What is Automotive Emission Control Catalyst - Global Market?

Automotive emission control catalysts are essential components in vehicles that help reduce harmful emissions from internal combustion engines. These catalysts are part of the exhaust system and work by converting toxic gases like carbon monoxide, nitrogen oxides, and hydrocarbons into less harmful substances such as carbon dioxide, nitrogen, and water vapor. The global market for these catalysts is driven by stringent environmental regulations aimed at reducing air pollution and improving air quality. As countries around the world implement stricter emission standards, the demand for effective emission control technologies continues to grow. The market encompasses a variety of catalyst types, including those made from precious metals like platinum, palladium, and rhodium, which are known for their effectiveness in facilitating chemical reactions that neutralize pollutants. The automotive emission control catalyst market is a dynamic and evolving sector, influenced by advancements in automotive technology, changes in regulatory frameworks, and shifts in consumer preferences towards cleaner and more sustainable transportation options. As the automotive industry transitions towards hybrid and electric vehicles, the role of emission control catalysts may evolve, but their importance in reducing emissions from traditional vehicles remains significant.

Palladium, Platinum, Rhodium, Other in the Automotive Emission Control Catalyst - Global Market:

Palladium, platinum, rhodium, and other materials play a crucial role in the automotive emission control catalyst market. These precious metals are integral to the catalytic converters used in vehicles to reduce harmful emissions. Palladium is widely used in catalytic converters for gasoline engines due to its excellent ability to oxidize carbon monoxide and hydrocarbons into carbon dioxide and water. Its high thermal stability and resistance to poisoning make it a preferred choice for many manufacturers. Platinum, on the other hand, is versatile and can be used in both gasoline and diesel engines. It is highly effective in facilitating the oxidation of carbon monoxide and hydrocarbons, as well as the reduction of nitrogen oxides. However, its high cost often leads manufacturers to use it sparingly or in combination with other metals. Rhodium is particularly effective in reducing nitrogen oxides, a major pollutant in vehicle emissions. It is often used in conjunction with platinum and palladium to enhance the overall efficiency of the catalytic converter. Despite its effectiveness, rhodium is one of the most expensive precious metals, which can impact the overall cost of the catalyst. Other materials, such as cerium and iron, are also used in emission control catalysts to enhance their performance and durability. These materials can help improve the thermal stability of the catalyst and increase its resistance to poisoning by sulfur and other contaminants. The choice of materials in a catalytic converter is influenced by several factors, including the type of engine, the specific emission standards that need to be met, and cost considerations. As the automotive industry continues to innovate and develop new technologies, the demand for these precious metals and other materials is expected to remain strong. However, fluctuations in the prices of these metals can pose challenges for manufacturers, who must balance performance with cost-effectiveness. Additionally, the push towards more sustainable and environmentally friendly transportation options may lead to the development of alternative materials and technologies that can reduce reliance on precious metals. Overall, palladium, platinum, rhodium, and other materials are essential components of the automotive emission control catalyst market, playing a vital role in reducing vehicle emissions and helping to meet stringent environmental regulations.

Gasoline Engine, Diesel Engine, Others in the Automotive Emission Control Catalyst - Global Market:

Automotive emission control catalysts are used in various types of engines, including gasoline engines, diesel engines, and others, to reduce harmful emissions and comply with environmental regulations. In gasoline engines, these catalysts are primarily used in catalytic converters, which are part of the exhaust system. The catalysts facilitate chemical reactions that convert toxic gases like carbon monoxide, hydrocarbons, and nitrogen oxides into less harmful substances such as carbon dioxide, water vapor, and nitrogen. This process helps reduce air pollution and improve air quality. Gasoline engines typically use a combination of palladium, platinum, and rhodium in their catalytic converters to achieve optimal performance and efficiency. In diesel engines, emission control catalysts are used in diesel oxidation catalysts (DOCs) and selective catalytic reduction (SCR) systems. DOCs help oxidize carbon monoxide and hydrocarbons, while SCR systems reduce nitrogen oxides by injecting a urea-based solution into the exhaust stream. This process converts nitrogen oxides into nitrogen and water, significantly reducing emissions. Diesel engines often require more complex emission control systems due to their higher levels of nitrogen oxides and particulate matter. As a result, the catalysts used in diesel engines may include additional materials like vanadium and tungsten to enhance their effectiveness. In addition to gasoline and diesel engines, emission control catalysts are also used in other applications, such as natural gas engines and hybrid vehicles. Natural gas engines produce fewer emissions than traditional gasoline or diesel engines, but they still require emission control systems to meet regulatory standards. Catalysts used in these engines are designed to optimize the conversion of methane and other hydrocarbons into carbon dioxide and water. Hybrid vehicles, which combine internal combustion engines with electric motors, also use emission control catalysts to reduce emissions from their combustion engines. As the automotive industry continues to evolve and develop new technologies, the use of emission control catalysts in various engine types is expected to remain a critical component in reducing vehicle emissions and meeting environmental regulations.

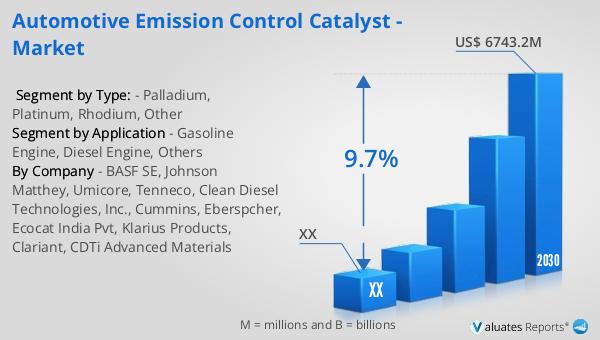

Automotive Emission Control Catalyst - Global Market Outlook:

The global market for automotive emission control catalysts was valued at approximately $3,568 million in 2023. It is projected to grow significantly, reaching an estimated size of $6,743.2 million by 2030, with a compound annual growth rate (CAGR) of 9.7% during the forecast period from 2024 to 2030. Currently, more than 90% of the world's automobiles are concentrated in three major regions: Asia, Europe, and North America. Asia leads in automobile production, accounting for 56% of the global output, followed by Europe at 20%, and North America at 16%. This concentration of automobile production in these regions underscores the importance of emission control catalysts in addressing environmental concerns and meeting regulatory standards. As these regions continue to produce a significant number of vehicles, the demand for effective emission control technologies is expected to grow, driving the market for automotive emission control catalysts. The increasing focus on reducing air pollution and improving air quality is likely to further propel the market, as countries implement stricter emission standards and regulations.

| Report Metric | Details |

| Report Name | Automotive Emission Control Catalyst - Market |

| Forecasted market size in 2030 | US$ 6743.2 million |

| CAGR | 9.7% |

| Forecasted years | 2024 - 2030 |

| Segment by Type: |

|

| Segment by Application |

|

| By Region |

|

| By Company | BASF SE, Johnson Matthey, Umicore, Tenneco, Clean Diesel Technologies, Inc., Cummins, Eberspcher, Ecocat India Pvt, Klarius Products, Clariant, CDTi Advanced Materials |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |