What is Global Blown Film Extrusion Machines Market?

The Global Blown Film Extrusion Machines Market refers to the industry focused on the production and sale of machines used to create blown films. Blown film extrusion is a process where plastic is melted and formed into a bubble, which is then cooled and flattened to create thin plastic films. These films are widely used in packaging, agriculture, and other industries due to their versatility and cost-effectiveness. The market for these machines is driven by the increasing demand for flexible packaging solutions, especially in the food and beverage sector, where the need for lightweight, durable, and protective packaging is paramount. Additionally, advancements in technology have led to the development of more efficient and environmentally friendly machines, further boosting market growth. As industries continue to seek sustainable packaging solutions, the demand for blown film extrusion machines is expected to rise, making this market a critical component of the global manufacturing landscape. The market is characterized by a mix of established players and new entrants, all striving to innovate and meet the evolving needs of their customers.

3 Layer Blown Film Extrusion Machines, 7 Layer Blown Film Extrusion Machines, Others in the Global Blown Film Extrusion Machines Market:

Blown film extrusion machines come in various configurations, with 3-layer and 7-layer machines being among the most common. A 3-layer blown film extrusion machine is designed to produce films with three distinct layers, each potentially made from different materials. This configuration allows manufacturers to tailor the properties of the film to specific applications, such as improving strength, flexibility, or barrier properties. For instance, in the food packaging industry, a 3-layer film might consist of an outer layer for printability, a middle layer for strength, and an inner layer for sealing. These machines are popular due to their ability to produce high-quality films at a relatively low cost, making them a staple in many production facilities. On the other hand, 7-layer blown film extrusion machines offer even greater versatility and complexity. With seven layers, manufacturers can create films with highly specialized properties, such as enhanced barrier protection against moisture, oxygen, or other environmental factors. This makes them ideal for packaging perishable goods, pharmaceuticals, and other sensitive products. The ability to fine-tune each layer's composition allows for the creation of films that meet stringent industry standards and consumer expectations. While these machines are more expensive and complex to operate than their 3-layer counterparts, the benefits they offer in terms of product performance and market differentiation can justify the investment. Beyond 3-layer and 7-layer machines, the market also includes other configurations, such as 5-layer or 9-layer machines, each offering unique advantages depending on the intended application. These machines cater to niche markets where specific film properties are required, such as in the automotive or construction industries. As technology continues to advance, the capabilities of blown film extrusion machines are expected to expand, enabling manufacturers to produce films with even more sophisticated properties. This ongoing innovation is crucial for meeting the diverse needs of global industries and maintaining competitiveness in a rapidly evolving market.

PE, PP, PVC, Others in the Global Blown Film Extrusion Machines Market:

The Global Blown Film Extrusion Machines Market plays a crucial role in the production of films made from various materials, including polyethylene (PE), polypropylene (PP), polyvinyl chloride (PVC), and others. Each of these materials has unique properties that make them suitable for different applications. Polyethylene, for instance, is one of the most commonly used materials in blown film extrusion due to its excellent flexibility, durability, and resistance to moisture. It is widely used in the production of plastic bags, shrink films, and agricultural films. The versatility of PE makes it a preferred choice for manufacturers looking to produce cost-effective and reliable packaging solutions. Polypropylene, on the other hand, is known for its high melting point and excellent clarity, making it ideal for applications that require heat resistance and transparency. PP films are commonly used in food packaging, textiles, and stationery products. The ability to produce clear and strong films makes PP a valuable material in the blown film extrusion market. Polyvinyl chloride, or PVC, is another important material used in blown film extrusion. Known for its rigidity and strength, PVC is often used in applications that require durability and resistance to environmental factors. It is commonly used in the production of construction films, medical packaging, and industrial applications. The use of PVC in blown film extrusion allows manufacturers to create films that can withstand harsh conditions and provide long-lasting protection. In addition to these materials, the market also includes other polymers and blends that offer unique properties for specific applications. For example, biodegradable materials are gaining popularity as industries seek more sustainable packaging solutions. The ability to produce films from a wide range of materials is a key advantage of blown film extrusion machines, allowing manufacturers to meet the diverse needs of their customers. As the demand for specialized films continues to grow, the Global Blown Film Extrusion Machines Market is expected to play an increasingly important role in the production of innovative and sustainable packaging solutions.

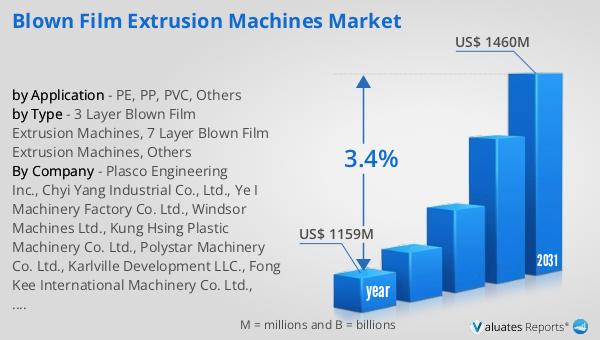

Global Blown Film Extrusion Machines Market Outlook:

The worldwide market for Blown Film Extrusion Machines was valued at approximately $1,159 million in 2024 and is anticipated to expand to a revised size of around $1,460 million by 2031, reflecting a compound annual growth rate (CAGR) of 3.4% over the forecast period. This growth trajectory underscores the increasing demand for these machines across various industries, driven by the need for efficient and sustainable packaging solutions. The market is dominated by the top five manufacturers, who collectively hold a significant share of over 70%. This concentration of market power highlights the competitive nature of the industry, where leading companies leverage their technological expertise and extensive distribution networks to maintain their market positions. As the market continues to evolve, these key players are likely to focus on innovation and strategic partnerships to capitalize on emerging opportunities and address the changing needs of their customers. The projected growth of the Blown Film Extrusion Machines Market reflects broader trends in the global economy, including the rising demand for flexible packaging, advancements in material science, and the increasing emphasis on sustainability. As industries continue to adapt to these trends, the market for blown film extrusion machines is expected to remain a vital component of the global manufacturing landscape, providing the tools necessary for the production of high-quality films that meet the diverse needs of consumers and businesses alike.

| Report Metric | Details |

| Report Name | Blown Film Extrusion Machines Market |

| Accounted market size in year | US$ 1159 million |

| Forecasted market size in 2031 | US$ 1460 million |

| CAGR | 3.4% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| by Type |

|

| by Application |

|

| Production by Region |

|

| Consumption by Region |

|

| By Company | Plasco Engineering Inc., Chyi Yang Industrial Co., Ltd., Ye I Machinery Factory Co. Ltd., Windsor Machines Ltd., Kung Hsing Plastic Machinery Co. Ltd., Polystar Machinery Co. Ltd., Karlville Development LLC., Fong Kee International Machinery Co. Ltd., Brampton Engineering Inc., Friul Filiere SpA, Alpha Marathon Technologies Group |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |