What is Global Fuel Card Market?

The Global Fuel Card Market is a dynamic and essential component of the modern transportation and logistics industry. Fuel cards, also known as fleet cards, are specialized payment cards used by businesses to manage fuel expenses for their vehicle fleets. These cards offer a convenient and efficient way to track fuel purchases, monitor fuel consumption, and streamline administrative processes. The market for fuel cards is driven by the increasing need for businesses to optimize their fleet operations, reduce fuel costs, and enhance overall efficiency. With the rise of digital payment solutions and advancements in technology, fuel cards have evolved to offer additional features such as real-time reporting, fraud prevention, and integration with telematics systems. The global fuel card market is characterized by a diverse range of offerings, including registered and non-registered fuel cards, catering to different business needs and preferences. As businesses continue to expand their operations globally, the demand for fuel cards is expected to grow, driven by the need for cost-effective and efficient fuel management solutions. The market is also influenced by factors such as fluctuating fuel prices, regulatory changes, and the increasing adoption of electric and hybrid vehicles. Overall, the Global Fuel Card Market plays a crucial role in helping businesses manage their fuel expenses and improve operational efficiency.

Registered Fuel Card, Non-Registered Fuel Card in the Global Fuel Card Market:

In the Global Fuel Card Market, registered fuel cards and non-registered fuel cards serve distinct purposes and cater to different user needs. Registered fuel cards are typically issued to specific vehicles or drivers and are linked to a particular account or business entity. These cards offer a higher level of control and security, as they allow businesses to monitor fuel purchases, set spending limits, and track fuel consumption in real-time. Registered fuel cards are often used by large fleets and businesses that require detailed reporting and analysis of fuel expenses. They provide valuable insights into fuel usage patterns, helping businesses identify areas for cost savings and operational improvements. Additionally, registered fuel cards often come with advanced features such as fraud detection, purchase restrictions, and integration with fleet management systems. On the other hand, non-registered fuel cards are more flexible and can be used by multiple vehicles or drivers without being tied to a specific account. These cards are ideal for smaller businesses or individuals who require a simple and convenient way to pay for fuel without the need for detailed reporting or analysis. Non-registered fuel cards offer the advantage of ease of use and accessibility, making them a popular choice for businesses with smaller fleets or those that do not require extensive fuel management capabilities. While they may lack some of the advanced features of registered fuel cards, non-registered fuel cards still provide a convenient and efficient way to manage fuel expenses. In the Global Fuel Card Market, both registered and non-registered fuel cards play a vital role in helping businesses optimize their fuel management processes and reduce operational costs. As the market continues to evolve, businesses are increasingly looking for fuel card solutions that offer a balance of control, flexibility, and cost-effectiveness. The choice between registered and non-registered fuel cards ultimately depends on the specific needs and preferences of the business, as well as the size and complexity of their fleet operations. With the ongoing advancements in technology and the growing demand for efficient fuel management solutions, the Global Fuel Card Market is poised for continued growth and innovation.

Light Weight Vehicle, Heavy Weight Vehicle in the Global Fuel Card Market:

The usage of the Global Fuel Card Market in light-weight and heavy-weight vehicles is crucial for optimizing fuel management and reducing operational costs. For light-weight vehicles, which typically include cars, vans, and small trucks, fuel cards offer a convenient way to manage fuel expenses and streamline administrative processes. Businesses that operate light-weight vehicle fleets, such as delivery services, sales teams, and service providers, benefit from the ability to track fuel purchases, monitor fuel consumption, and set spending limits. Fuel cards provide real-time reporting and analytics, allowing businesses to identify fuel usage patterns and implement cost-saving measures. Additionally, fuel cards help prevent unauthorized fuel purchases and reduce the risk of fraud, providing an added layer of security for businesses. For heavy-weight vehicles, such as large trucks and buses, fuel cards are essential for managing the significant fuel expenses associated with long-haul transportation and logistics operations. Heavy-weight vehicle fleets often require more advanced fuel management solutions, including integration with telematics systems and detailed reporting capabilities. Fuel cards enable businesses to monitor fuel consumption, optimize routes, and improve overall fleet efficiency. They also provide valuable insights into driver behavior and vehicle performance, helping businesses identify areas for improvement and reduce fuel costs. In both light-weight and heavy-weight vehicle applications, fuel cards play a vital role in enhancing operational efficiency and reducing administrative burdens. As businesses continue to expand their operations and seek ways to optimize their fleet management processes, the demand for fuel card solutions is expected to grow. The Global Fuel Card Market offers a wide range of options to cater to the diverse needs of businesses, from small fleets to large-scale logistics operations. With the ongoing advancements in technology and the increasing focus on sustainability and cost-effectiveness, fuel cards are becoming an indispensable tool for businesses looking to improve their fuel management practices and achieve greater operational efficiency.

Global Fuel Card Market Outlook:

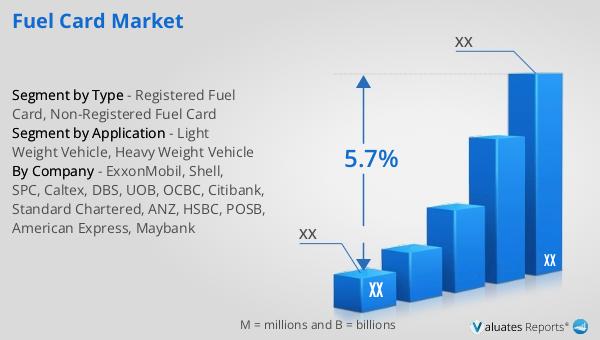

In 2024, the global market size of the Fuel Card industry was valued at approximately US$ 892,850 million. This market is projected to grow significantly, reaching an estimated value of around US$ 1,309,050 million by 2031. This growth is expected to occur at a compound annual growth rate (CAGR) of 5.7% during the forecast period from 2025 to 2031. The market is dominated by the top five manufacturers, who collectively hold a substantial share of about 90%. Within the product segments, the registered fuel card emerges as the largest, commanding a significant share of approximately 75%. This dominance can be attributed to the registered fuel card's ability to offer enhanced control, security, and detailed reporting capabilities, making it a preferred choice for businesses with large fleets and complex fuel management needs. The growth of the Global Fuel Card Market is driven by the increasing demand for efficient fuel management solutions, advancements in digital payment technologies, and the need for businesses to optimize their fleet operations. As the market continues to evolve, businesses are seeking fuel card solutions that offer a balance of control, flexibility, and cost-effectiveness to meet their specific needs. The Global Fuel Card Market is poised for continued growth and innovation, providing businesses with the tools they need to manage their fuel expenses and improve operational efficiency.

| Report Metric | Details |

| Report Name | Fuel Card Market |

| CAGR | 5.7% |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | ExxonMobil, Shell, SPC, Caltex, DBS, UOB, OCBC, Citibank, Standard Chartered, ANZ, HSBC, POSB, American Express, Maybank |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |