What is Global CSP Solder Balls Market?

The Global CSP (Chip Scale Package) Solder Balls Market is a specialized segment within the electronics manufacturing industry, focusing on the production and distribution of solder balls used in chip scale packaging. CSP solder balls are tiny spheres of solder that serve as the connection points between the semiconductor chip and the substrate or printed circuit board (PCB). These solder balls are crucial for ensuring reliable electrical connections and mechanical stability in electronic devices. The market for CSP solder balls is driven by the increasing demand for miniaturized electronic components, as they enable the production of smaller, more efficient devices. As technology advances, the need for high-performance, compact, and lightweight electronic products continues to grow, further fueling the demand for CSP solder balls. The market is characterized by a variety of solder ball types, including lead-free and lead-based options, each catering to different industry requirements and regulatory standards. Manufacturers in this market are continually innovating to improve the performance, reliability, and environmental compliance of their products, ensuring they meet the evolving needs of the electronics industry. The Global CSP Solder Balls Market plays a vital role in the advancement of modern electronics, supporting the development of cutting-edge technologies and applications.

Lead-Free Solder Balls, Lead Solder Balls in the Global CSP Solder Balls Market:

Lead-Free Solder Balls and Lead Solder Balls are two primary types of solder balls used in the Global CSP Solder Balls Market, each with distinct characteristics and applications. Lead-Free Solder Balls are increasingly popular due to environmental and health concerns associated with lead. These solder balls are made from alternative materials such as tin, silver, and copper, which provide similar performance without the harmful effects of lead. The shift towards lead-free options is driven by stringent regulations, such as the Restriction of Hazardous Substances (RoHS) directive, which limits the use of hazardous materials in electronic products. Lead-Free Solder Balls offer several advantages, including improved thermal and mechanical properties, making them suitable for high-reliability applications in industries like automotive and aerospace. However, they also present challenges, such as higher melting points and potential issues with joint reliability, which manufacturers are continually addressing through research and development. On the other hand, Lead Solder Balls have been a staple in the electronics industry for decades, known for their excellent wettability, low melting point, and ease of use. These solder balls typically consist of a tin-lead alloy, which provides reliable electrical connections and mechanical strength. Despite their proven performance, the use of lead solder balls is declining due to environmental concerns and regulatory pressures. However, they are still used in specific applications where their unique properties are required, such as in military and aerospace sectors, where reliability and performance are paramount. The transition from lead to lead-free solder balls is a significant trend in the Global CSP Solder Balls Market, with manufacturers investing in new materials and technologies to meet the changing demands of the industry. The choice between Lead-Free and Lead Solder Balls depends on various factors, including the specific application, regulatory requirements, and cost considerations. Lead-Free Solder Balls are often preferred in consumer electronics and other industries where environmental compliance is a priority. In contrast, Lead Solder Balls may still be used in applications where their superior performance characteristics are essential. As the electronics industry continues to evolve, the demand for both types of solder balls is expected to grow, driven by the increasing complexity and miniaturization of electronic devices. Manufacturers in the Global CSP Solder Balls Market are focused on developing innovative solutions that balance performance, reliability, and environmental impact, ensuring they meet the diverse needs of their customers.

IDM, OSAT in the Global CSP Solder Balls Market:

The Global CSP Solder Balls Market finds significant usage in various areas, including Integrated Device Manufacturers (IDM) and Outsourced Semiconductor Assembly and Test (OSAT) companies. IDMs are companies that design, manufacture, and sell integrated circuits (ICs) and other semiconductor devices. They rely on CSP solder balls to ensure reliable connections between the semiconductor chips and the substrates or PCBs. The use of CSP solder balls in IDM applications is driven by the need for high-performance, miniaturized electronic components that can support the development of advanced technologies such as 5G, IoT, and AI. CSP solder balls enable IDMs to produce smaller, more efficient devices with improved thermal and mechanical properties, meeting the demands of modern electronic applications. OSAT companies, on the other hand, specialize in providing assembly, packaging, and testing services for semiconductor manufacturers. They play a crucial role in the semiconductor supply chain, offering cost-effective solutions for companies that do not have in-house assembly and testing capabilities. CSP solder balls are essential for OSAT companies, as they facilitate the assembly and packaging of semiconductor devices, ensuring reliable electrical connections and mechanical stability. The use of CSP solder balls in OSAT applications is driven by the increasing demand for outsourced semiconductor services, as companies seek to reduce costs and improve efficiency. CSP solder balls enable OSAT companies to offer high-quality assembly and packaging services, supporting the development of cutting-edge electronic products. Both IDM and OSAT companies benefit from the advancements in CSP solder ball technology, as manufacturers continue to innovate and improve the performance, reliability, and environmental compliance of their products. The Global CSP Solder Balls Market plays a vital role in supporting the growth and development of the semiconductor industry, enabling the production of advanced electronic devices that meet the evolving needs of consumers and businesses. As the demand for miniaturized, high-performance electronic components continues to grow, the importance of CSP solder balls in IDM and OSAT applications is expected to increase, driving further innovation and development in the market.

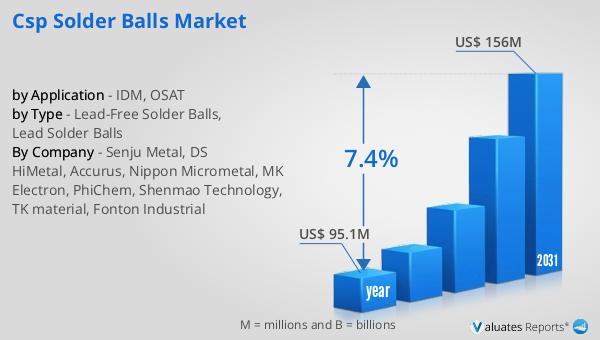

Global CSP Solder Balls Market Outlook:

In 2024, the global market for CSP Solder Balls was valued at approximately $95.1 million. Looking ahead, this market is anticipated to expand significantly, reaching an estimated size of $156 million by 2031. This growth trajectory represents a compound annual growth rate (CAGR) of 7.4% over the forecast period. This upward trend is indicative of the increasing demand for CSP solder balls, driven by the rapid advancements in electronic devices and the growing need for miniaturized components. As technology continues to evolve, the demand for high-performance, reliable, and environmentally compliant solder balls is expected to rise, further fueling the growth of the market. Manufacturers in the Global CSP Solder Balls Market are focused on developing innovative solutions that meet the changing needs of the electronics industry, ensuring they remain competitive in a rapidly evolving market. The projected growth of the CSP Solder Balls Market highlights the importance of these components in the development of modern electronic devices, supporting the advancement of cutting-edge technologies and applications.

| Report Metric | Details |

| Report Name | CSP Solder Balls Market |

| Accounted market size in year | US$ 95.1 million |

| Forecasted market size in 2031 | US$ 156 million |

| CAGR | 7.4% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| by Type |

|

| by Application |

|

| Production by Region |

|

| Consumption by Region |

|

| By Company | Senju Metal, DS HiMetal, Accurus, Nippon Micrometal, MK Electron, PhiChem, Shenmao Technology, TK material, Fonton Industrial |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |