What is Automotive Infrared Camera - Global Market?

The automotive infrared camera market is a rapidly evolving segment within the global automotive industry. These cameras are primarily used in vehicles to enhance safety and driver assistance systems. They work by detecting infrared radiation, which is emitted by objects and living beings, and converting it into an image that can be displayed on a screen. This technology is particularly useful in low-light or nighttime conditions, where traditional cameras may struggle to provide clear images. Automotive infrared cameras are increasingly being integrated into advanced driver-assistance systems (ADAS) to improve vehicle safety by detecting pedestrians, animals, and other obstacles on the road. The global market for these cameras is driven by the growing demand for enhanced safety features in vehicles, as well as the increasing adoption of autonomous and semi-autonomous driving technologies. As the automotive industry continues to innovate and prioritize safety, the demand for infrared cameras is expected to grow significantly. This growth is further supported by regulatory mandates in various regions that require the implementation of advanced safety systems in vehicles. Overall, the automotive infrared camera market is poised for substantial expansion as it plays a crucial role in the future of vehicle safety and automation.

DC 9V-16V, DC 16V-32V in the Automotive Infrared Camera - Global Market:

In the context of the automotive infrared camera market, the power supply specifications such as DC 9V-16V and DC 16V-32V are crucial for the operation of these devices. These voltage ranges are indicative of the power requirements needed to ensure the proper functioning of infrared cameras in vehicles. The DC 9V-16V range is typically associated with passenger vehicles, which generally operate on a 12V electrical system. This voltage range ensures that the infrared cameras can be seamlessly integrated into the existing electrical architecture of most passenger cars without requiring significant modifications. On the other hand, the DC 16V-32V range is more commonly found in commercial vehicles, which often operate on a 24V electrical system. This higher voltage range is necessary to accommodate the more robust electrical demands of larger vehicles, such as trucks and buses, which may require more powerful infrared cameras to cover larger areas and provide enhanced safety features. The ability of automotive infrared cameras to operate within these specified voltage ranges is critical for their widespread adoption across different vehicle types. Manufacturers must ensure that their cameras are compatible with the varying electrical systems of both passenger and commercial vehicles to meet the diverse needs of the automotive market. Additionally, the power efficiency of these cameras is an important consideration, as it impacts the overall energy consumption of the vehicle. As the demand for more energy-efficient vehicles grows, automotive infrared cameras must be designed to operate efficiently within their specified voltage ranges to minimize their impact on the vehicle's electrical system. This is particularly important in electric and hybrid vehicles, where energy conservation is a key concern. The integration of automotive infrared cameras into vehicles also involves considerations related to the installation and maintenance of these devices. Ensuring that the cameras are easy to install and maintain is essential for their widespread adoption. This includes designing cameras that are compatible with existing vehicle architectures and can be easily integrated into the vehicle's electrical system. Furthermore, the durability and reliability of automotive infrared cameras are critical factors that influence their market acceptance. These cameras must be able to withstand the harsh conditions of the automotive environment, including temperature fluctuations, vibrations, and exposure to dust and moisture. Manufacturers must ensure that their cameras are built to last and can provide consistent performance over the lifetime of the vehicle. In summary, the power supply specifications of DC 9V-16V and DC 16V-32V are vital for the successful integration of automotive infrared cameras into passenger and commercial vehicles. These specifications ensure compatibility with the electrical systems of different vehicle types and contribute to the overall efficiency and reliability of the cameras. As the automotive industry continues to evolve, the demand for advanced safety features and energy-efficient technologies will drive the growth of the automotive infrared camera market. Manufacturers must continue to innovate and adapt their products to meet the changing needs of the market and ensure the widespread adoption of this critical safety technology.

Passenger Cars, Commercial Vehicles in the Automotive Infrared Camera - Global Market:

Automotive infrared cameras are increasingly being utilized in both passenger cars and commercial vehicles to enhance safety and improve driving experiences. In passenger cars, these cameras are primarily used as part of advanced driver-assistance systems (ADAS) to provide drivers with enhanced visibility in low-light conditions. By detecting infrared radiation, these cameras can identify pedestrians, animals, and other obstacles on the road that may not be visible to the naked eye, especially at night. This capability significantly reduces the risk of accidents and enhances overall road safety. Additionally, automotive infrared cameras are being integrated into autonomous and semi-autonomous vehicles to improve their ability to navigate complex driving environments. By providing real-time data on the vehicle's surroundings, these cameras enable autonomous systems to make more informed decisions and improve the overall safety and reliability of self-driving cars. In commercial vehicles, automotive infrared cameras play a crucial role in enhancing safety and operational efficiency. These cameras are often used in large trucks and buses to provide drivers with a better view of their surroundings, particularly in blind spots and during nighttime driving. By improving visibility, infrared cameras help reduce the risk of accidents and collisions, which is especially important for commercial vehicles that often operate in challenging driving conditions. Furthermore, the use of infrared cameras in commercial vehicles can lead to cost savings by reducing the likelihood of accidents and associated repair costs. In addition to safety applications, automotive infrared cameras are also being used in commercial vehicles for monitoring and surveillance purposes. For example, these cameras can be used to monitor cargo areas and ensure the security of transported goods. By providing real-time video feeds, infrared cameras enable fleet managers to keep track of their vehicles and cargo, improving overall operational efficiency and security. The integration of automotive infrared cameras into both passenger cars and commercial vehicles is driven by the growing demand for advanced safety features and the increasing adoption of autonomous and semi-autonomous driving technologies. As the automotive industry continues to prioritize safety and innovation, the use of infrared cameras is expected to become more widespread across different vehicle types. This trend is further supported by regulatory mandates in various regions that require the implementation of advanced safety systems in vehicles. Overall, the use of automotive infrared cameras in passenger cars and commercial vehicles is transforming the way we approach vehicle safety and driving experiences. By providing enhanced visibility and real-time data on the vehicle's surroundings, these cameras are helping to create safer and more efficient driving environments. As the technology continues to evolve, the potential applications of automotive infrared cameras are likely to expand, further driving their adoption in the global automotive market.

Automotive Infrared Camera - Global Market Outlook:

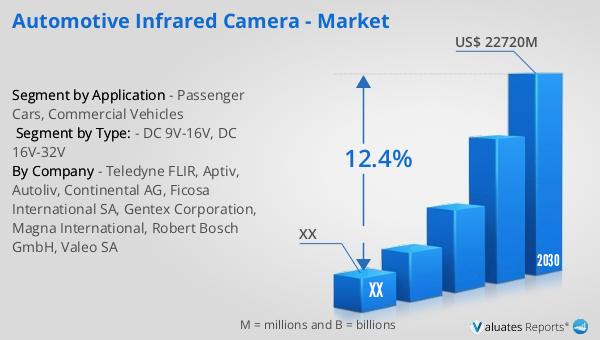

In 2023, the global automotive infrared camera market was valued at approximately US$ 9,458.5 million. This market is projected to grow significantly, reaching an estimated size of US$ 22,720 million by 2030, with a compound annual growth rate (CAGR) of 12.4% during the forecast period from 2024 to 2030. Currently, more than 90% of the world's automobiles are concentrated in three major continents: Asia, Europe, and North America. Among these, Asia leads in automobile production, accounting for 56% of the global output. Europe follows with a 20% share, while North America contributes 16% to the world's automobile production. This concentration of automobile manufacturing in these regions highlights the significant role they play in the global automotive market. The growth of the automotive infrared camera market is closely tied to the increasing demand for advanced safety features and the adoption of autonomous and semi-autonomous driving technologies. As these technologies become more prevalent, the need for reliable and efficient infrared cameras is expected to rise, driving further growth in the market. The expansion of the automotive infrared camera market is also supported by regulatory mandates in various regions that require the implementation of advanced safety systems in vehicles. These regulations are aimed at improving road safety and reducing the number of accidents, further fueling the demand for infrared cameras. As the market continues to evolve, manufacturers will need to innovate and adapt their products to meet the changing needs of the automotive industry and ensure the widespread adoption of this critical safety technology.

| Report Metric | Details |

| Report Name | Automotive Infrared Camera - Market |

| Forecasted market size in 2030 | US$ 22720 million |

| CAGR | 12.4% |

| Forecasted years | 2024 - 2030 |

| Segment by Type: |

|

| Segment by Application |

|

| By Region |

|

| By Company | Teledyne FLIR, Aptiv, Autoliv, Continental AG, Ficosa International SA, Gentex Corporation, Magna International, Robert Bosch GmbH, Valeo SA |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |