What is Global Corporate Finance Services Market?

The Global Corporate Finance Services Market is a vast and dynamic sector that plays a crucial role in the financial health and strategic growth of businesses worldwide. This market encompasses a wide range of services designed to assist corporations in managing their financial activities, optimizing their capital structure, and achieving their strategic objectives. These services include mergers and acquisitions, capital market advisory, private fund consulting, and board advisory services, among others. The primary goal of corporate finance services is to maximize shareholder value through long-term and short-term financial planning and the implementation of various strategies. Companies across different industries rely on these services to navigate complex financial landscapes, make informed investment decisions, and enhance their competitive edge. As businesses continue to expand globally, the demand for sophisticated corporate finance services is expected to grow, driven by the need for expert guidance in financial management and strategic planning. This market is characterized by its diversity, with service providers ranging from large multinational financial institutions to specialized boutique firms, each offering tailored solutions to meet the unique needs of their clients. The Global Corporate Finance Services Market is integral to the functioning of the global economy, facilitating capital flow, fostering innovation, and supporting sustainable business growth.

Mergers and Acquisitions, Capital Market, Private Fund Consulting, Board Advisory Services in the Global Corporate Finance Services Market:

Mergers and acquisitions (M&A) are a significant component of the Global Corporate Finance Services Market, involving the consolidation of companies or assets to achieve strategic objectives such as growth, diversification, or competitive advantage. M&A activities require meticulous planning, negotiation, and execution, often facilitated by corporate finance professionals who provide expertise in valuation, due diligence, and deal structuring. These transactions can be complex, involving various legal, financial, and regulatory considerations, and are crucial for companies looking to expand their market presence or enter new markets. Capital market services, another vital aspect of corporate finance, involve advising companies on raising capital through equity or debt offerings. This includes initial public offerings (IPOs), secondary offerings, and private placements. Corporate finance experts assist businesses in navigating the intricacies of capital markets, ensuring compliance with regulatory requirements, and optimizing their capital structure to support growth initiatives. Private fund consulting services cater to the needs of private equity firms, venture capitalists, and other investment entities, providing strategic advice on fund formation, investment strategies, and portfolio management. These services are essential for investors seeking to maximize returns while managing risks in a competitive investment landscape. Board advisory services focus on enhancing corporate governance and strategic decision-making at the board level. Corporate finance professionals offer insights on financial performance, risk management, and strategic planning, helping boards make informed decisions that align with shareholder interests. These services are particularly important in today's rapidly changing business environment, where boards face increasing scrutiny and pressure to deliver sustainable value. Overall, the Global Corporate Finance Services Market is a multifaceted industry that supports businesses in achieving their financial and strategic goals through a range of specialized services.

Business, Finance in the Global Corporate Finance Services Market:

The usage of Global Corporate Finance Services Market in business and finance is extensive and multifaceted, providing essential support to organizations in navigating the complexities of today's economic landscape. In the realm of business, corporate finance services play a pivotal role in strategic planning and decision-making. Companies rely on these services to assess potential investment opportunities, evaluate financial risks, and develop strategies for growth and expansion. By leveraging the expertise of corporate finance professionals, businesses can make informed decisions that align with their long-term objectives and enhance their competitive position. These services also assist companies in optimizing their capital structure, ensuring they have the necessary resources to fund operations and pursue strategic initiatives. In the finance sector, corporate finance services are instrumental in facilitating capital flow and investment activities. Financial institutions, investment firms, and other entities utilize these services to manage their portfolios, assess market trends, and identify lucrative investment opportunities. Corporate finance professionals provide valuable insights into market dynamics, helping clients make informed investment decisions and manage risks effectively. Additionally, these services support financial institutions in structuring complex financial transactions, such as mergers and acquisitions, debt financing, and equity offerings. By providing expert guidance and strategic advice, corporate finance services enable businesses and financial institutions to navigate the challenges of the global economy and achieve their financial objectives. The Global Corporate Finance Services Market is a critical component of the business and finance sectors, offering a wide range of services that drive growth, innovation, and value creation.

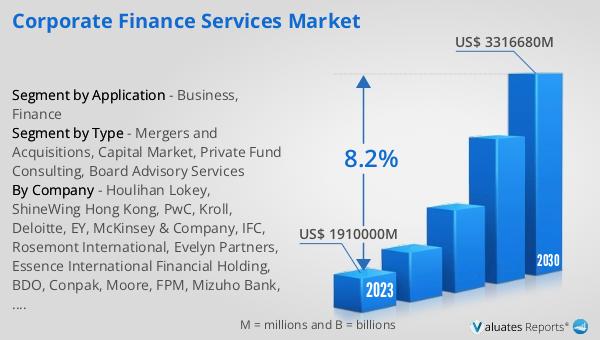

Global Corporate Finance Services Market Outlook:

The global market for Corporate Finance Services was valued at approximately $2,219,540 million in 2024, and it is anticipated to expand significantly, reaching an estimated size of $3,824,290 million by 2031. This growth trajectory represents a compound annual growth rate (CAGR) of 8.2% over the forecast period. The robust expansion of this market underscores the increasing demand for corporate finance services as businesses seek to optimize their financial strategies and navigate the complexities of the global economy. The projected growth is driven by several factors, including the rising need for expert financial guidance, the increasing complexity of financial transactions, and the growing importance of strategic financial planning in achieving business objectives. As companies continue to expand their operations and explore new markets, the demand for sophisticated corporate finance services is expected to rise, further fueling market growth. The Global Corporate Finance Services Market is poised for substantial growth, reflecting the critical role these services play in supporting businesses and financial institutions in achieving their strategic and financial goals. This market outlook highlights the dynamic nature of the corporate finance services industry and its vital contribution to the global economy.

| Report Metric | Details |

| Report Name | Corporate Finance Services Market |

| Accounted market size in year | US$ 2219540 million |

| Forecasted market size in 2031 | US$ 3824290 million |

| CAGR | 8.2% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | Houlihan Lokey, ShineWing Hong Kong, PwC, Kroll, Deloitte, EY, McKinsey & Company, IFC, Rosemont International, Evelyn Partners, Essence International Financial Holding, BDO, Conpak, Moore, FPM, Mizuho Bank, Opus Financial Group, UHY Hacker Young, PKF International, Findex Group |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |