What is Shipping Insurance - Global Market?

Shipping insurance is a specialized service that provides financial protection for goods during transit. It is a crucial component of the global market, ensuring that businesses and individuals can safeguard their shipments against potential losses or damages. This type of insurance covers a wide range of risks, including theft, damage, and loss due to unforeseen events such as natural disasters or accidents. The global market for shipping insurance is vast, encompassing various sectors such as commercial trade, traffic, and construction. As international trade continues to expand, the demand for shipping insurance is expected to grow, driven by the need for secure and reliable transportation of goods across borders. Shipping insurance not only offers peace of mind to shippers but also plays a vital role in facilitating global commerce by mitigating the financial risks associated with shipping. By providing coverage for potential losses, shipping insurance helps businesses maintain their operations smoothly and efficiently, ensuring that goods reach their destinations safely and on time. This market is continually evolving, with advancements in technology and data analytics enhancing the services offered by insurance providers, making it an indispensable part of the global supply chain.

International Shipping Insurance, Domestic Shipping Insurance in the Shipping Insurance - Global Market:

International shipping insurance and domestic shipping insurance are two key components of the shipping insurance global market, each catering to different needs and scenarios. International shipping insurance is designed to protect goods that are transported across international borders. This type of insurance is crucial for businesses engaged in global trade, as it covers a wide range of risks associated with international shipping, such as customs delays, political instability, and varying regulatory requirements in different countries. International shipping insurance provides coverage for potential losses or damages that may occur during transit, ensuring that businesses can operate smoothly and efficiently in the global market. It also offers protection against unforeseen events such as natural disasters, theft, and accidents, which can significantly impact the delivery of goods. On the other hand, domestic shipping insurance focuses on protecting goods that are transported within a single country. This type of insurance is essential for businesses that operate within national borders, providing coverage for risks such as damage, theft, and loss during transit. Domestic shipping insurance ensures that goods are delivered safely and on time, minimizing the financial impact of potential losses. Both international and domestic shipping insurance play a vital role in the global market, offering businesses the security and peace of mind they need to conduct their operations effectively. As the global economy continues to grow and evolve, the demand for shipping insurance is expected to increase, driven by the need for reliable and secure transportation of goods. Insurance providers are continually adapting to the changing needs of the market, offering innovative solutions and services to meet the demands of businesses engaged in both international and domestic trade. By providing comprehensive coverage for potential risks, shipping insurance helps businesses navigate the complexities of the global supply chain, ensuring that goods reach their destinations safely and efficiently.

Commercial Trade, Traffic, Construction, Others in the Shipping Insurance - Global Market:

Shipping insurance plays a crucial role in various sectors, including commercial trade, traffic, construction, and others, by providing financial protection and peace of mind. In commercial trade, shipping insurance is essential for businesses that rely on the transportation of goods to and from different markets. It covers potential losses or damages that may occur during transit, ensuring that businesses can maintain their operations smoothly and efficiently. This type of insurance is particularly important for companies engaged in international trade, as it provides coverage for risks associated with cross-border shipping, such as customs delays, political instability, and varying regulatory requirements. In the traffic sector, shipping insurance is vital for protecting vehicles and goods transported by road, rail, or air. It offers coverage for potential damages or losses that may occur during transit, ensuring that goods reach their destinations safely and on time. This type of insurance is essential for logistics companies and other businesses that rely on the transportation of goods to meet their operational needs. In the construction industry, shipping insurance is crucial for protecting materials and equipment transported to and from construction sites. It provides coverage for potential damages or losses that may occur during transit, ensuring that construction projects can proceed without delays or financial setbacks. This type of insurance is particularly important for large-scale construction projects that require the transportation of heavy machinery and materials over long distances. In addition to these sectors, shipping insurance is also used in other areas, such as the transportation of valuable or fragile items, where the risk of damage or loss is high. By providing comprehensive coverage for potential risks, shipping insurance helps businesses navigate the complexities of the global supply chain, ensuring that goods reach their destinations safely and efficiently.

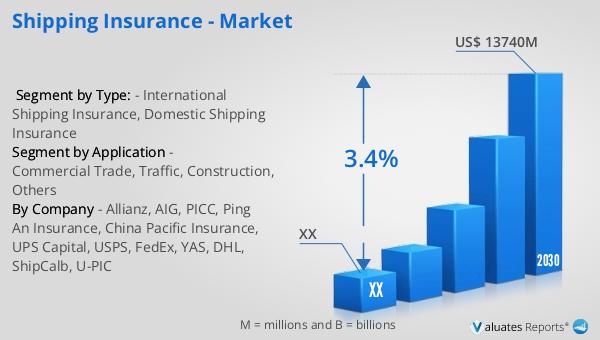

Shipping Insurance - Global Market Outlook:

The global market for shipping insurance was valued at approximately $10,830 million in 2023 and is projected to grow to around $13,740 million by 2030, with a compound annual growth rate (CAGR) of 3.4% during the forecast period from 2024 to 2030. This growth is driven by the increasing demand for secure and reliable transportation of goods across borders, as well as advancements in technology that are enhancing the services offered by insurance providers. The technological development of the shipping insurance industry is primarily reflected in the use of big data analysis and prediction technology to improve customer service levels and ensure safety. By leveraging big data, insurance companies can better assess risks, tailor their offerings to meet the specific needs of their clients, and enhance their overall service delivery. Additionally, the improvement of insurance companies' research and development (R&D) and promotion capabilities through cloud computing technology and big data analysis technology is further driving the growth of the market. These technological advancements are enabling insurance providers to offer more innovative and efficient solutions, ensuring that businesses can navigate the complexities of the global supply chain with greater ease and confidence. As the global economy continues to evolve, the shipping insurance market is expected to play an increasingly important role in facilitating international trade and commerce.

| Report Metric | Details |

| Report Name | Shipping Insurance - Market |

| Forecasted market size in 2030 | US$ 13740 million |

| CAGR | 3.4% |

| Forecasted years | 2024 - 2030 |

| Segment by Type: |

|

| Segment by Application |

|

| By Region |

|

| By Company | Allianz, AIG, PICC, Ping An Insurance, China Pacific Insurance, UPS Capital, USPS, FedEx, YAS, DHL, ShipCalb, U-PIC |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |