different manufacturers seamlessly. This integration is crucial for maintaining a consistent user experience across all machines, regardless of their make or model. The global market for multivendor ATM software is driven by the increasing demand for advanced ATM functionalities, such as bill payments, card payments, and cash or cheque deposits. As financial institutions strive to offer more comprehensive services to their customers, the adoption of multivendor ATM software is expected to grow. This software not only improves operational efficiency but also reduces costs associated with managing multiple ATM systems. Furthermore, it enhances security features, ensuring safe and reliable transactions for users. Overall, multivendor ATM software plays a vital role in modernizing ATM networks and meeting the evolving needs of consumers in the digital age.

Bill Payment, Card Payment, Cash or Cheque Dispenser, Cash or Cheque Deposit, Others in the Multivendor ATM Software - Global Market:

Multivendor ATM software supports a variety of transactions and services, making it a versatile tool for financial institutions. One of the primary functions is bill payment, which allows users to pay utility bills, credit card bills, and other expenses directly from the ATM. This feature is particularly beneficial for customers who prefer to handle their financial transactions in person rather than online. By offering bill payment services, ATMs become more than just cash dispensers; they transform into comprehensive financial service kiosks. Card payment is another critical function supported by multivendor ATM software. This feature enables users to make payments using their debit or credit cards, facilitating quick and convenient transactions. Whether it's paying for groceries, dining out, or shopping, card payment functionality at ATMs provides users with an alternative to traditional point-of-sale systems. The cash or cheque dispenser function remains a core component of ATM services. Multivendor ATM software enhances this capability by allowing machines to dispense cash or cheques efficiently and securely. This function is essential for users who need immediate access to funds or prefer to receive cheques for specific transactions. Additionally, the software supports cash or cheque deposit functions, enabling users to deposit money or cheques into their accounts without visiting a bank branch. This feature is particularly useful for businesses and individuals who handle large volumes of cash or cheques regularly. By facilitating deposits at ATMs, financial institutions can reduce the workload on branch staff and improve customer convenience. Beyond these core functions, multivendor ATM software supports various other services, such as balance inquiries, mini-statements, and fund transfers. These additional features enhance the overall user experience by providing customers with easy access to essential banking services. Moreover, the software's ability to integrate with different ATM models ensures that these services are available across all machines, regardless of their manufacturer. This interoperability is crucial for maintaining a consistent and reliable service offering, which is vital for customer satisfaction and loyalty. In summary, multivendor ATM software significantly expands the capabilities of ATMs, transforming them into multifunctional service points that cater to a wide range of customer needs.

Banks and Financial Institutions, Independent ATM Deployer in the Multivendor ATM Software - Global Market:

The usage of multivendor ATM software is particularly prominent in banks and financial institutions, where it plays a crucial role in streamlining operations and enhancing customer service. For banks, the software provides a unified platform to manage ATMs from different manufacturers, eliminating the need for multiple software systems. This integration simplifies the management process, reduces operational costs, and ensures a consistent user experience across all ATMs. By supporting a wide range of transactions, such as cash withdrawals, deposits, and bill payments, multivendor ATM software enables banks to offer comprehensive services to their customers. This capability is essential for retaining customers in a competitive market where convenience and accessibility are key differentiators. Furthermore, the software's advanced security features help protect against fraud and unauthorized access, ensuring that customer transactions are safe and secure. Independent ATM deployers (IADs) also benefit significantly from multivendor ATM software. IADs are companies that own and operate ATMs independently of banks, often placing them in high-traffic locations such as shopping malls, airports, and convenience stores. For these operators, the ability to manage a diverse fleet of ATMs using a single software platform is invaluable. It allows them to offer a wide range of services to customers, including cash dispensing, card payments, and balance inquiries, without being tied to a specific ATM manufacturer. This flexibility is crucial for IADs, as it enables them to adapt quickly to changing market demands and customer preferences. Additionally, multivendor ATM software helps IADs optimize their operations by providing real-time data and analytics on ATM performance and usage patterns. This information is vital for making informed decisions about ATM placement, maintenance, and service offerings. By leveraging the capabilities of multivendor ATM software, both banks and independent ATM deployers can enhance their service offerings, improve operational efficiency, and meet the evolving needs of their customers.

Multivendor ATM Software - Global Market Outlook:

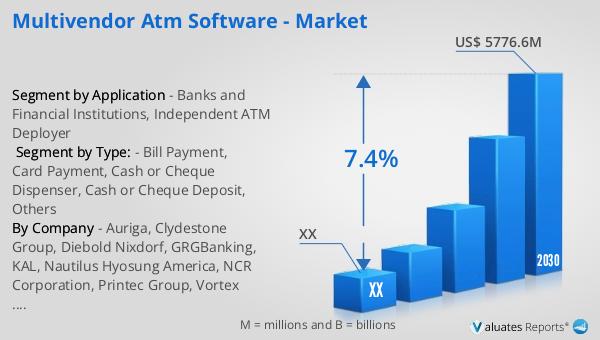

The global market for multivendor ATM software was valued at approximately $3,511 million in 2023. It is projected to grow to a revised size of $5,776.6 million by 2030, reflecting a compound annual growth rate (CAGR) of 7.4% during the forecast period from 2024 to 2030. This growth is driven by the increasing demand for advanced ATM functionalities and the need for financial institutions to offer more comprehensive services to their customers. The Global Mobile Economy Development Report 2023, released by GSMA Intelligence, highlighted that the number of global mobile users exceeded 5.4 billion by the end of 2022. This surge in mobile users underscores the growing importance of digital and mobile banking solutions, including multivendor ATM software. Additionally, data from the Ministry of Industry and Information Technology of China revealed that the cumulative revenue of telecommunications services in 2022 reached 1.58 trillion, marking an 8% increase over the previous year. This growth in telecommunications revenue further emphasizes the expanding digital landscape and the increasing reliance on technology-driven solutions in the financial sector. As financial institutions continue to adapt to these changes, the demand for multivendor ATM software is expected to rise, driving market growth in the coming years.

| Report Metric | Details |

| Report Name | Multivendor ATM Software - Market |

| Forecasted market size in 2030 | US$ 5776.6 million |

| CAGR | 7.4% |

| Forecasted years | 2024 - 2030 |

| Segment by Type: |

|

| Segment by Application |

|

| By Region |

|

| By Company | Auriga, Clydestone Group, Diebold Nixdorf, GRGBanking, KAL, Nautilus Hyosung America, NCR Corporation, Printec Group, Vortex Engineering |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |