What is Construction Equipment Insurance - Global Market?

Construction equipment insurance is a specialized form of coverage designed to protect the machinery and tools used in the construction industry. This insurance is crucial for businesses that rely on heavy equipment like bulldozers, cranes, excavators, and other machinery essential for construction projects. The global market for construction equipment insurance is vast, reflecting the industry's need to safeguard these valuable assets against risks such as theft, damage, and accidents. This type of insurance not only covers the cost of repairing or replacing damaged equipment but also provides liability coverage in case the equipment causes harm to third parties or property. As construction projects become more complex and equipment becomes more advanced and expensive, the demand for comprehensive insurance solutions continues to grow. The global market for construction equipment insurance is driven by factors such as increasing construction activities, technological advancements in equipment, and the rising awareness of risk management among construction companies. This market is characterized by a diverse range of insurance products tailored to meet the specific needs of different types of construction equipment and projects. Overall, construction equipment insurance plays a vital role in ensuring the smooth operation and financial stability of construction businesses worldwide.

Insured Amount below 100,000 USD, Insurance Amount between 100,000 and 1,000,000 USD, Insured Amount more than 1000000 USD in the Construction Equipment Insurance - Global Market:

In the realm of construction equipment insurance, the insured amount plays a significant role in determining the level of coverage and protection a business can expect. For insured amounts below 100,000 USD, the focus is typically on smaller equipment or tools that are essential yet not as costly as larger machinery. This level of insurance is often chosen by smaller construction firms or individual contractors who need to protect their investments without incurring high insurance premiums. Coverage at this level usually includes protection against theft, minor damages, and some liability coverage, ensuring that even smaller players in the construction industry can operate with peace of mind. As the insured amount increases to between 100,000 and 1,000,000 USD, the scope of coverage expands significantly. This range is suitable for medium-sized construction companies that utilize a mix of small and large equipment. Insurance policies in this bracket often cover a broader range of risks, including more extensive damage, loss due to natural disasters, and higher liability limits. This level of insurance is crucial for businesses that handle more complex projects and require a higher degree of protection for their equipment. For insured amounts exceeding 1,000,000 USD, the insurance coverage is comprehensive and tailored to large construction firms with extensive fleets of high-value machinery. These policies offer the highest level of protection, covering everything from theft and accidental damage to business interruption and liability claims. Large construction companies often face significant risks due to the scale and complexity of their projects, making this level of insurance indispensable. The policies are designed to provide maximum financial security, ensuring that even in the event of a major incident, the business can recover and continue operations with minimal disruption. Overall, the construction equipment insurance market offers a range of options to suit the diverse needs of the industry, ensuring that businesses of all sizes can protect their valuable assets and maintain operational stability.

Furnish, Real Estate, Garden, Others in the Construction Equipment Insurance - Global Market:

Construction equipment insurance is utilized across various sectors, including furnishing, real estate, gardening, and others, each with unique requirements and challenges. In the furnishing sector, construction equipment insurance is essential for businesses involved in the installation and assembly of large furniture pieces or fixtures. These companies often use specialized equipment such as lifts, cranes, and power tools, which are crucial for efficient operations. Insurance coverage ensures that any damage or loss of equipment does not disrupt the business, allowing for timely project completion and customer satisfaction. In the real estate industry, construction equipment insurance is vital for developers and contractors working on residential, commercial, or industrial projects. The real estate sector relies heavily on heavy machinery for tasks such as excavation, foundation laying, and structural construction. Insurance provides a safety net against potential risks like equipment failure, theft, or damage, which could otherwise lead to costly project delays and financial losses. For gardening and landscaping businesses, construction equipment insurance covers tools and machinery like lawnmowers, tractors, and excavators used for large-scale landscaping projects. These businesses often operate in diverse environments, exposing their equipment to various risks. Insurance coverage helps mitigate these risks, ensuring that equipment is repaired or replaced promptly, allowing businesses to maintain their service quality and reputation. Beyond these specific sectors, construction equipment insurance is also crucial for other industries that rely on specialized machinery, such as mining, agriculture, and infrastructure development. In these areas, insurance provides comprehensive protection against a wide range of risks, ensuring that businesses can operate efficiently and sustainably. Overall, construction equipment insurance is a critical component of risk management across multiple sectors, providing financial security and operational stability to businesses worldwide.

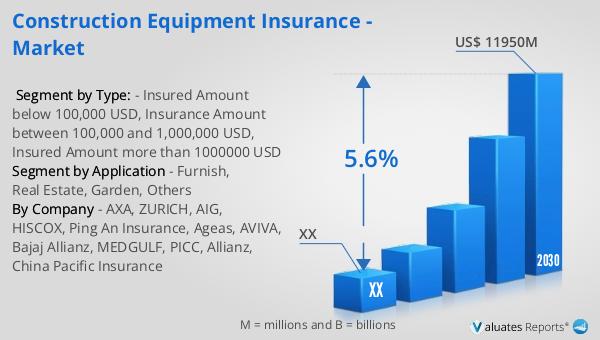

Construction Equipment Insurance - Global Market Outlook:

The global market for construction equipment insurance was valued at approximately 8,273 million USD in 2023, with projections indicating a growth to around 11,950 million USD by 2030. This growth represents a compound annual growth rate (CAGR) of 5.6% during the forecast period from 2024 to 2030. This upward trend reflects the increasing demand for construction equipment insurance as businesses seek to protect their valuable assets against various risks. In North America, the market for construction equipment insurance is also expected to grow significantly during the same period. Although specific figures for the North American market were not provided, the region's growth is anticipated to align with the global trend, driven by factors such as rising construction activities, technological advancements in equipment, and a growing awareness of risk management practices. The construction equipment insurance market's expansion is indicative of the industry's recognition of the importance of safeguarding their investments and ensuring operational continuity. As construction projects become more complex and equipment becomes more advanced and expensive, the need for comprehensive insurance solutions continues to grow. This market outlook highlights the critical role that construction equipment insurance plays in supporting the construction industry's growth and resilience.

| Report Metric | Details |

| Report Name | Construction Equipment Insurance - Market |

| Forecasted market size in 2030 | US$ 11950 million |

| CAGR | 5.6% |

| Forecasted years | 2024 - 2030 |

| Segment by Type: |

|

| Segment by Application |

|

| By Region |

|

| By Company | AXA, ZURICH, AIG, HISCOX, Ping An Insurance, Ageas, AVIVA, Bajaj Allianz, MEDGULF, PICC, Allianz, China Pacific Insurance |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |