What is Global Financial Payment Cards Market?

The Global Financial Payment Cards Market refers to the expansive and dynamic industry that encompasses various types of payment cards used worldwide for financial transactions. These cards include credit cards, debit cards, bank cards, purchasing cards, and other specialized cards designed to facilitate seamless and secure monetary exchanges. The market is driven by the increasing demand for cashless transactions, technological advancements in payment systems, and the growing adoption of digital banking solutions. Financial payment cards offer convenience, security, and efficiency, making them a preferred choice for consumers and businesses alike. The market is characterized by continuous innovation, with companies constantly developing new features and services to enhance user experience and security. As the global economy becomes more interconnected, the demand for financial payment cards is expected to rise, driven by factors such as urbanization, rising disposable incomes, and the proliferation of e-commerce. The market is also influenced by regulatory changes, consumer preferences, and competitive dynamics among card issuers and payment networks. Overall, the Global Financial Payment Cards Market plays a crucial role in shaping the future of financial transactions, offering a wide range of options to meet the diverse needs of consumers and businesses across the globe.

Bank Cards, Credit Cards, Debit Cards, Purchasing Cards, Other in the Global Financial Payment Cards Market:

Bank cards, credit cards, debit cards, purchasing cards, and other types of financial payment cards each serve distinct purposes within the Global Financial Payment Cards Market. Bank cards are typically issued by financial institutions and can function as either debit or credit cards. They are linked directly to the cardholder's bank account, allowing for easy access to funds and facilitating transactions at various points of sale. Credit cards, on the other hand, provide users with a line of credit that can be used for purchases, with the obligation to repay the borrowed amount at a later date. They offer benefits such as reward points, cashback, and travel perks, making them popular among consumers who seek flexibility and additional value from their spending. Debit cards, in contrast, draw funds directly from the user's bank account, ensuring that transactions are limited to the available balance. They are widely used for everyday purchases and are favored by individuals who prefer to manage their finances without incurring debt. Purchasing cards, often used by businesses, are designed to streamline procurement processes and manage expenses efficiently. They allow companies to control spending, track transactions, and simplify accounting procedures. Other specialized cards in the market include prepaid cards, which are loaded with a specific amount of money and can be used until the balance is exhausted. These cards are popular for gifting, travel, and budgeting purposes. Additionally, virtual cards are gaining traction, offering a secure and convenient way to make online transactions without the need for a physical card. Each type of card within the Global Financial Payment Cards Market caters to specific needs and preferences, contributing to the overall growth and diversification of the industry. As technology continues to evolve, the market is likely to witness further innovations, enhancing the functionality and appeal of financial payment cards for consumers and businesses worldwide.

Personal use, Business use in the Global Financial Payment Cards Market:

The usage of Global Financial Payment Cards Market extends to both personal and business applications, offering a wide range of benefits and conveniences. For personal use, financial payment cards provide individuals with a secure and efficient means of managing their finances. Credit cards, for instance, allow consumers to make purchases without immediate cash outflow, offering the flexibility to pay off the balance over time. This can be particularly useful for managing cash flow, handling emergencies, or making large purchases. Additionally, many credit cards offer rewards programs, cashback, and other incentives, encouraging users to spend while earning benefits. Debit cards, on the other hand, offer a straightforward way to access funds directly from a bank account, making them ideal for everyday transactions and budgeting. They provide a sense of financial discipline, as users can only spend what they have, reducing the risk of debt accumulation. For business use, financial payment cards play a crucial role in streamlining operations and managing expenses. Purchasing cards, for example, are widely used by companies to control spending, track expenses, and simplify procurement processes. They enable businesses to set spending limits, monitor transactions in real-time, and integrate with accounting systems for efficient financial management. Credit cards are also valuable for businesses, offering a line of credit that can be used to manage cash flow, invest in growth opportunities, or cover unexpected expenses. They often come with additional benefits such as travel insurance, purchase protection, and rewards programs tailored to business needs. Overall, the Global Financial Payment Cards Market provides versatile solutions for both personal and business use, enhancing financial management, convenience, and security for users worldwide.

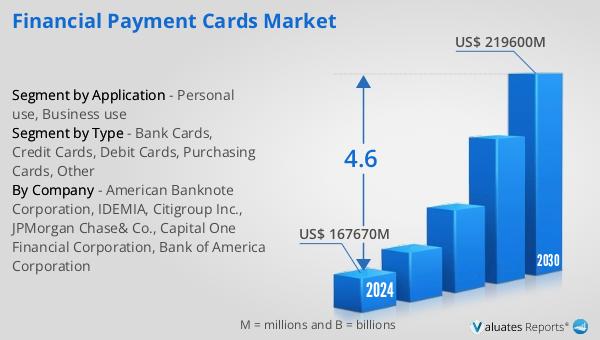

Global Financial Payment Cards Market Outlook:

The global market for financial payment cards was valued at approximately $174.61 billion in 2024, and it is anticipated to expand to a revised size of around $238.16 billion by 2031. This growth trajectory represents a compound annual growth rate (CAGR) of 4.6% over the forecast period. This upward trend in the market is indicative of the increasing reliance on cashless transactions and the growing adoption of digital payment solutions across the globe. The expansion of the market is driven by several factors, including technological advancements in payment systems, the proliferation of e-commerce, and the rising demand for secure and convenient payment methods. As consumers and businesses continue to embrace digital banking and financial technologies, the market for financial payment cards is expected to witness sustained growth. The increasing urbanization and rising disposable incomes in emerging economies further contribute to the market's expansion, as more individuals gain access to banking services and financial products. Additionally, the competitive landscape of the market is characterized by continuous innovation, with companies striving to enhance user experience, security, and functionality of payment cards. As a result, the global financial payment cards market is poised for significant growth, offering a wide range of opportunities for stakeholders in the industry.

| Report Metric | Details |

| Report Name | Financial Payment Cards Market |

| Accounted market size in year | US$ 174610 million |

| Forecasted market size in 2031 | US$ 238160 million |

| CAGR | 4.6% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| Segment by Type |

|

| Segment by Application |

|

| Consumption by Region |

|

| By Company | CPI Card Group, Gemalto, American Banknote Corporation, IDEMIA, Citigroup Inc., JPMorgan Chase& Co., Capital One Financial Corporation, Bank of America Corporation |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |