What is Global Platinum Ingots Market?

The Global Platinum Ingots Market is a significant segment of the precious metals industry, focusing on the production and distribution of platinum ingots. Platinum ingots are refined bars of platinum, a dense, malleable, and highly unreactive metal. These ingots are primarily used in various industrial applications due to their excellent catalytic properties, resistance to corrosion, and high melting point. The market for platinum ingots is driven by demand from sectors such as automotive, jewelry, electronics, and investment. In the automotive industry, platinum is a critical component in catalytic converters, which help reduce harmful emissions from vehicles. The jewelry sector values platinum for its lustrous appearance and durability, making it a popular choice for high-end jewelry pieces. Additionally, platinum's rarity and intrinsic value make it an attractive option for investors seeking to diversify their portfolios. The market is influenced by factors such as mining output, geopolitical stability, and technological advancements in refining processes. As industries continue to innovate and seek sustainable solutions, the demand for platinum ingots is expected to remain robust, reflecting the metal's versatility and enduring appeal.

0.9995, 0.9999 in the Global Platinum Ingots Market:

In the Global Platinum Ingots Market, the purity levels of platinum are crucial, with 0.9995 and 0.9999 being the most common standards. These numbers represent the percentage of platinum content in the ingot, with 0.9995 indicating 99.95% purity and 0.9999 indicating 99.99% purity. The higher the purity, the more valuable the ingot, as it contains fewer impurities and offers superior performance in various applications. The 0.9995 purity level is often used in industrial applications where slight impurities do not significantly impact performance. For instance, in the automotive industry, platinum with 0.9995 purity is used in catalytic converters to reduce vehicle emissions. The presence of minor impurities does not hinder its catalytic efficiency, making it a cost-effective choice for manufacturers. On the other hand, 0.9999 purity platinum ingots are preferred in applications where the highest level of purity is essential. In the jewelry industry, for example, 0.9999 platinum is favored for its brilliant shine and hypoallergenic properties, ensuring that it does not cause skin irritation. This level of purity is also sought after by investors who view platinum as a store of value, similar to gold. The investment sector values 0.9999 platinum ingots for their purity and potential for appreciation, especially during economic uncertainty. The production of high-purity platinum ingots involves advanced refining techniques to remove impurities and achieve the desired purity level. This process requires sophisticated technology and expertise, contributing to the higher cost of 0.9999 platinum ingots. The choice between 0.9995 and 0.9999 purity levels depends on the specific requirements of the application and the budget constraints of the buyer. In the electronics industry, where precision and reliability are paramount, 0.9999 platinum is often used in components such as hard disk drives and thermocouples. The high purity ensures consistent performance and longevity, which are critical in high-tech applications. The demand for different purity levels in the Global Platinum Ingots Market is influenced by factors such as technological advancements, regulatory standards, and consumer preferences. As industries evolve and new applications for platinum emerge, the market for both 0.9995 and 0.9999 purity platinum ingots is expected to grow. Manufacturers and suppliers must stay attuned to these trends to meet the diverse needs of their customers and maintain a competitive edge in the market.

Automotive Catalysts, Jewelry, Industrial, Investments in the Global Platinum Ingots Market:

The Global Platinum Ingots Market plays a vital role in several key areas, including automotive catalysts, jewelry, industrial applications, and investments. In the automotive sector, platinum is primarily used in catalytic converters, which are essential for reducing harmful emissions from vehicles. The metal's excellent catalytic properties enable it to convert toxic gases such as carbon monoxide and nitrogen oxides into less harmful substances like carbon dioxide and nitrogen. This application is crucial for meeting stringent environmental regulations and improving air quality. As the automotive industry continues to innovate with hybrid and electric vehicles, the demand for platinum in catalytic converters remains strong. In the jewelry industry, platinum is highly valued for its lustrous appearance, durability, and hypoallergenic properties. It is often used in high-end jewelry pieces, such as engagement rings and luxury watches, where its brilliant shine and resistance to tarnish make it a preferred choice. Platinum's rarity and prestige also add to its allure, making it a symbol of wealth and sophistication. The industrial sector utilizes platinum in various applications due to its unique properties, such as resistance to corrosion and high melting point. It is used in the production of glass, chemicals, and electronics, where its stability and conductivity are essential. For example, platinum is used in the manufacture of hard disk drives and thermocouples, where precision and reliability are critical. In the investment arena, platinum is considered a valuable asset, similar to gold and silver. Investors view platinum as a hedge against inflation and economic uncertainty, with its rarity and intrinsic value making it an attractive option for portfolio diversification. The demand for platinum ingots in the investment sector is influenced by market conditions, geopolitical stability, and investor sentiment. As global economies continue to evolve, the usage of platinum ingots in these areas is expected to remain robust, reflecting the metal's versatility and enduring appeal.

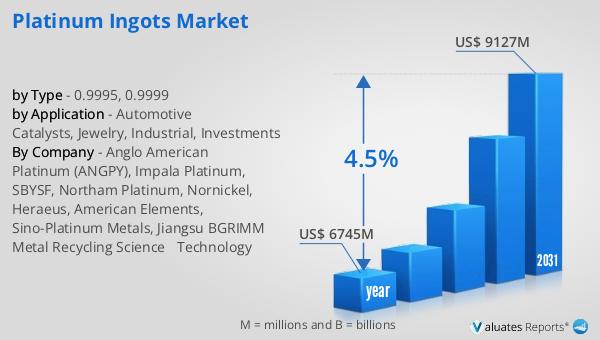

Global Platinum Ingots Market Outlook:

In 2024, the global market for Platinum Ingots was valued at approximately $6,745 million. Looking ahead, projections indicate that by 2031, this market is expected to expand to a revised size of around $9,127 million, reflecting a compound annual growth rate (CAGR) of 4.5% over the forecast period. This growth trajectory underscores the increasing demand and value associated with platinum ingots across various industries. Notably, the market is dominated by the top five manufacturers, who collectively hold a significant share exceeding 85%. This concentration highlights the competitive landscape and the influence of key players in shaping market dynamics. In terms of application, the automotive sector emerges as the largest consumer of platinum ingots, accounting for over 42% of the market share. This substantial share is primarily driven by the widespread use of platinum in automotive catalysts, which are crucial for reducing vehicle emissions and meeting environmental standards. The robust demand from the automotive industry underscores the critical role of platinum in advancing sustainable transportation solutions. As the market continues to evolve, the interplay of factors such as technological advancements, regulatory changes, and consumer preferences will shape the future trajectory of the Global Platinum Ingots Market.

| Report Metric | Details |

| Report Name | Platinum Ingots Market |

| Accounted market size in year | US$ 6745 million |

| Forecasted market size in 2031 | US$ 9127 million |

| CAGR | 4.5% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| by Type |

|

| by Application |

|

| Production by Region |

|

| Consumption by Region |

|

| By Company | Anglo American Platinum (ANGPY), Impala Platinum, SBYSF, Northam Platinum, Nornickel, Heraeus, American Elements, Sino-Platinum Metals, Jiangsu BGRIMM Metal Recycling Science &Technology |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |