What is Agricultural Cost Insurance - Global Market?

Agricultural Cost Insurance is a specialized financial product designed to protect farmers and agricultural businesses from the unpredictable costs associated with farming. This type of insurance covers various expenses that farmers might incur due to unforeseen events such as natural disasters, pest infestations, or sudden market changes. The global market for Agricultural Cost Insurance is growing as more farmers recognize the importance of safeguarding their investments against these risks. By providing a safety net, this insurance allows farmers to manage their financial stability better, ensuring they can continue operations even when faced with unexpected challenges. The insurance typically covers costs related to crop production, equipment repair, and other essential farming activities. As the agricultural sector faces increasing volatility due to climate change and global economic shifts, the demand for Agricultural Cost Insurance is expected to rise, offering farmers a crucial tool for risk management and financial planning. This growth in demand is reflected in the market's expansion, with more insurance providers entering the field to offer tailored solutions that meet the diverse needs of farmers worldwide.

Crop Yield Insurance, Crop Price Insurance in the Agricultural Cost Insurance - Global Market:

Crop Yield Insurance and Crop Price Insurance are two critical components of Agricultural Cost Insurance that cater to different aspects of farming risks. Crop Yield Insurance primarily focuses on protecting farmers against the loss of crop production due to natural calamities like droughts, floods, or pest invasions. This insurance ensures that farmers receive compensation if their actual yield falls below a predetermined level, providing them with financial support to cover their losses and continue their operations. On the other hand, Crop Price Insurance addresses the financial risks associated with fluctuating market prices. It guarantees a minimum price for the crops, ensuring that farmers receive a stable income even when market prices drop unexpectedly. This type of insurance is particularly beneficial in volatile markets where price swings can significantly impact a farmer's revenue. Both types of insurance play a vital role in stabilizing the agricultural sector by offering farmers a reliable means to manage risks and secure their livelihoods. As the global market for Agricultural Cost Insurance expands, these insurance products are becoming increasingly sophisticated, with insurers offering customized policies that cater to the specific needs of different crops and regions. This customization allows farmers to choose the coverage that best suits their unique circumstances, providing them with peace of mind and financial security. The integration of technology in the insurance process, such as satellite imagery and data analytics, is also enhancing the accuracy and efficiency of these insurance products, making them more accessible and effective for farmers worldwide. As a result, Crop Yield Insurance and Crop Price Insurance are becoming indispensable tools for modern farmers, enabling them to navigate the complexities of the agricultural industry with greater confidence and resilience.

Crops, Food Crops, Farm Facilities, Employee Salary in the Agricultural Cost Insurance - Global Market:

Agricultural Cost Insurance is utilized in various areas of farming, including crops, food crops, farm facilities, and employee salaries, providing comprehensive coverage that addresses the diverse needs of the agricultural sector. For crops, this insurance covers the costs associated with planting, growing, and harvesting, ensuring that farmers can recover their investments even in the face of adverse conditions. This coverage is crucial for maintaining the financial viability of farming operations, as it allows farmers to manage risks effectively and focus on maximizing their yield. In the case of food crops, Agricultural Cost Insurance plays a vital role in ensuring food security by protecting the production of essential crops that form the backbone of the global food supply. By safeguarding these crops against potential losses, the insurance helps stabilize food prices and availability, benefiting both farmers and consumers. Farm facilities, such as barns, silos, and irrigation systems, are also covered under Agricultural Cost Insurance, providing protection against damage or loss due to natural disasters or accidents. This coverage ensures that farmers can maintain their infrastructure and continue their operations without incurring significant financial burdens. Additionally, Agricultural Cost Insurance can cover employee salaries, offering financial support to farmers in times of crisis when they might struggle to meet payroll obligations. This aspect of the insurance is particularly important for larger farming operations that rely on a stable workforce to maintain productivity. By covering these various areas, Agricultural Cost Insurance provides a comprehensive safety net that supports the entire agricultural ecosystem, enabling farmers to manage risks effectively and sustain their livelihoods in an increasingly uncertain world.

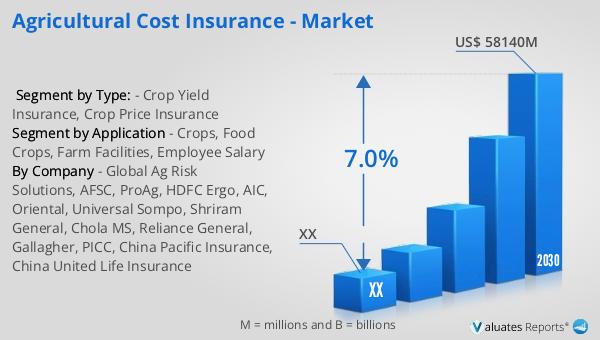

Agricultural Cost Insurance - Global Market Outlook:

The global market for Agricultural Cost Insurance was valued at approximately $36,420 million in 2023, with projections indicating a growth to around $58,140 million by 2030. This growth represents a compound annual growth rate (CAGR) of 7.0% during the forecast period from 2024 to 2030. The North American segment of this market was also valued at a significant amount in 2023, with expectations of continued growth through 2030. This expansion reflects the increasing recognition of the importance of Agricultural Cost Insurance in mitigating the financial risks associated with farming. As farmers face challenges such as climate change, market volatility, and rising production costs, the demand for comprehensive insurance solutions is expected to rise. The market's growth is driven by the need for tailored insurance products that address the specific risks faced by farmers in different regions and sectors. Insurance providers are responding to this demand by offering innovative solutions that incorporate advanced technologies and data analytics to enhance the accuracy and efficiency of their products. This trend is expected to continue as the agricultural sector evolves, with insurers playing a crucial role in supporting farmers' financial stability and resilience. The projected growth of the Agricultural Cost Insurance market underscores its importance as a vital tool for risk management and financial planning in the agricultural industry.

| Report Metric | Details |

| Report Name | Agricultural Cost Insurance - Market |

| Forecasted market size in 2030 | US$ 58140 million |

| CAGR | 7.0% |

| Forecasted years | 2024 - 2030 |

| Segment by Type: |

|

| Segment by Application |

|

| By Region |

|

| By Company | Global Ag Risk Solutions, AFSC, ProAg, HDFC Ergo, AIC, Oriental, Universal Sompo, Shriram General, Chola MS, Reliance General, Gallagher, PICC, China Pacific Insurance, China United Life Insurance |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |