What is Global SiC-SBD Market?

The Global SiC-SBD Market refers to the worldwide market for Silicon Carbide Schottky Barrier Diodes (SiC-SBDs), which are semiconductor devices used in various electronic applications due to their superior performance characteristics. These diodes are known for their high efficiency, fast switching speeds, and ability to operate at high temperatures and voltages, making them ideal for use in power electronics. The market for SiC-SBDs is driven by the increasing demand for energy-efficient electronic devices and the growing adoption of electric vehicles (EVs) and renewable energy systems. As industries continue to seek ways to reduce energy consumption and improve performance, SiC-SBDs are becoming a critical component in achieving these goals. The market is characterized by rapid technological advancements and increasing investments in research and development to enhance the performance and reduce the cost of these devices. As a result, the Global SiC-SBD Market is expected to experience significant growth in the coming years, driven by the expanding applications of SiC-SBDs across various industries.

650V SiC SBD, 1200V SiC SBD, Others in the Global SiC-SBD Market:

The Global SiC-SBD Market is segmented into different voltage categories, including 650V SiC SBD, 1200V SiC SBD, and others, each serving specific applications based on their voltage ratings. The 650V SiC SBDs are primarily used in applications that require moderate voltage levels, such as power supplies and photovoltaic inverters. These diodes offer high efficiency and fast switching capabilities, making them suitable for use in renewable energy systems and power management applications. The 1200V SiC SBDs, on the other hand, are designed for high-voltage applications, such as electric vehicle (EV) powertrains and industrial motor drives. These diodes provide superior performance in terms of efficiency and thermal management, enabling them to handle higher power levels and operate in harsh environments. The "others" category includes SiC-SBDs with voltage ratings beyond 1200V, which are used in specialized applications that require even higher voltage levels, such as high-power industrial equipment and advanced power conversion systems. The demand for these diodes is driven by the need for more efficient and reliable power electronics in various industries, including automotive, industrial, and renewable energy. As the adoption of SiC-SBDs continues to grow, manufacturers are focusing on developing advanced technologies to enhance the performance and reduce the cost of these devices. This includes innovations in materials, design, and manufacturing processes to improve the efficiency, reliability, and thermal performance of SiC-SBDs. Additionally, the increasing focus on sustainability and energy efficiency is driving the demand for SiC-SBDs in applications such as electric vehicles, renewable energy systems, and industrial automation. The 650V SiC SBDs are particularly popular in the renewable energy sector, where they are used in photovoltaic inverters to convert solar energy into usable electricity. These diodes offer high efficiency and fast switching capabilities, making them ideal for use in solar power systems. The 1200V SiC SBDs are widely used in the automotive industry, where they are used in electric vehicle powertrains to improve efficiency and reduce energy losses. These diodes are also used in industrial motor drives, where they provide superior performance in terms of efficiency and thermal management. The "others" category of SiC-SBDs is used in specialized applications that require high voltage levels, such as high-power industrial equipment and advanced power conversion systems. These diodes offer high efficiency and reliability, making them suitable for use in demanding applications. As the demand for SiC-SBDs continues to grow, manufacturers are investing in research and development to enhance the performance and reduce the cost of these devices. This includes innovations in materials, design, and manufacturing processes to improve the efficiency, reliability, and thermal performance of SiC-SBDs. Additionally, the increasing focus on sustainability and energy efficiency is driving the demand for SiC-SBDs in applications such as electric vehicles, renewable energy systems, and industrial automation.

Automotive & EV/HEV, EV Charging, Industrial Motor/Drive, PV, Energy Storage, Wind Power, UPS, Data Center & Server, Rail Transport, Others in the Global SiC-SBD Market:

The Global SiC-SBD Market finds extensive usage across various sectors, including Automotive & EV/HEV, EV Charging, Industrial Motor/Drive, PV, Energy Storage, Wind Power, UPS, Data Center & Server, Rail Transport, and others. In the automotive sector, SiC-SBDs are crucial for electric vehicles (EVs) and hybrid electric vehicles (HEVs), where they enhance the efficiency of powertrains and reduce energy losses. These diodes enable faster charging and discharging cycles, contributing to improved vehicle performance and extended battery life. In EV charging infrastructure, SiC-SBDs play a vital role in increasing the efficiency and speed of charging stations, making them more reliable and effective for widespread adoption. In industrial applications, SiC-SBDs are used in motor drives and power converters, where they offer superior efficiency and thermal management, leading to reduced energy consumption and operational costs. In the photovoltaic (PV) sector, SiC-SBDs are employed in solar inverters to convert solar energy into usable electricity with high efficiency and minimal energy loss. This makes them essential for maximizing the output of solar power systems. In energy storage systems, SiC-SBDs enhance the efficiency of power conversion processes, ensuring reliable and efficient energy storage and retrieval. In wind power applications, these diodes are used in power converters to improve the efficiency and reliability of wind turbines, contributing to increased energy output and reduced maintenance costs. In uninterruptible power supply (UPS) systems, SiC-SBDs provide fast switching capabilities and high efficiency, ensuring reliable power backup during outages. In data centers and servers, SiC-SBDs are used to improve the efficiency of power supplies, reducing energy consumption and cooling requirements. In rail transport, SiC-SBDs are employed in traction systems to enhance the efficiency and reliability of trains, leading to reduced energy consumption and operational costs. The versatility and superior performance of SiC-SBDs make them suitable for a wide range of applications, driving their adoption across various industries. As the demand for energy-efficient and reliable electronic devices continues to grow, the usage of SiC-SBDs is expected to expand further, contributing to the development of sustainable and efficient technologies.

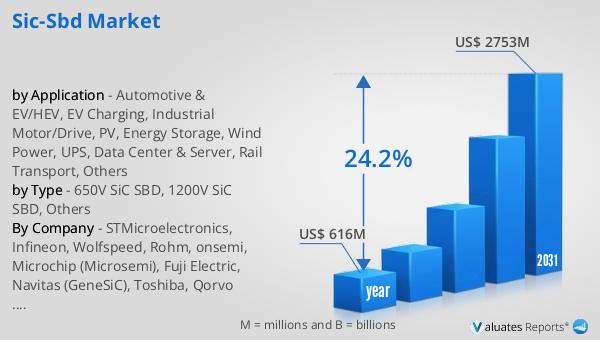

Global SiC-SBD Market Outlook:

The outlook for the Global SiC-SBD Market indicates significant growth potential, with the market valued at approximately $616 million in 2024 and projected to reach around $2,753 million by 2031, reflecting a robust compound annual growth rate (CAGR) of 24.2% during the forecast period. This growth is largely driven by the increasing adoption of SiC-SBDs in various applications, particularly in the automotive sector. In China, the sales of new energy vehicles reached an impressive 9.495 million units, accounting for 64.8% of global sales, highlighting the country's leading position in the adoption of electric vehicles. In 2023, the United States and Europe also witnessed significant growth in new energy vehicle sales, with 2.94 million and 1.46 million units sold, respectively, representing year-on-year growth rates of 18.3% and 48.0%. This surge in demand for electric vehicles is a key driver for the SiC-SBD market, as these diodes are essential for improving the efficiency and performance of EV powertrains and charging infrastructure. The increasing focus on sustainability and energy efficiency is further propelling the demand for SiC-SBDs across various industries, including renewable energy, industrial automation, and data centers. As manufacturers continue to invest in research and development to enhance the performance and reduce the cost of SiC-SBDs, the market is expected to witness significant advancements in technology and innovation. This, in turn, will drive the adoption of SiC-SBDs in new and emerging applications, contributing to the overall growth of the market.

| Report Metric | Details |

| Report Name | SiC-SBD Market |

| Accounted market size in year | US$ 616 million |

| Forecasted market size in 2031 | US$ 2753 million |

| CAGR | 24.2% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| by Type |

|

| by Application |

|

| Production by Region |

|

| Consumption by Region |

|

| By Company | STMicroelectronics, Infineon, Wolfspeed, Rohm, onsemi, Microchip (Microsemi), Fuji Electric, Navitas (GeneSiC), Toshiba, Qorvo (UnitedSiC), San'an Optoelectronics, Littelfuse (IXYS), CETC 55, WeEn Semiconductors, BASiC Semiconductor, SemiQ, Diodes Incorporated, KEC Corporation, PANJIT Group, Nexperia, Vishay Intertechnology, Zhuzhou CRRC Times Electric, China Resources Microelectronics Limited, Yangzhou Yangjie Electronic Technology, Changzhou Galaxy Century Microelectronics, Cissoid, SK powertech |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |