What is Global Plasma Protein Products Market?

The Global Plasma Protein Products Market is a rapidly evolving sector within the healthcare industry, focusing on the extraction and utilization of proteins found in human plasma. Plasma, the liquid component of blood, is rich in proteins that play crucial roles in maintaining health and treating various medical conditions. The market encompasses a range of products derived from plasma, including albumin, immunoglobulins, and coagulation factors, among others. These products are essential in treating conditions such as immune deficiencies, hemophilia, and other blood-related disorders. The demand for plasma protein products is driven by the increasing prevalence of these conditions, advancements in medical technology, and a growing awareness of the benefits of plasma-derived therapies. As the global population ages and healthcare systems improve, the need for effective and reliable plasma protein products continues to rise, making this market a vital component of modern medicine. The market's growth is further supported by ongoing research and development efforts aimed at enhancing the efficacy and safety of plasma-derived therapies, ensuring that they remain a cornerstone of treatment for various medical conditions worldwide.

Albumin, Immunoglobulin, Coagulation Factor, Others in the Global Plasma Protein Products Market:

Albumin, immunoglobulin, coagulation factors, and other plasma-derived products are integral components of the Global Plasma Protein Products Market, each serving distinct yet vital roles in healthcare. Albumin, a protein found in high concentrations in plasma, is primarily used to treat conditions related to blood volume loss, such as burns, trauma, and surgeries. It helps maintain blood pressure and volume, ensuring that organs receive adequate oxygen and nutrients. Albumin's versatility extends to its use in treating liver diseases and as a stabilizer in vaccines and other medical formulations. Immunoglobulins, or antibodies, are another critical component, used to bolster the immune system in individuals with immune deficiencies or autoimmune diseases. They are administered to patients to help fight infections and provide passive immunity, offering protection against a wide range of pathogens. Coagulation factors, on the other hand, are essential for individuals with bleeding disorders like hemophilia. These proteins help in blood clotting, preventing excessive bleeding during injuries or surgeries. The market also includes other plasma-derived products, such as protease inhibitors and fibrinogen, which are used in various therapeutic applications. Protease inhibitors are crucial in managing conditions like hereditary angioedema, while fibrinogen is used in treating bleeding disorders and during surgical procedures to promote clot formation. The diverse applications of these products highlight the importance of the Global Plasma Protein Products Market in addressing a wide array of medical needs. As research continues to advance, the development of new plasma-derived therapies is expected to further expand the market, offering innovative solutions for patients worldwide. The integration of cutting-edge technologies and improved manufacturing processes ensures that these products are not only effective but also safe and accessible to those who need them most. This ongoing evolution underscores the market's commitment to enhancing patient outcomes and improving quality of life through the power of plasma proteins.

Hospital, Retail Pharmacy, Other in the Global Plasma Protein Products Market:

The usage of Global Plasma Protein Products Market extends across various healthcare settings, including hospitals, retail pharmacies, and other medical facilities, each playing a crucial role in delivering these life-saving therapies to patients. In hospitals, plasma protein products are indispensable in managing acute and chronic conditions. They are used in emergency rooms and intensive care units to treat patients with severe trauma, burns, or undergoing major surgeries, where maintaining blood volume and pressure is critical. Albumin, for instance, is frequently administered to stabilize patients and support recovery. Immunoglobulins are used in hospital settings to treat patients with immune deficiencies or autoimmune disorders, providing them with the necessary antibodies to fight infections. Coagulation factors are vital in surgical and trauma care, ensuring that patients with bleeding disorders receive the appropriate treatment to prevent excessive bleeding. Retail pharmacies also play a significant role in the distribution of plasma protein products, making them accessible to patients who require ongoing treatment for chronic conditions. Patients with immune deficiencies or bleeding disorders often rely on regular infusions of immunoglobulins or coagulation factors, which can be conveniently obtained from pharmacies. This accessibility ensures that patients can maintain their treatment regimens without frequent hospital visits, improving their quality of life and reducing the burden on healthcare facilities. Other medical facilities, such as specialized clinics and outpatient centers, also contribute to the distribution and administration of plasma protein products. These facilities often cater to patients with specific needs, providing targeted therapies and personalized care. The integration of plasma protein products into various healthcare settings highlights their versatility and essential role in modern medicine. As the demand for these therapies continues to grow, healthcare providers are increasingly focused on ensuring that patients have access to the treatments they need, when and where they need them. This commitment to accessibility and patient-centered care is a driving force behind the ongoing expansion of the Global Plasma Protein Products Market, as it strives to meet the diverse needs of patients worldwide.

Global Plasma Protein Products Market Outlook:

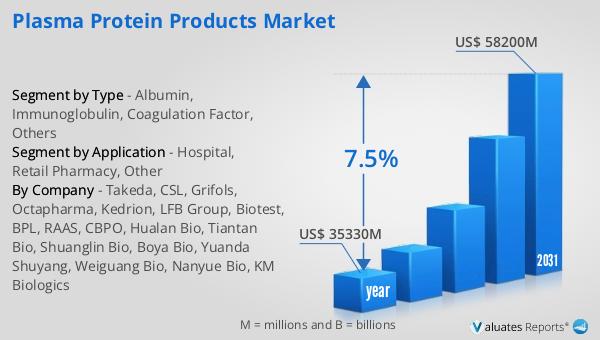

The global market for Plasma Protein Products was valued at approximately $35.33 billion in 2024, with projections indicating a significant growth trajectory. By 2031, the market is expected to reach an estimated size of $58.2 billion, reflecting a compound annual growth rate (CAGR) of 7.5% over the forecast period. This robust growth is indicative of the increasing demand for plasma-derived therapies, driven by factors such as the rising prevalence of chronic diseases, advancements in medical technology, and a growing awareness of the benefits of these products. North America stands out as the largest consumer of plasma protein products, accounting for nearly 40% of the revenue market share in 2023. This dominance can be attributed to the region's well-established healthcare infrastructure, high healthcare expenditure, and a strong focus on research and development. The market's expansion is further supported by the presence of key industry players and a favorable regulatory environment that encourages innovation and the introduction of new therapies. As the market continues to evolve, stakeholders are increasingly focused on enhancing the accessibility and affordability of plasma protein products, ensuring that patients worldwide can benefit from these life-saving treatments. The ongoing commitment to research and development, coupled with strategic partnerships and collaborations, is expected to drive further growth and innovation in the Global Plasma Protein Products Market, solidifying its position as a critical component of the global healthcare landscape.

| Report Metric | Details |

| Report Name | Plasma Protein Products Market |

| Accounted market size in year | US$ 35330 million |

| Forecasted market size in 2031 | US$ 58200 million |

| CAGR | 7.5% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | Takeda, CSL, Grifols, Octapharma, Kedrion, LFB Group, Biotest, BPL, RAAS, CBPO, Hualan Bio, Tiantan Bio, Shuanglin Bio, Boya Bio, Yuanda Shuyang, Weiguang Bio, Nanyue Bio, KM Biologics |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |