What is Global Starter Solenoid Market?

The Global Starter Solenoid Market is a crucial segment within the automotive and machinery industries, focusing on the production and distribution of starter solenoids. These components are essential for initiating the engine's operation in vehicles and machinery by transmitting electrical current from the battery to the starter motor. The market encompasses a wide range of applications, including automobiles, trucks, construction equipment, and industrial machinery. As technology advances, the demand for efficient and reliable starter solenoids has increased, driving innovation and development within the industry. Manufacturers are continually striving to enhance the performance, durability, and energy efficiency of these components to meet the evolving needs of consumers and industries worldwide. The market's growth is also influenced by the increasing adoption of electric and hybrid vehicles, which require advanced starter solenoid systems. Additionally, the expansion of the construction and manufacturing sectors in emerging economies contributes to the rising demand for starter solenoids. Overall, the Global Starter Solenoid Market plays a vital role in ensuring the smooth operation of engines across various industries, making it an indispensable component in modern machinery and vehicles.

24V, 12V in the Global Starter Solenoid Market:

In the Global Starter Solenoid Market, the voltage specifications of 24V and 12V are significant as they cater to different types of vehicles and machinery. The 12V starter solenoids are predominantly used in standard passenger vehicles, motorcycles, and small machinery. These solenoids are designed to handle the electrical requirements of smaller engines, providing the necessary power to start the engine efficiently. The 12V systems are widely adopted due to their compatibility with the majority of consumer vehicles, making them a staple in the automotive industry. On the other hand, 24V starter solenoids are typically used in larger vehicles and heavy-duty machinery, such as trucks, buses, construction equipment, and industrial machines. The higher voltage is necessary to accommodate the increased power demands of larger engines, ensuring reliable performance and durability under strenuous conditions. The use of 24V systems is prevalent in industries where robust and powerful machinery is essential for operations. The distinction between 12V and 24V starter solenoids highlights the market's adaptability to diverse applications, catering to both everyday consumer needs and specialized industrial requirements. As the market evolves, manufacturers are focusing on enhancing the efficiency and reliability of both 12V and 24V systems to meet the growing demands of modern vehicles and machinery. This includes the integration of advanced materials and technologies to improve performance and reduce energy consumption. The development of smart solenoids with diagnostic capabilities is also gaining traction, allowing for real-time monitoring and maintenance, which is particularly beneficial in industrial applications where downtime can be costly. Furthermore, the shift towards electric and hybrid vehicles presents new opportunities and challenges for the Global Starter Solenoid Market. While traditional starter solenoids are still essential for internal combustion engines, the rise of electric vehicles necessitates the development of specialized solenoids that can operate efficiently within these new systems. This transition is driving innovation and encouraging manufacturers to explore new technologies and materials to create solenoids that are compatible with the unique requirements of electric and hybrid vehicles. In conclusion, the Global Starter Solenoid Market is characterized by its adaptability and innovation, with 12V and 24V systems playing a crucial role in meeting the diverse needs of the automotive and machinery industries. As technology continues to advance, the market is poised for growth, driven by the increasing demand for efficient, reliable, and environmentally friendly starter solenoids.

Manufacturing Industry, Power Industry, Construction, Other (e.g. Mining,Metallurgy) in the Global Starter Solenoid Market:

The Global Starter Solenoid Market finds extensive usage across various industries, including manufacturing, power, construction, and others such as mining and metallurgy. In the manufacturing industry, starter solenoids are integral to the operation of machinery and equipment. They ensure the smooth initiation of engines, which is crucial for maintaining productivity and efficiency in manufacturing processes. The reliability and durability of starter solenoids are paramount in this sector, as any failure can lead to significant downtime and financial losses. Manufacturers rely on high-quality solenoids to ensure their operations run seamlessly, highlighting the importance of this component in the industry. In the power industry, starter solenoids are used in generators and other power equipment. They play a vital role in starting engines that generate electricity, making them essential for power plants and backup power systems. The demand for reliable and efficient starter solenoids is high in this sector, as they are critical for ensuring uninterrupted power supply. The construction industry also heavily relies on starter solenoids for the operation of heavy machinery and equipment. From excavators to cranes, these machines require robust starter solenoids to handle the demanding conditions of construction sites. The ability to withstand harsh environments and provide consistent performance is crucial for solenoids used in construction, as any malfunction can lead to project delays and increased costs. In other industries such as mining and metallurgy, starter solenoids are used in various equipment and vehicles. The challenging conditions in these sectors require solenoids that can endure extreme temperatures, dust, and vibrations. The reliability of starter solenoids is critical in these industries, as equipment failure can have severe consequences on operations and safety. Overall, the Global Starter Solenoid Market plays a vital role in ensuring the efficient and reliable operation of machinery and equipment across various industries. The demand for high-quality solenoids is driven by the need for productivity, efficiency, and safety in these sectors. As industries continue to evolve and adopt new technologies, the market for starter solenoids is expected to grow, with manufacturers focusing on innovation and quality to meet the diverse needs of their customers.

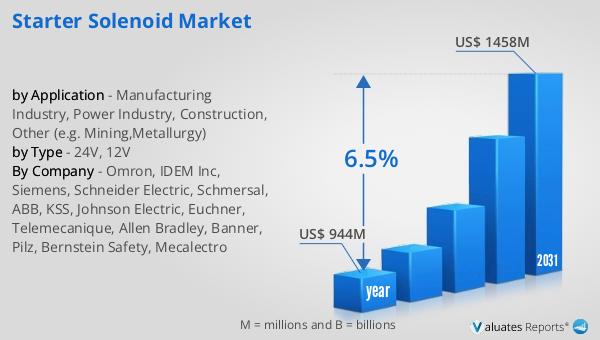

Global Starter Solenoid Market Outlook:

The global market for starter solenoids was valued at approximately $944 million in 2024. This figure reflects the significant demand for these components across various industries, including automotive, construction, and manufacturing. As the market continues to evolve, it is projected to reach an estimated size of $1,458 million by 2031. This growth is expected to occur at a compound annual growth rate (CAGR) of 6.5% during the forecast period. The increasing adoption of advanced technologies and the rising demand for efficient and reliable starter solenoids are key factors driving this growth. The market's expansion is also influenced by the growing construction and manufacturing sectors, particularly in emerging economies. Additionally, the shift towards electric and hybrid vehicles presents new opportunities for the starter solenoid market, as these vehicles require specialized solenoids to operate efficiently. Manufacturers are focusing on innovation and quality to meet the evolving needs of their customers, ensuring the continued growth and success of the Global Starter Solenoid Market. As the market progresses, it will be essential for companies to adapt to changing technologies and consumer demands to maintain their competitive edge and capitalize on the opportunities presented by this dynamic industry.

| Report Metric | Details |

| Report Name | Starter Solenoid Market |

| Accounted market size in year | US$ 944 million |

| Forecasted market size in 2031 | US$ 1458 million |

| CAGR | 6.5% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| by Type |

|

| by Application |

|

| Production by Region |

|

| Consumption by Region |

|

| By Company | Omron, IDEM Inc, Siemens, Schneider Electric, Schmersal, ABB, KSS, Johnson Electric, Euchner, Telemecanique, Allen Bradley, Banner, Pilz, Bernstein Safety, Mecalectro |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |