What is Automotive Aftermarket Tire Pressure Monitoring System - Global Market?

The Automotive Aftermarket Tire Pressure Monitoring System (TPMS) is a crucial component in the global automotive industry, designed to enhance vehicle safety and efficiency. This system monitors the air pressure inside pneumatic tires on various types of vehicles, alerting drivers when tire pressure drops below the recommended level. The global market for these systems is expanding rapidly due to increasing awareness about vehicle safety and the benefits of maintaining optimal tire pressure. Proper tire pressure not only ensures safety by reducing the risk of tire blowouts but also improves fuel efficiency and extends tire life. As more consumers and fleet operators recognize these advantages, the demand for aftermarket TPMS is on the rise. This market includes both direct and indirect TPMS technologies, each offering unique benefits and catering to different consumer needs. With advancements in technology and growing regulatory mandates for vehicle safety, the automotive aftermarket TPMS market is poised for significant growth in the coming years.

Direct TPMS, Indirect TPMS in the Automotive Aftermarket Tire Pressure Monitoring System - Global Market:

Direct Tire Pressure Monitoring Systems (Direct TPMS) and Indirect Tire Pressure Monitoring Systems (Indirect TPMS) are two primary technologies used in the automotive aftermarket TPMS market. Direct TPMS uses sensors mounted on the wheels to measure the actual air pressure in each tire. These sensors transmit real-time data to the vehicle's onboard computer, which alerts the driver if any tire is under-inflated. This system provides accurate and immediate readings, making it highly reliable. Direct TPMS is particularly beneficial for drivers who prioritize precision and immediate feedback on their tire conditions. However, it can be more expensive due to the need for individual sensors and regular maintenance, such as battery replacement. On the other hand, Indirect TPMS does not use physical sensors to measure tire pressure. Instead, it relies on the vehicle's anti-lock braking system (ABS) wheel speed sensors to estimate tire pressure. By comparing the rotational speed of each wheel, the system can infer if a tire is under-inflated, as an under-inflated tire will have a different rotational speed than properly inflated ones. Indirect TPMS is generally less expensive and easier to maintain since it does not require additional sensors. However, it may not provide as precise readings as direct systems and can sometimes be less responsive to gradual pressure changes. Both systems have their advantages and are chosen based on consumer preferences, cost considerations, and specific vehicle requirements. As the global market for automotive aftermarket TPMS continues to grow, both direct and indirect systems are expected to see increased adoption, driven by technological advancements and heightened awareness of vehicle safety.

Passenger Vehicle, Commercial Vehicle in the Automotive Aftermarket Tire Pressure Monitoring System - Global Market:

The usage of Automotive Aftermarket Tire Pressure Monitoring Systems in passenger and commercial vehicles is becoming increasingly prevalent as the benefits of maintaining optimal tire pressure become more widely recognized. In passenger vehicles, TPMS plays a crucial role in enhancing safety and driving comfort. By ensuring that tires are properly inflated, TPMS helps reduce the risk of accidents caused by tire blowouts or loss of control due to under-inflated tires. Additionally, maintaining the correct tire pressure improves fuel efficiency, which is a significant consideration for many drivers looking to reduce fuel costs and minimize their environmental impact. For commercial vehicles, the benefits of TPMS are even more pronounced. Fleet operators are particularly focused on maximizing vehicle uptime and minimizing maintenance costs. Under-inflated tires can lead to increased wear and tear, resulting in more frequent tire replacements and higher maintenance expenses. By using TPMS, fleet managers can proactively monitor tire conditions and address any issues before they lead to costly downtime. Furthermore, TPMS can contribute to improved fuel efficiency in commercial vehicles, which is critical given the high fuel consumption associated with large trucks and buses. The ability to maintain optimal tire pressure across an entire fleet can result in significant cost savings and operational efficiencies. As a result, the adoption of TPMS in both passenger and commercial vehicles is expected to continue growing, driven by the dual benefits of enhanced safety and cost savings.

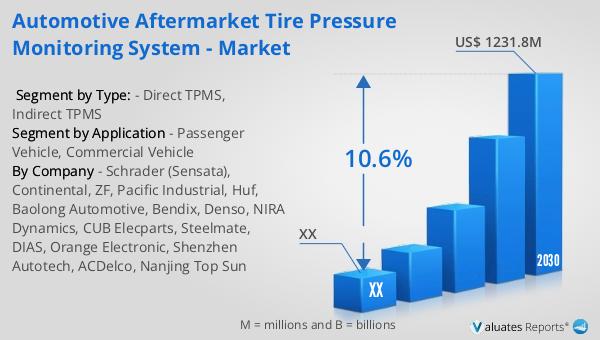

Automotive Aftermarket Tire Pressure Monitoring System - Global Market Outlook:

The global market for Automotive Aftermarket Tire Pressure Monitoring Systems was valued at approximately $625 million in 2023. It is projected to grow significantly, reaching an estimated $1,231.8 million by 2030, with a compound annual growth rate (CAGR) of 10.6% during the forecast period from 2024 to 2030. This growth is fueled by increasing awareness of vehicle safety and the benefits of maintaining optimal tire pressure. Currently, over 90% of the world's automobiles are concentrated in Asia, Europe, and North America. Asia leads in automobile production, accounting for 56% of the global output, followed by Europe at 20% and North America at 16%. This concentration of automotive production in these regions is a key driver for the TPMS market, as regulatory mandates and consumer awareness about vehicle safety are more pronounced in these areas. As the market continues to expand, manufacturers and suppliers of TPMS are likely to focus on these regions to capitalize on the growing demand for aftermarket solutions. The increasing adoption of TPMS in both passenger and commercial vehicles further underscores the market's potential for growth, as consumers and fleet operators alike seek to enhance safety and efficiency.

| Report Metric | Details |

| Report Name | Automotive Aftermarket Tire Pressure Monitoring System - Market |

| Forecasted market size in 2030 | US$ 1231.8 million |

| CAGR | 10.6% |

| Forecasted years | 2024 - 2030 |

| Segment by Type: |

|

| Segment by Application |

|

| By Region |

|

| By Company | Schrader (Sensata), Continental, ZF, Pacific Industrial, Huf, Baolong Automotive, Bendix, Denso, NIRA Dynamics, CUB Elecparts, Steelmate, DIAS, Orange Electronic, Shenzhen Autotech, ACDelco, Nanjing Top Sun |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |