What is Global Single Trip Travel Insurance Market?

The Global Single Trip Travel Insurance Market is a segment of the insurance industry that provides coverage for individuals traveling abroad or domestically for a single trip. This type of insurance is designed to offer financial protection against unforeseen events that may occur during the trip, such as medical emergencies, trip cancellations, lost luggage, or travel delays. Unlike annual travel insurance, which covers multiple trips within a year, single trip travel insurance is tailored for one specific journey, making it ideal for travelers who do not travel frequently. The market for single trip travel insurance has been expanding due to the increasing number of international travelers and the growing awareness of the potential risks associated with travel. Insurance providers offer a range of policies that can be customized based on the destination, duration, and specific needs of the traveler. This market is characterized by a variety of players, including insurance companies, brokers, and intermediaries, each offering different levels of coverage and pricing options. As travel continues to become more accessible and affordable, the demand for single trip travel insurance is expected to rise, providing travelers with peace of mind and financial security during their journeys.

Personal Insurance, Group Insurance in the Global Single Trip Travel Insurance Market:

Personal insurance and group insurance are two primary categories within the Global Single Trip Travel Insurance Market, each catering to different needs and preferences of travelers. Personal insurance is designed for individual travelers or families who are planning a single trip. This type of insurance provides coverage tailored to the specific needs of the individual or family, offering protection against a range of potential travel-related issues. Personal insurance policies can be customized to include coverage for medical emergencies, trip cancellations, lost or stolen luggage, and other unforeseen events. The flexibility of personal insurance makes it an attractive option for travelers who want to ensure they are adequately protected during their journey. On the other hand, group insurance is aimed at organizations or groups of people traveling together, such as corporate teams, school trips, or tour groups. Group insurance policies offer coverage for multiple individuals under a single policy, often at a reduced rate compared to purchasing individual policies for each traveler. This type of insurance is beneficial for organizations that frequently organize group travel, as it simplifies the process of obtaining coverage and can result in cost savings. Group insurance policies typically provide similar coverage options as personal insurance, including medical emergencies, trip cancellations, and lost luggage, but are designed to accommodate the needs of larger groups. Both personal and group insurance play a crucial role in the Global Single Trip Travel Insurance Market, providing travelers with the necessary protection and peace of mind to enjoy their trips without worrying about potential financial setbacks. As the market continues to grow, insurance providers are likely to develop more innovative and tailored solutions to meet the evolving needs of travelers, ensuring that both personal and group insurance remain integral components of the travel insurance landscape.

Insurance Intermediaries, Insurance Company, Bank, Insurance Broker, Others in the Global Single Trip Travel Insurance Market:

The Global Single Trip Travel Insurance Market serves various sectors, including insurance intermediaries, insurance companies, banks, insurance brokers, and others, each playing a significant role in the distribution and utilization of travel insurance products. Insurance intermediaries act as a bridge between the insurance providers and the consumers, helping travelers find the most suitable insurance policies for their needs. They offer expert advice and assistance in selecting the right coverage, ensuring that travelers are adequately protected during their trips. Insurance companies are the primary providers of single trip travel insurance, offering a wide range of policies that cater to different types of travelers and their specific needs. These companies are responsible for underwriting the policies, setting the terms and conditions, and handling claims when necessary. Banks also play a role in the travel insurance market by offering insurance products as part of their financial services portfolio. Many banks partner with insurance companies to provide travel insurance to their customers, often bundling it with other financial products such as credit cards or personal loans. This makes it convenient for travelers to obtain insurance coverage while managing their finances. Insurance brokers, similar to intermediaries, assist travelers in finding the best insurance policies by comparing different options from various providers. They offer personalized service and expert advice, helping travelers navigate the complexities of the insurance market. Other players in the market include travel agencies and online platforms that offer travel insurance as part of their services. These platforms provide travelers with easy access to insurance products, allowing them to compare and purchase policies online. The involvement of these various sectors in the Global Single Trip Travel Insurance Market ensures that travelers have access to a wide range of insurance options, making it easier for them to find coverage that suits their needs and budget. As the market continues to evolve, these sectors will likely play an increasingly important role in shaping the future of travel insurance, driving innovation and improving the overall customer experience.

Global Single Trip Travel Insurance Market Outlook:

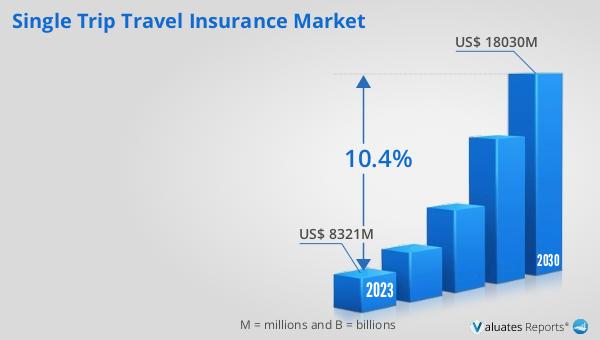

The outlook for the Global Single Trip Travel Insurance Market indicates a promising growth trajectory. The market is anticipated to expand from a valuation of approximately US$ 9,985 million in 2024 to an impressive US$ 18,030 million by 2030. This growth is expected to occur at a Compound Annual Growth Rate (CAGR) of 10.4% over the forecast period. This significant increase in market size reflects the rising demand for travel insurance as more people embark on international and domestic trips. The growing awareness of the potential risks associated with travel, such as medical emergencies, trip cancellations, and lost luggage, is driving more travelers to seek insurance coverage. Additionally, the increasing accessibility and affordability of travel are contributing to the expansion of the market. As more people travel for leisure, business, or other purposes, the need for reliable and comprehensive travel insurance becomes more apparent. Insurance providers are responding to this demand by offering a wider range of products and services, tailored to meet the diverse needs of travelers. This growth in the Global Single Trip Travel Insurance Market is not only beneficial for travelers, who gain peace of mind and financial protection, but also for the insurance industry, which stands to benefit from the increased demand for its products and services.

| Report Metric | Details |

| Report Name | Single Trip Travel Insurance Market |

| Accounted market size in 2024 | US$ 9985 million |

| Forecasted market size in 2030 | US$ 18030 million |

| CAGR | 10.4 |

| Base Year | 2024 |

| Forecasted years | 2025 - 2030 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | Allianz, AIG, Munich RE, Generali, Tokio Marine, Sompo Japan, CSA Travel Protection, AXA, Pingan Baoxian, Mapfre Asistencia, USI Affinity, Seven Corners, Hanse Merkur, MH Ross, STARR |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |