What is Mefenamic Acid - Global Market?

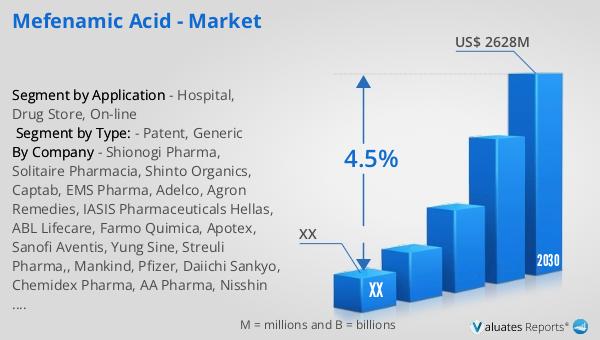

Mefenamic acid is a non-steroidal anti-inflammatory drug (NSAID) commonly used to relieve mild to moderate pain, including menstrual pain, and to reduce inflammation. The global market for mefenamic acid is a significant segment within the pharmaceutical industry, driven by its widespread use and effectiveness in pain management. As of 2023, the market was valued at approximately US$ 1935 million, with expectations to grow to US$ 2628 million by 2030, reflecting a compound annual growth rate (CAGR) of 4.5% from 2024 to 2030. This growth is fueled by increasing demand for effective pain management solutions, rising awareness about NSAIDs, and the expanding healthcare infrastructure in emerging markets. The market is characterized by a mix of patented and generic formulations, with generic versions playing a crucial role in making the drug more accessible and affordable. The pharmaceutical industry, valued at US$ 1475 billion in 2022, is experiencing a steady growth rate of 5% over the next six years, indicating a robust demand for pharmaceutical products, including NSAIDs like mefenamic acid. The chemical drug market, a subset of the broader pharmaceutical industry, also shows growth, increasing from US$ 1005 billion in 2018 to US$ 1094 billion in 2022, highlighting the ongoing demand for chemical-based medications.

Patent, Generic in the Mefenamic Acid - Global Market:

In the context of the mefenamic acid global market, understanding the dynamics between patented and generic drugs is crucial. Patented drugs are those that are protected by intellectual property rights, allowing the original manufacturer exclusive rights to produce and sell the drug for a certain period, typically 20 years from the filing date. This exclusivity enables the company to recoup research and development costs and earn profits. Mefenamic acid, like many other drugs, was initially available as a patented medication. During this period, the market was dominated by the original manufacturer, who set the price and controlled the supply. However, once the patent expired, generic versions of mefenamic acid entered the market. Generic drugs are chemically identical to their branded counterparts but are typically sold at a lower price, making them more accessible to a broader population. The introduction of generics significantly impacts the market dynamics, often leading to a reduction in the overall price of the drug and increased competition among manufacturers. In the case of mefenamic acid, the availability of generic versions has expanded its reach, particularly in developing regions where cost is a significant barrier to access. The competition between branded and generic versions also drives innovation, as companies seek to differentiate their products through improved formulations or delivery methods. Moreover, the regulatory landscape plays a vital role in shaping the market. Regulatory bodies ensure that generic versions meet the same standards of quality, safety, and efficacy as the original branded drug, instilling confidence among healthcare providers and patients. The balance between patented and generic drugs in the mefenamic acid market reflects broader trends in the pharmaceutical industry, where the expiration of patents often leads to increased competition and accessibility. This dynamic is essential for fostering a competitive market environment that benefits consumers through lower prices and wider availability. As the global market for mefenamic acid continues to grow, the interplay between patented and generic drugs will remain a key factor influencing market trends and consumer access.

Hospital, Drug Store, On-line in the Mefenamic Acid - Global Market:

Mefenamic acid is utilized across various distribution channels, including hospitals, drug stores, and online platforms, each playing a distinct role in the global market. Hospitals are significant consumers of mefenamic acid, particularly for managing post-operative pain and other acute pain conditions. In a hospital setting, the drug is often administered under medical supervision, ensuring appropriate dosage and monitoring for potential side effects. The availability of mefenamic acid in hospitals is crucial for providing immediate pain relief to patients, contributing to its steady demand in this sector. Drug stores, or pharmacies, represent another critical distribution channel for mefenamic acid. They serve as the primary point of access for patients with prescriptions, offering both branded and generic versions of the drug. The convenience and accessibility of drug stores make them a popular choice for patients seeking over-the-counter pain relief options. Pharmacists play a vital role in advising patients on the appropriate use of mefenamic acid, ensuring safe and effective pain management. The rise of online pharmacies has introduced a new dimension to the distribution of mefenamic acid. Online platforms offer the convenience of home delivery, often at competitive prices, making them an attractive option for consumers. The digitalization of pharmaceutical sales has expanded the reach of mefenamic acid, particularly in regions with limited access to physical pharmacies. However, the online sale of pharmaceuticals also raises concerns about the authenticity and quality of products, necessitating stringent regulatory oversight to protect consumers. Each distribution channel contributes to the overall accessibility and availability of mefenamic acid, catering to diverse consumer needs and preferences. The interplay between these channels reflects broader trends in the pharmaceutical industry, where convenience, accessibility, and cost-effectiveness drive consumer choices. As the global market for mefenamic acid continues to evolve, the role of hospitals, drug stores, and online platforms will remain integral to its growth and accessibility.

Mefenamic Acid - Global Market Outlook:

The global market outlook for mefenamic acid indicates a promising growth trajectory. In 2023, the market was valued at approximately US$ 1935 million, with projections to reach a revised size of US$ 2628 million by 2030, growing at a compound annual growth rate (CAGR) of 4.5% from 2024 to 2030. This growth is indicative of the increasing demand for effective pain management solutions and the expanding healthcare infrastructure in various regions. In comparison, the global pharmaceutical market was valued at US$ 1475 billion in 2022, with an anticipated growth rate of 5% over the next six years. This growth reflects the ongoing demand for pharmaceutical products, driven by factors such as an aging population, rising prevalence of chronic diseases, and advancements in drug development. The chemical drug market, a significant segment of the pharmaceutical industry, has also shown growth, increasing from US$ 1005 billion in 2018 to US$ 1094 billion in 2022. This trend underscores the sustained demand for chemical-based medications, including NSAIDs like mefenamic acid. The interplay between these markets highlights the dynamic nature of the pharmaceutical industry, where innovation, competition, and regulatory frameworks shape market trends and consumer access. As the global market for mefenamic acid continues to expand, it will contribute to the broader growth of the pharmaceutical industry, offering effective pain management solutions to a diverse population.

| Report Metric | Details |

| Report Name | Mefenamic Acid - Market |

| Forecasted market size in 2030 | US$ 2628 million |

| CAGR | 4.5% |

| Forecasted years | 2024 - 2030 |

| Segment by Type: |

|

| Segment by Application |

|

| By Region |

|

| By Company | Shionogi Pharma, Solitaire Pharmacia, Shinto Organics, Captab, EMS Pharma, Adelco, Agron Remedies, IASIS Pharmaceuticals Hellas, ABL Lifecare, Farmo Quimica, Apotex, Sanofi Aventis, Yung Sine, Streuli Pharma,, Mankind, Pfizer, Daiichi Sankyo, Chemidex Pharma, AA Pharma, Nisshin Pharmaceutical, Koa Isei, Teva, Wockhardt, Esteve |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |