What is Global Reinsurance Market?

The global reinsurance market is a crucial component of the broader insurance industry, serving as a safety net for insurance companies by providing them with additional financial protection. Reinsurance is essentially insurance for insurers, allowing them to manage risk more effectively by transferring portions of their risk portfolios to other parties. This process helps insurance companies stabilize their financial standing, especially in the face of large-scale claims resulting from catastrophic events like natural disasters. By spreading risk across multiple entities, reinsurance ensures that no single company bears the full brunt of a significant loss, thereby promoting stability and confidence within the insurance sector. The global reinsurance market is characterized by its complexity and diversity, with numerous players operating across different regions and offering a variety of products tailored to meet the specific needs of their clients. This market is influenced by a range of factors, including economic conditions, regulatory changes, and emerging risks, all of which can impact the demand for reinsurance services. As the world continues to face new challenges and uncertainties, the role of reinsurance remains vital in safeguarding the financial health of the insurance industry and, by extension, the broader economy.

P&C Reinsurance, Life Reinsurance, Segment by Distribution Channel, Direct Writing, Broker in the Global Reinsurance Market:

Property and Casualty (P&C) reinsurance and life reinsurance are two primary segments within the global reinsurance market, each serving distinct purposes and catering to different types of risks. P&C reinsurance covers a wide array of non-life insurance products, including property damage, liability, and other forms of casualty insurance. This segment is particularly important for managing risks associated with natural disasters, accidents, and other unforeseen events that can lead to significant financial losses. By providing a layer of protection for insurers, P&C reinsurance helps ensure that they can meet their obligations to policyholders even in the face of large-scale claims. On the other hand, life reinsurance focuses on life insurance products, offering coverage for risks related to mortality, longevity, and morbidity. This segment is essential for life insurers looking to manage their exposure to long-term liabilities and ensure the sustainability of their portfolios. Life reinsurance can also provide insurers with the flexibility to offer more competitive products and pricing to their customers. In terms of distribution channels, the global reinsurance market operates through both direct writing and broker-based models. Direct writing involves reinsurers working directly with primary insurers to negotiate and underwrite reinsurance contracts. This approach allows for more personalized service and tailored solutions, as reinsurers can develop a deep understanding of their clients' specific needs and risk profiles. Broker-based distribution, on the other hand, involves intermediaries who facilitate the placement of reinsurance contracts between insurers and reinsurers. Brokers play a crucial role in the market by leveraging their expertise and relationships to match insurers with the most suitable reinsurance partners and products. They also provide valuable advisory services, helping insurers navigate the complexities of the reinsurance market and optimize their risk management strategies. Both distribution channels have their advantages and are often used in combination to achieve the best outcomes for insurers and reinsurers alike. The global reinsurance market is a dynamic and evolving landscape, shaped by a multitude of factors including technological advancements, regulatory developments, and changing risk environments. As insurers continue to face new challenges and opportunities, the role of reinsurance in supporting their financial stability and growth remains as important as ever.

in the Global Reinsurance Market:

The global reinsurance market finds applications across a wide range of industries and sectors, each with its unique set of risks and challenges. One of the primary applications of reinsurance is in the property and casualty insurance sector, where it plays a critical role in managing risks associated with natural disasters, accidents, and other unforeseen events. By providing a financial safety net for insurers, reinsurance helps ensure that they can meet their obligations to policyholders even in the face of large-scale claims. This is particularly important in regions prone to natural disasters, such as hurricanes, earthquakes, and floods, where the potential for catastrophic losses is high. In addition to property and casualty insurance, reinsurance is also widely used in the life insurance sector. Life reinsurance provides coverage for risks related to mortality, longevity, and morbidity, helping life insurers manage their exposure to long-term liabilities and ensure the sustainability of their portfolios. This is especially important in an era of increasing life expectancies and changing demographic trends, where the demand for life insurance products is on the rise. Reinsurance also plays a vital role in the health insurance sector, where it helps insurers manage the financial risks associated with providing coverage for medical expenses. By spreading risk across multiple entities, reinsurance allows health insurers to offer more comprehensive and affordable coverage to their customers, while also ensuring their own financial stability. Beyond the traditional insurance sectors, reinsurance is increasingly being applied in emerging areas such as cyber insurance and climate risk insurance. As the world becomes more interconnected and digitalized, the threat of cyberattacks and data breaches has grown significantly, leading to increased demand for cyber insurance products. Reinsurance provides a crucial layer of protection for insurers in this space, helping them manage the complex and evolving risks associated with cyber threats. Similarly, as the impacts of climate change become more pronounced, there is a growing need for insurance solutions that address climate-related risks. Reinsurance can help insurers develop and offer innovative products that cater to these emerging needs, while also ensuring their own financial resilience in the face of changing risk landscapes. Overall, the global reinsurance market plays a vital role in supporting the insurance industry and the broader economy by providing a mechanism for managing and mitigating risk across a wide range of applications.

Global Reinsurance Market Outlook:

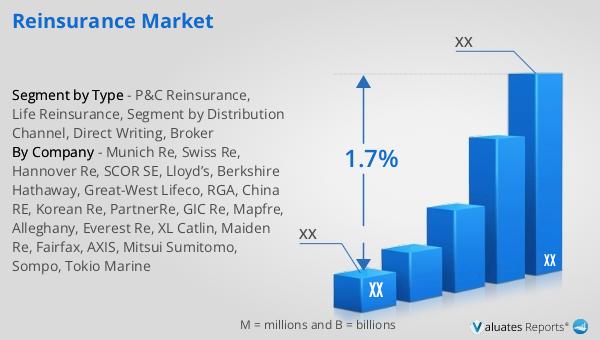

In 2024, the global reinsurance market was valued at approximately US$ 289.38 billion, with projections indicating growth to around US$ 325.08 billion by 2031. This growth is expected to occur at a compound annual growth rate (CAGR) of 1.7% during the forecast period from 2025 to 2031. The market is dominated by the top five manufacturers, who collectively hold about 50% of the market share. North America stands as the largest regional market, accounting for approximately 45% of the global share, followed by Europe with about 30%. Within the product segments, Property and Casualty (P&C) reinsurance emerges as the largest, capturing around 70% of the market. This dominance is reflective of the significant demand for P&C reinsurance products, driven by the need to manage risks associated with natural disasters, accidents, and other unforeseen events. The market's growth trajectory is influenced by various factors, including economic conditions, regulatory changes, and emerging risks, all of which can impact the demand for reinsurance services. As the global economy continues to evolve, the reinsurance market remains a critical component of the insurance industry, providing essential risk management solutions that support financial stability and growth.

| Report Metric | Details |

| Report Name | Reinsurance Market |

| CAGR | 1.7% |

| Segment by Type |

|

| By Region |

|

| By Company | Munich Re, Swiss Re, Hannover Re, SCOR SE, Lloyd’s, Berkshire Hathaway, Great-West Lifeco, RGA, China RE, Korean Re, PartnerRe, GIC Re, Mapfre, Alleghany, Everest Re, XL Catlin, Maiden Re, Fairfax, AXIS, Mitsui Sumitomo, Sompo, Tokio Marine |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |