What is Global Marine Cylinder Oil Market?

The Global Marine Cylinder Oil Market is a crucial segment within the broader marine lubricants industry, serving as a vital component for the smooth operation of marine engines. These oils are specifically designed to lubricate the cylinders of large two-stroke marine engines, which are commonly used in ships and vessels traversing the world's oceans. The primary function of marine cylinder oil is to reduce friction between the moving parts of the engine, thereby minimizing wear and tear and extending the engine's lifespan. Additionally, these oils play a significant role in neutralizing acidic by-products formed during fuel combustion, which can otherwise lead to corrosion and damage. The market for marine cylinder oil is driven by the increasing demand for maritime transport, which remains a cornerstone of global trade. As the shipping industry continues to grow, so does the need for efficient and reliable lubrication solutions, making the Global Marine Cylinder Oil Market an essential component of the maritime sector. The market is characterized by a range of products tailored to meet the specific needs of different engine types and operating conditions, ensuring optimal performance and compliance with environmental regulations.

High-BN (70-100 BN), Low-BN (15-60 BN) in the Global Marine Cylinder Oil Market:

In the Global Marine Cylinder Oil Market, products are often categorized based on their Base Number (BN), which indicates the oil's alkalinity and its ability to neutralize acidic compounds. High-BN oils, typically ranging from 70 to 100 BN, are formulated for use with high-sulfur fuels. These oils are essential in environments where the fuel's sulfur content is significant, as they provide the necessary alkalinity to counteract the corrosive effects of sulfuric acid formed during combustion. High-BN oils are particularly important for vessels operating in regions where high-sulfur fuels are prevalent, ensuring that engines remain protected from corrosion and wear. On the other hand, Low-BN oils, with a BN range of 15 to 60, are designed for use with low-sulfur fuels, which have become more common due to stringent environmental regulations aimed at reducing sulfur emissions. These oils offer sufficient alkalinity to protect the engine while minimizing the risk of deposit formation, which can occur if the oil's BN is too high for the fuel being used. The choice between High-BN and Low-BN oils is critical for ship operators, as using the wrong type of oil can lead to engine damage and increased maintenance costs. The transition to low-sulfur fuels, driven by regulations such as the International Maritime Organization's (IMO) 2020 sulfur cap, has significantly impacted the demand for different types of marine cylinder oils. Ship operators must carefully consider their fuel choices and operating conditions to select the appropriate oil, balancing the need for engine protection with compliance to environmental standards. The shift towards cleaner fuels has also spurred innovation in the marine cylinder oil market, with manufacturers developing advanced formulations that offer enhanced performance and protection. These innovations are crucial for meeting the evolving needs of the shipping industry, which is increasingly focused on sustainability and efficiency. As the market continues to evolve, the ability to adapt to changing fuel compositions and regulatory requirements will be key for both oil manufacturers and ship operators. The ongoing development of new oil formulations and technologies will play a vital role in supporting the maritime industry's transition to a more sustainable future, ensuring that marine engines remain efficient, reliable, and environmentally compliant.

Deep Sea, Inland and Coastal in the Global Marine Cylinder Oil Market:

The usage of Global Marine Cylinder Oil Market products varies significantly across different maritime sectors, including deep sea, inland, and coastal operations. In deep-sea shipping, which involves long voyages across oceans, the demand for high-performance marine cylinder oils is paramount. These vessels often operate continuously for extended periods, requiring oils that can withstand harsh conditions and provide consistent lubrication. High-BN oils are commonly used in this sector, especially for ships using high-sulfur fuels, as they offer the necessary protection against corrosion and wear. The reliability of marine cylinder oils in deep-sea operations is critical, as any engine failure can lead to significant delays and financial losses. In contrast, inland shipping, which involves the transportation of goods along rivers and canals, typically requires different oil formulations. Vessels operating in these environments often use low-sulfur fuels, making Low-BN oils more suitable. These oils provide adequate protection while minimizing the risk of deposit formation, which can be more prevalent in the slower-moving engines used in inland shipping. The choice of oil in this sector is influenced by the need for compliance with local environmental regulations, which often mandate the use of cleaner fuels and lubricants. Coastal shipping, which involves the movement of goods along coastlines, presents its own set of challenges and requirements. Vessels in this sector may operate in a variety of conditions, from calm waters to rough seas, necessitating oils that offer both versatility and reliability. The choice between High-BN and Low-BN oils in coastal shipping depends on the specific fuel used and the vessel's operating conditions. As with other sectors, compliance with environmental regulations is a key consideration, driving the demand for oils that support sustainable operations. Across all these sectors, the Global Marine Cylinder Oil Market plays a vital role in ensuring the efficient and reliable operation of marine engines. The ability to select the right oil for each application is crucial for ship operators, impacting not only engine performance but also operational costs and environmental compliance. As the maritime industry continues to evolve, the demand for advanced marine cylinder oils that offer enhanced performance and sustainability will remain a key driver of market growth.

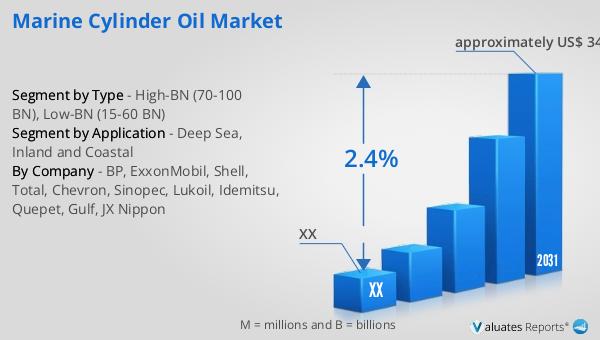

Global Marine Cylinder Oil Market Outlook:

In 2024, the global market size for Marine Cylinder Oil was valued at approximately US$ 2,889 million, with projections indicating it could reach around US$ 3,403 million by 2031. This growth is expected to occur at a compound annual growth rate (CAGR) of 2.4% during the forecast period from 2025 to 2031. The market is dominated by the top five manufacturers, who collectively hold about 75% of the market share. The Asia Pacific region emerges as the largest market, accounting for roughly 50% of the global share, followed by Europe, which holds about 20%. In terms of product segmentation, High-BN (70-100 BN) oils represent the largest segment, capturing approximately 85% of the market. This dominance is largely due to the widespread use of high-sulfur fuels in certain regions, necessitating the use of High-BN oils for effective engine protection. The market dynamics are influenced by various factors, including regulatory changes, fuel composition, and technological advancements in oil formulations. As the industry adapts to new environmental standards and fuel types, the demand for specialized marine cylinder oils is expected to grow, driving innovation and competition among manufacturers. The ability to meet the diverse needs of the maritime sector, from deep-sea to coastal operations, will be crucial for companies looking to maintain and expand their market presence.

| Report Metric | Details |

| Report Name | Marine Cylinder Oil Market |

| Forecasted market size in 2031 | approximately US$ 3403 million |

| CAGR | 2.4% |

| Forecasted years | 2025 - 2031 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | BP, ExxonMobil, Shell, Total, Chevron, Sinopec, Lukoil, Idemitsu, Quepet, Gulf, JX Nippon |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |