What is In Vitro Diagnostic Medical Devices and Equipment - Global Market?

In vitro diagnostic (IVD) medical devices and equipment play a crucial role in the healthcare industry by enabling the detection, diagnosis, and monitoring of diseases through tests conducted on samples such as blood, urine, or tissue. These devices are essential for providing accurate and timely information that aids in clinical decision-making. The global market for IVD medical devices encompasses a wide range of products, including reagents, instruments, and software systems, which are used in various healthcare settings. The demand for these devices is driven by factors such as the increasing prevalence of chronic diseases, advancements in technology, and the growing emphasis on personalized medicine. As healthcare systems worldwide strive to improve patient outcomes and reduce costs, the adoption of IVD devices is expected to continue to rise. This market is characterized by rapid innovation, with companies constantly developing new and improved products to meet the evolving needs of healthcare providers and patients. The global IVD market is a dynamic and competitive landscape, with numerous players vying for market share by offering innovative solutions that enhance the accuracy, efficiency, and accessibility of diagnostic testing.

Reagent Products, Disposable Medical Supplies, Instrument, Software System, Others in the In Vitro Diagnostic Medical Devices and Equipment - Global Market:

Reagent products are a fundamental component of in vitro diagnostic medical devices, serving as the chemical substances used to detect or measure specific components in a sample. These reagents are crucial for the accurate performance of diagnostic tests, as they react with the sample to produce measurable signals that indicate the presence or concentration of a particular analyte. The global market for reagent products is driven by the increasing demand for diagnostic testing, particularly in the areas of infectious diseases, cancer, and genetic disorders. Disposable medical supplies, such as test strips, pipettes, and sample containers, are also integral to the IVD market. These supplies are designed for single-use to prevent contamination and ensure the reliability of test results. The growing emphasis on infection control and the need for cost-effective testing solutions are key factors contributing to the demand for disposable medical supplies. Instruments used in IVD testing include analyzers and other devices that automate and streamline the testing process. These instruments are essential for high-throughput testing environments, such as clinical laboratories, where efficiency and accuracy are paramount. The development of advanced instruments with features such as automation, connectivity, and multiplexing capabilities is a significant trend in the IVD market. Software systems play a critical role in the management and analysis of diagnostic data, enabling healthcare providers to interpret test results accurately and efficiently. These systems are increasingly being integrated with electronic health records and other healthcare IT solutions to enhance data sharing and improve patient care. The demand for sophisticated software systems is driven by the need for comprehensive data management and the growing trend towards digital healthcare. Other products in the IVD market include quality control materials, calibration tools, and laboratory consumables, which are essential for ensuring the accuracy and reliability of diagnostic tests. The global market for these products is influenced by factors such as regulatory requirements, technological advancements, and the increasing complexity of diagnostic testing. Overall, the IVD market is characterized by a diverse range of products that cater to the varying needs of healthcare providers and patients, with innovation and quality being key drivers of market growth.

Hospital, Clinic, Others in the In Vitro Diagnostic Medical Devices and Equipment - Global Market:

In vitro diagnostic medical devices and equipment are widely used in hospitals, clinics, and other healthcare settings to facilitate the diagnosis and monitoring of diseases. In hospitals, IVD devices are essential for providing timely and accurate diagnostic information that supports clinical decision-making and patient management. These devices are used in various departments, including pathology, microbiology, and hematology, to perform a wide range of tests, from routine blood work to complex genetic analyses. The integration of IVD devices with hospital information systems and electronic health records enhances the efficiency and effectiveness of diagnostic testing, enabling healthcare providers to deliver better patient care. In clinics, IVD devices are used to perform point-of-care testing, which allows for rapid diagnosis and treatment of patients. This is particularly important in primary care settings, where timely diagnosis can significantly impact patient outcomes. The use of portable and easy-to-use IVD devices in clinics enables healthcare providers to conduct tests on-site, reducing the need for patients to visit multiple healthcare facilities. This not only improves patient convenience but also helps to reduce healthcare costs by minimizing the need for additional diagnostic procedures. In other healthcare settings, such as research laboratories and home healthcare, IVD devices are used to support various diagnostic and monitoring activities. In research laboratories, these devices are used to conduct studies on disease mechanisms, drug development, and biomarker discovery. In home healthcare, IVD devices enable patients to monitor their health conditions, such as blood glucose levels or cholesterol, from the comfort of their homes. This empowers patients to take an active role in managing their health and can lead to improved health outcomes. Overall, the use of IVD devices in hospitals, clinics, and other settings is driven by the need for accurate, efficient, and cost-effective diagnostic solutions that enhance patient care and support healthcare providers in delivering high-quality services.

In Vitro Diagnostic Medical Devices and Equipment - Global Market Outlook:

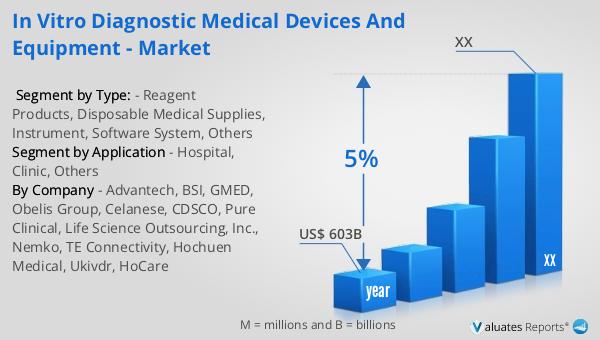

Our analysis indicates that the global market for medical devices is projected to reach approximately $603 billion in 2023, with an anticipated growth rate of 5% annually over the next six years. This growth is fueled by several factors, including the increasing prevalence of chronic diseases, technological advancements, and the rising demand for personalized medicine. As healthcare systems worldwide strive to improve patient outcomes and reduce costs, the adoption of innovative medical devices is expected to continue to rise. The market is characterized by rapid innovation, with companies constantly developing new and improved products to meet the evolving needs of healthcare providers and patients. The competitive landscape of the medical device market is dynamic, with numerous players vying for market share by offering innovative solutions that enhance the accuracy, efficiency, and accessibility of healthcare services. The integration of digital technologies, such as artificial intelligence and machine learning, into medical devices is a significant trend that is expected to drive market growth. Additionally, the increasing focus on regulatory compliance and quality assurance is shaping the development and commercialization of medical devices. Overall, the global medical device market presents significant opportunities for growth and innovation, with companies poised to capitalize on the increasing demand for advanced healthcare solutions.

| Report Metric | Details |

| Report Name | In Vitro Diagnostic Medical Devices and Equipment - Market |

| Accounted market size in year | US$ 603 billion |

| CAGR | 5% |

| Base Year | year |

| Segment by Type: |

|

| Segment by Application |

|

| By Region |

|

| By Company | Advantech, BSI, GMED, Obelis Group, Celanese, CDSCO, Pure Clinical, Life Science Outsourcing, Inc., Nemko, TE Connectivity, Hochuen Medical, Ukivdr, HoCare |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |