What is Global Display Glass Substrate Market?

The Global Display Glass Substrate Market is a crucial component of the electronics industry, serving as the foundational material for various display technologies. Display glass substrates are thin sheets of glass that act as the base layer for electronic displays, such as those found in televisions, monitors, laptops, and smartphones. These substrates are essential for the production of liquid crystal displays (LCDs), organic light-emitting diode (OLED) displays, and other advanced display technologies. The market for display glass substrates is driven by the increasing demand for high-quality displays with better resolution, brightness, and energy efficiency. As consumer electronics continue to evolve, the need for advanced display technologies grows, pushing manufacturers to innovate and improve the quality of glass substrates. The market is characterized by rapid technological advancements, with manufacturers focusing on producing thinner, lighter, and more durable glass substrates to meet the demands of modern electronic devices. The global market is highly competitive, with key players investing in research and development to maintain their market position and cater to the ever-changing needs of the electronics industry.

Gen. 8/8+, Gen. 7/7.5, Gen. 6/6.5, Gen. 5/5.5, Gen. 4/4- in the Global Display Glass Substrate Market:

In the Global Display Glass Substrate Market, different generations of glass substrates are used, each offering unique features and benefits. Gen. 8/8+ substrates are among the largest and most advanced, typically used in the production of large-sized displays such as televisions and large monitors. These substrates allow for the efficient production of large panels, reducing waste and improving manufacturing efficiency. Gen. 7/7.5 substrates are slightly smaller but still cater to large display applications. They are often used in the production of high-definition televisions and large computer monitors, offering a balance between size and production efficiency. Gen. 6/6.5 substrates are commonly used for medium-sized displays, such as those found in laptops and smaller monitors. These substrates provide a good balance between size, cost, and performance, making them a popular choice for a wide range of applications. Gen. 5/5.5 substrates are typically used for smaller displays, such as those found in tablets and smaller laptops. They offer a cost-effective solution for producing high-quality displays in smaller sizes. Finally, Gen. 4/4- substrates are the smallest and are often used in the production of small electronic devices, such as smartphones and handheld gaming devices. These substrates are designed to be lightweight and durable, making them ideal for portable electronics. Each generation of glass substrate offers unique advantages, allowing manufacturers to choose the best option for their specific application needs. As technology continues to advance, the demand for different generations of glass substrates is expected to evolve, with manufacturers continually innovating to meet the changing needs of the market.

Televisions, Monitors, Laptops, Others in the Global Display Glass Substrate Market:

The Global Display Glass Substrate Market plays a vital role in the production of various electronic devices, including televisions, monitors, laptops, and other applications. In the television industry, display glass substrates are used to create large, high-definition screens that offer vibrant colors and sharp images. The demand for larger and more advanced televisions has driven the need for larger glass substrates, such as Gen. 8/8+, which allow for the efficient production of large panels. In the monitor market, display glass substrates are used to produce high-resolution screens for computers and professional displays. The need for better image quality and larger screen sizes has led to the use of advanced glass substrates that offer improved performance and durability. In the laptop market, display glass substrates are used to create lightweight and durable screens that offer excellent image quality and energy efficiency. As laptops become thinner and more portable, the demand for thinner and lighter glass substrates has increased, driving innovation in the market. Other applications of display glass substrates include tablets, smartphones, and wearable devices, where the need for high-quality, durable, and lightweight displays is critical. The versatility of display glass substrates makes them an essential component in the production of a wide range of electronic devices, and their importance is expected to grow as technology continues to advance.

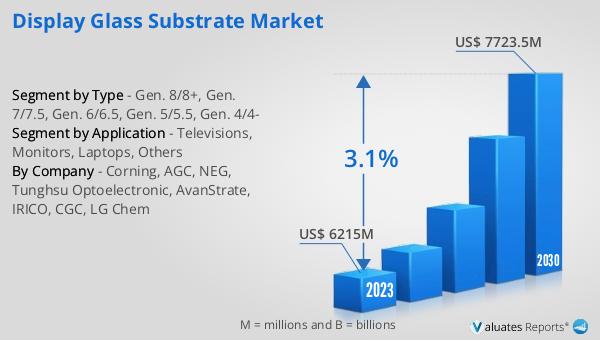

Global Display Glass Substrate Market Outlook:

In 2024, the global market size of Display Glass Substrate was valued at approximately US$ 6,610 million. This market is projected to grow, reaching an estimated value of around US$ 8,161 million by 2031, with a compound annual growth rate (CAGR) of 3.1% during the forecast period from 2025 to 2031. The market is dominated by the top five manufacturers, who collectively hold about 95% of the market share. Among the various product segments, Gen. 8/8+ is the largest, accounting for approximately 40% of the market share. This dominance is attributed to the increasing demand for larger and more advanced displays, particularly in the television and monitor markets. The growth of the Display Glass Substrate Market is driven by the continuous advancements in display technology and the rising demand for high-quality electronic devices. As manufacturers strive to meet the evolving needs of consumers, the market is expected to witness significant growth, with key players investing in research and development to maintain their competitive edge. The future of the Display Glass Substrate Market looks promising, with opportunities for growth and innovation in various segments.

| Report Metric | Details |

| Report Name | Display Glass Substrate Market |

| CAGR | 3.1% |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | Corning, AGC, NEG, Tunghsu Optoelectronic, AvanStrate, IRICO, CGC, LG Chem |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |