What is Global 6 Inches Conductive SiC Wafer Market?

The Global 6 Inches Conductive SiC Wafer Market is a specialized segment within the semiconductor industry, focusing on the production and distribution of silicon carbide (SiC) wafers that are six inches in diameter. These wafers are known for their exceptional electrical conductivity and thermal stability, making them ideal for high-power and high-frequency applications. SiC wafers are increasingly being used in various industries, including automotive, renewable energy, and telecommunications, due to their ability to operate efficiently at high temperatures and voltages. The demand for these wafers is driven by the growing need for energy-efficient electronic devices and systems. As industries continue to seek ways to reduce energy consumption and improve performance, the adoption of SiC technology is expected to rise. The market is characterized by rapid technological advancements and increasing investments in research and development to enhance the quality and performance of SiC wafers. Companies operating in this market are focusing on expanding their production capacities and improving their manufacturing processes to meet the rising demand. Overall, the Global 6 Inches Conductive SiC Wafer Market is poised for significant growth, driven by the increasing adoption of SiC technology across various applications.

Warpage ≤ 40μm, Warpage 40- 60μm, Other in the Global 6 Inches Conductive SiC Wafer Market:

In the Global 6 Inches Conductive SiC Wafer Market, warpage is a critical parameter that affects the performance and reliability of the wafers. Warpage refers to the deviation of the wafer from a flat surface, and it is measured in micrometers (μm). In this market, wafers are categorized based on their warpage levels: Warpage ≤ 40μm, Warpage 40-60μm, and Other. Wafers with warpage ≤ 40μm are considered to have the highest quality and are preferred for applications that require precise and reliable performance. These wafers are used in high-end applications where even the slightest deviation can impact the overall functionality of the device. The low warpage ensures better contact with other components, reducing the risk of defects and improving the efficiency of the device. On the other hand, wafers with warpage between 40-60μm are suitable for applications where slight deviations are acceptable. These wafers offer a balance between cost and performance, making them a popular choice for mid-range applications. They provide adequate performance while being more cost-effective compared to wafers with lower warpage. The "Other" category includes wafers with warpage levels that do not fall within the specified ranges. These wafers may be used in applications where warpage is not a critical factor, or where the cost is a more significant consideration than performance. The choice of wafer based on warpage depends on the specific requirements of the application, including the desired performance, cost constraints, and the operating environment. Manufacturers in the Global 6 Inches Conductive SiC Wafer Market are continuously working to improve the flatness of their wafers to meet the increasing demand for high-quality products. Advanced manufacturing techniques and quality control measures are being implemented to reduce warpage and enhance the overall performance of the wafers. As the demand for SiC wafers continues to grow, the focus on minimizing warpage is expected to intensify, driving further innovations in the production processes. The ability to produce wafers with minimal warpage is a key competitive advantage for companies operating in this market, as it directly impacts the performance and reliability of the end products. Overall, warpage is a crucial factor in the Global 6 Inches Conductive SiC Wafer Market, influencing the choice of wafers for different applications and driving advancements in manufacturing technologies.

New Energy Vehicles, Charging Piles, Photovoltaic and Wind Power, Other in the Global 6 Inches Conductive SiC Wafer Market:

The Global 6 Inches Conductive SiC Wafer Market plays a vital role in several key areas, including New Energy Vehicles, Charging Piles, Photovoltaic and Wind Power, and other applications. In the realm of New Energy Vehicles, SiC wafers are used in power electronics components such as inverters and converters. These components are essential for managing the flow of electricity within the vehicle, ensuring efficient energy use and extending the range of electric vehicles. The high thermal conductivity and efficiency of SiC wafers make them ideal for these applications, as they can handle high power levels without overheating. In Charging Piles, which are critical for the infrastructure supporting electric vehicles, SiC wafers are used in power modules to improve the efficiency and speed of charging. The ability of SiC technology to operate at higher voltages and temperatures allows for faster charging times and reduced energy losses, making it a preferred choice for modern charging stations. In the renewable energy sector, SiC wafers are used in Photovoltaic and Wind Power systems to enhance the efficiency of power conversion and distribution. In photovoltaic systems, SiC-based inverters convert the direct current generated by solar panels into alternating current for use in the grid. The high efficiency and reliability of SiC technology help maximize the energy harvested from solar panels, reducing the overall cost of solar power. Similarly, in wind power systems, SiC wafers are used in converters and inverters to manage the electricity generated by wind turbines. The robust performance of SiC technology in harsh environmental conditions makes it suitable for use in wind farms, where reliability and efficiency are paramount. Beyond these specific applications, SiC wafers are also used in various other industries, including telecommunications, aerospace, and industrial automation. In telecommunications, SiC technology is used in radio frequency amplifiers and other components to improve signal quality and reduce energy consumption. In aerospace, the lightweight and high-performance characteristics of SiC wafers make them ideal for use in power systems and electronic components in aircraft and spacecraft. In industrial automation, SiC wafers are used in motor drives and other power electronics to enhance the efficiency and reliability of automated systems. Overall, the Global 6 Inches Conductive SiC Wafer Market is integral to the advancement of technology in these areas, providing the foundation for more efficient, reliable, and sustainable solutions.

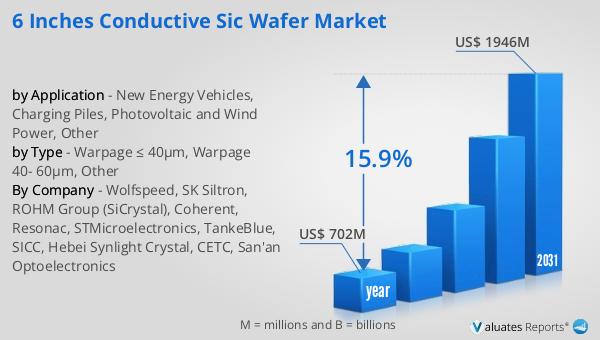

Global 6 Inches Conductive SiC Wafer Market Outlook:

The worldwide market for 6 Inches Conductive SiC Wafer was valued at $702 million in 2024, and it is anticipated to expand to a revised size of $1,946 million by 2031, reflecting a compound annual growth rate (CAGR) of 15.9% throughout the forecast period. This growth trajectory underscores the increasing demand for SiC wafers across various industries, driven by the need for more efficient and reliable electronic components. The market's robust growth is attributed to the rising adoption of SiC technology in applications such as electric vehicles, renewable energy systems, and telecommunications. As industries continue to prioritize energy efficiency and performance, the demand for SiC wafers is expected to rise significantly. The market's expansion is also supported by ongoing advancements in manufacturing technologies and increased investments in research and development. Companies operating in this market are focusing on enhancing their production capabilities and improving the quality of their products to meet the growing demand. The projected growth of the Global 6 Inches Conductive SiC Wafer Market highlights the critical role of SiC technology in shaping the future of various industries, offering solutions that are not only efficient but also sustainable.

| Report Metric | Details |

| Report Name | 6 Inches Conductive SiC Wafer Market |

| Accounted market size in year | US$ 702 million |

| Forecasted market size in 2031 | US$ 1946 million |

| CAGR | 15.9% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| by Type |

|

| by Application |

|

| Production by Region |

|

| Consumption by Region |

|

| By Company | Wolfspeed, SK Siltron, ROHM Group (SiCrystal), Coherent, Resonac, STMicroelectronics, TankeBlue, SICC, Hebei Synlight Crystal, CETC, San'an Optoelectronics |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |