What is Universal Supplementary Medical Insurance - Global Market?

Universal Supplementary Medical Insurance is a concept that aims to provide additional health coverage beyond the basic medical insurance plans available in many countries. This type of insurance is designed to cover the gaps left by standard health insurance policies, ensuring that individuals have access to a broader range of medical services and treatments. The global market for Universal Supplementary Medical Insurance is growing as more people recognize the importance of comprehensive health coverage. This market includes various insurance products that cater to different needs, such as covering costs for specialized treatments, medications, and healthcare services not typically included in basic plans. As healthcare costs continue to rise, the demand for supplementary insurance is expected to increase, providing individuals with financial protection against unexpected medical expenses. The market's growth is driven by factors such as an aging population, increasing prevalence of chronic diseases, and a greater awareness of the benefits of comprehensive health coverage. As a result, insurance providers are expanding their offerings to meet the diverse needs of consumers, making Universal Supplementary Medical Insurance an essential component of the global healthcare landscape.

Health Insurance, Pension Insurance, Nursing Insurance in the Universal Supplementary Medical Insurance - Global Market:

Health insurance, pension insurance, and nursing insurance are integral components of the Universal Supplementary Medical Insurance market, each serving distinct yet interconnected roles in providing comprehensive coverage. Health insurance is the cornerstone, offering financial protection against medical expenses incurred from illnesses, injuries, and other health-related issues. It typically covers a range of services, including hospital stays, doctor visits, prescription medications, and preventive care. In the context of Universal Supplementary Medical Insurance, health insurance extends beyond basic coverage to include specialized treatments, alternative therapies, and advanced medical technologies that are often excluded from standard policies. This ensures that individuals have access to a wider array of healthcare options, enhancing their overall well-being and quality of life. Pension insurance, on the other hand, focuses on providing financial security during retirement. It is designed to replace a portion of an individual's income once they retire, ensuring they can maintain their standard of living without relying solely on savings or government pensions. In the realm of Universal Supplementary Medical Insurance, pension insurance can be tailored to include healthcare benefits, addressing the unique medical needs of retirees. This integration is crucial as healthcare costs tend to rise with age, and retirees often face increased medical expenses due to chronic conditions or age-related health issues. By incorporating healthcare benefits into pension plans, individuals can enjoy a more secure and comfortable retirement, free from the financial burden of unexpected medical bills. Nursing insurance, also known as long-term care insurance, is another vital aspect of Universal Supplementary Medical Insurance. It provides coverage for services related to long-term care, which may include assistance with daily activities, home healthcare, and nursing home care. As the global population ages, the demand for long-term care services is expected to rise, making nursing insurance an essential component of comprehensive health coverage. This type of insurance ensures that individuals receive the necessary care and support as they age, without depleting their savings or burdening their families with caregiving responsibilities. In the context of Universal Supplementary Medical Insurance, nursing insurance can be customized to cover a wide range of services, from in-home care to specialized facilities, catering to the diverse needs of the aging population. By integrating health, pension, and nursing insurance, Universal Supplementary Medical Insurance offers a holistic approach to healthcare coverage, addressing the financial and medical needs of individuals at every stage of life. This comprehensive coverage not only provides peace of mind but also empowers individuals to make informed decisions about their healthcare, ensuring they receive the best possible care without compromising their financial stability. As the global market for Universal Supplementary Medical Insurance continues to grow, insurance providers are increasingly focusing on developing innovative products that cater to the evolving needs of consumers, making it an essential component of the modern healthcare landscape.

Business, personal in the Universal Supplementary Medical Insurance - Global Market:

The usage of Universal Supplementary Medical Insurance in business and personal contexts highlights its versatility and importance in today's healthcare landscape. For businesses, offering Universal Supplementary Medical Insurance as part of employee benefits packages can be a strategic move to attract and retain top talent. In a competitive job market, comprehensive health coverage is a highly valued perk that can set a company apart from its competitors. By providing supplementary insurance, businesses demonstrate their commitment to employee well-being, fostering a positive work environment and enhancing job satisfaction. This, in turn, can lead to increased productivity, reduced absenteeism, and lower turnover rates, ultimately benefiting the company's bottom line. Moreover, businesses that offer Universal Supplementary Medical Insurance may also enjoy tax advantages, as premiums paid for employee health benefits are often tax-deductible. On a personal level, Universal Supplementary Medical Insurance provides individuals with the peace of mind that comes from knowing they have access to a wide range of healthcare services and treatments. This type of insurance is particularly beneficial for those with specific medical needs or chronic conditions that require ongoing care and specialized treatments. By covering the costs of services not typically included in standard health insurance plans, supplementary insurance ensures that individuals can receive the care they need without facing financial hardship. Additionally, Universal Supplementary Medical Insurance can be tailored to meet the unique needs of individuals and families, offering flexible coverage options that align with their healthcare priorities and budget. This personalized approach allows policyholders to choose the level of coverage that best suits their needs, ensuring they receive the most value from their insurance plan. Furthermore, Universal Supplementary Medical Insurance can play a crucial role in financial planning, helping individuals manage healthcare costs and protect their savings from unexpected medical expenses. By providing a safety net against high out-of-pocket costs, supplementary insurance enables individuals to allocate their financial resources more effectively, ensuring they can meet their healthcare needs without compromising their financial goals. In summary, the usage of Universal Supplementary Medical Insurance in both business and personal contexts underscores its significance as a tool for enhancing healthcare coverage and financial security. As the global market for this type of insurance continues to expand, it is likely to become an increasingly important component of employee benefits packages and personal financial planning strategies, offering individuals and businesses alike the opportunity to access comprehensive healthcare coverage and achieve greater peace of mind.

Universal Supplementary Medical Insurance - Global Market Outlook:

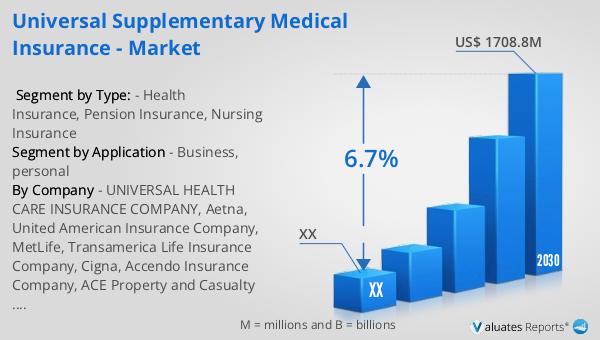

The global market for Universal Supplementary Medical Insurance was valued at approximately $1,085 million in 2023. Projections indicate that this market is poised for significant growth, with expectations to reach an adjusted size of around $1,708.8 million by 2030. This growth trajectory represents a compound annual growth rate (CAGR) of 6.7% during the forecast period from 2024 to 2030. This upward trend reflects the increasing demand for comprehensive healthcare coverage that goes beyond basic insurance plans. As healthcare costs continue to rise and the global population ages, more individuals are seeking supplementary insurance options to ensure they have access to a broader range of medical services and treatments. In parallel, the global market for medical devices is also experiencing growth, with an estimated value of $603 billion in 2023. This market is projected to grow at a CAGR of 5% over the next six years, highlighting the ongoing advancements in medical technology and the increasing reliance on medical devices for diagnosis, treatment, and monitoring of various health conditions. The growth of both the Universal Supplementary Medical Insurance market and the medical devices market underscores the evolving landscape of healthcare, where comprehensive coverage and advanced medical technologies play a crucial role in improving health outcomes and enhancing the quality of life for individuals worldwide.

| Report Metric | Details |

| Report Name | Universal Supplementary Medical Insurance - Market |

| Forecasted market size in 2030 | US$ 1708.8 million |

| CAGR | 6.7% |

| Forecasted years | 2024 - 2030 |

| Segment by Type: |

|

| Segment by Application |

|

| By Region |

|

| By Company | UNIVERSAL HEALTH CARE INSURANCE COMPANY, Aetna, United American Insurance Company, MetLife, Transamerica Life Insurance Company, Cigna, Accendo Insurance Company, ACE Property and Casualty Insurance Company, Aetna Health Insurance Company, Cigna National Health Insurance Company, PICC, China Pacific Insurance, China United Life Insurance |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |