What is Global Personal Travel Insurance Market?

The Global Personal Travel Insurance Market is a rapidly evolving sector that caters to the needs of travelers seeking financial protection against unforeseen events during their journeys. This market encompasses a range of insurance products designed to cover various travel-related risks, such as trip cancellations, medical emergencies, lost luggage, and other unexpected incidents that can occur while traveling domestically or internationally. As globalization and international travel continue to rise, the demand for personal travel insurance has grown significantly. Travelers are increasingly aware of the potential risks associated with travel and are seeking comprehensive insurance solutions to safeguard their trips. The market is characterized by a diverse array of insurance providers, including traditional insurance companies, specialized travel insurance firms, and digital platforms offering tailored policies. These providers offer a variety of coverage options to meet the unique needs of different travelers, whether they are embarking on a single trip or traveling frequently throughout the year. The Global Personal Travel Insurance Market is poised for continued growth as more individuals recognize the importance of protecting their travel investments and ensuring peace of mind while exploring the world.

Single Trip Coverage, Annual Multi Trip Coverage, Other in the Global Personal Travel Insurance Market:

In the Global Personal Travel Insurance Market, coverage options are typically categorized into Single Trip Coverage, Annual Multi-Trip Coverage, and other specialized plans. Single Trip Coverage is designed for travelers who embark on one-off journeys, providing protection for the duration of a specific trip. This type of coverage is ideal for individuals or families planning a vacation or business trip, as it offers financial protection against trip cancellations, medical emergencies, and other unforeseen events that may occur during the trip. Single Trip Coverage is often customizable, allowing travelers to select the level of coverage that best suits their needs and budget. On the other hand, Annual Multi-Trip Coverage is tailored for frequent travelers who embark on multiple trips throughout the year. This type of policy provides continuous coverage for an entire year, eliminating the need to purchase separate insurance for each trip. Annual Multi-Trip Coverage is particularly beneficial for business travelers, travel enthusiasts, or individuals with family living abroad, as it offers convenience and cost savings. These policies typically cover a wide range of travel-related risks, including medical emergencies, trip cancellations, and lost luggage, ensuring that travelers are protected no matter how often they travel. In addition to Single Trip and Annual Multi-Trip Coverage, the Global Personal Travel Insurance Market also offers other specialized plans to cater to specific travel needs. For instance, some providers offer coverage for adventure sports or activities, which may not be included in standard policies. These specialized plans are designed for travelers who engage in high-risk activities such as skiing, scuba diving, or mountain climbing, providing them with the necessary protection in case of accidents or injuries. Other specialized plans may include coverage for senior travelers, students studying abroad, or expatriates living in foreign countries. These plans are tailored to address the unique risks and challenges faced by these specific groups, ensuring that they have adequate protection during their travels. Overall, the Global Personal Travel Insurance Market offers a wide range of coverage options to meet the diverse needs of travelers, providing them with peace of mind and financial security while exploring the world.

Insurance Intermediaries, Insurance Company, Bank, Insurance Broker, Others in the Global Personal Travel Insurance Market:

The usage of the Global Personal Travel Insurance Market spans various channels, including Insurance Intermediaries, Insurance Companies, Banks, Insurance Brokers, and others. Insurance Intermediaries play a crucial role in connecting travelers with suitable insurance products. These intermediaries, which include travel agencies and online platforms, offer a convenient way for travelers to compare and purchase travel insurance policies. They provide valuable information and guidance, helping travelers understand the different coverage options available and select the policy that best meets their needs. Insurance Companies are the primary providers of travel insurance products, offering a wide range of policies to cater to different traveler profiles. These companies leverage their expertise and resources to design comprehensive insurance solutions that address the various risks associated with travel. They also invest in marketing and distribution channels to reach a broader audience and increase their market share. Banks also play a significant role in the Global Personal Travel Insurance Market by offering travel insurance as part of their financial services portfolio. Many banks partner with insurance companies to provide travel insurance products to their customers, often bundling these policies with credit card offerings or other banking services. This approach allows banks to enhance their value proposition and strengthen customer loyalty. Insurance Brokers act as intermediaries between travelers and insurance companies, providing personalized advice and assistance in selecting the right travel insurance policy. Brokers have in-depth knowledge of the insurance market and can offer tailored recommendations based on the specific needs and preferences of their clients. They also assist with claims processing and other administrative tasks, ensuring a smooth and hassle-free experience for travelers. Other channels in the Global Personal Travel Insurance Market include digital platforms and mobile applications that offer innovative and user-friendly solutions for purchasing travel insurance. These platforms leverage technology to streamline the insurance buying process, allowing travelers to compare policies, obtain quotes, and purchase coverage online. They also offer additional features such as policy management, claims filing, and customer support, enhancing the overall customer experience. In summary, the Global Personal Travel Insurance Market utilizes a variety of channels to reach and serve travelers, providing them with convenient access to comprehensive insurance solutions that protect their travel investments.

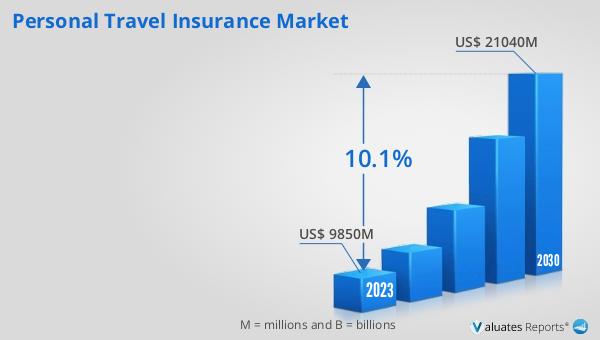

Global Personal Travel Insurance Market Outlook:

The outlook for the Global Personal Travel Insurance Market indicates a promising growth trajectory, with the market expected to expand from $11,820 million in 2024 to $21,040 million by 2030. This growth represents a Compound Annual Growth Rate (CAGR) of 10.1% over the forecast period. The increasing awareness of travel-related risks and the growing demand for comprehensive insurance solutions are key drivers of this market expansion. As more individuals embark on domestic and international journeys, the need for financial protection against unforeseen events such as trip cancellations, medical emergencies, and lost luggage becomes increasingly important. Insurance providers are responding to this demand by offering a diverse range of products and services that cater to the unique needs of different travelers. The market is also benefiting from advancements in technology, which are making it easier for travelers to access and purchase insurance products online. Digital platforms and mobile applications are streamlining the insurance buying process, providing travelers with convenient and user-friendly solutions. Additionally, partnerships between insurance companies, banks, and other financial institutions are enhancing the distribution and accessibility of travel insurance products. As the Global Personal Travel Insurance Market continues to grow, it is expected to play a vital role in ensuring the safety and security of travelers worldwide.

| Report Metric | Details |

| Report Name | Personal Travel Insurance Market |

| Accounted market size in 2024 | US$ 11820 in million |

| Forecasted market size in 2030 | US$ 21040 million |

| CAGR | 10.1 |

| Base Year | 2024 |

| Forecasted years | 2025 - 2030 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | Allianz, AIG, Munich RE, Generali, Tokio Marine, Sompo Japan, CSA Travel Protection, AXA, Pingan Baoxian, Mapfre Asistencia, USI Affinity, Seven Corners, Hanse Merkur, MH Ross, STARR |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |