What is Global Cruise Travel Insurance Market?

The Global Cruise Travel Insurance Market is a specialized segment within the broader travel insurance industry, focusing specifically on providing coverage for travelers embarking on cruise vacations. This market caters to the unique needs of cruise travelers, offering protection against a variety of potential risks and unforeseen events that can occur before or during a cruise trip. These risks include trip cancellations, medical emergencies, lost luggage, and other travel-related issues that can disrupt a cruise vacation. The market is driven by the increasing popularity of cruise travel, as more people seek the convenience and luxury of cruise vacations. As a result, there is a growing demand for insurance products that offer comprehensive coverage tailored to the specific needs of cruise travelers. This market is characterized by a range of insurance products, including single trip coverage, annual multi-trip coverage, and other specialized policies designed to meet the diverse needs of cruise travelers. The Global Cruise Travel Insurance Market is expected to continue growing as more travelers recognize the importance of protecting their investment in cruise vacations and seek out insurance solutions that provide peace of mind and financial protection.

Single Trip Coverage, Annual Multi Trip Coverage, Other in the Global Cruise Travel Insurance Market:

Single Trip Coverage in the Global Cruise Travel Insurance Market is designed for travelers who plan to take one cruise trip within a specified period. This type of coverage is ideal for individuals or families who do not travel frequently but want to ensure they are protected during their cruise vacation. Single trip coverage typically includes benefits such as trip cancellation and interruption protection, which reimburses travelers for non-refundable expenses if they need to cancel or cut short their trip due to covered reasons like illness, injury, or unforeseen events. Additionally, it often covers medical emergencies, providing financial assistance for medical treatment and evacuation if necessary. Baggage loss and delay coverage is another common feature, offering compensation for lost, stolen, or delayed luggage. This type of insurance is particularly appealing to first-time cruisers or those taking a once-in-a-lifetime cruise, as it provides comprehensive protection for a single journey.

Insurance Intermediaries, Insurance Company, Bank, Insurance Broker, Others in the Global Cruise Travel Insurance Market:

Annual Multi-Trip Coverage, on the other hand, is designed for frequent travelers who plan to take multiple cruise trips within a year. This type of coverage offers the convenience of a single policy that covers all trips taken during the policy period, eliminating the need to purchase separate insurance for each trip. Annual multi-trip coverage typically includes the same benefits as single trip coverage, such as trip cancellation and interruption protection, medical emergency coverage, and baggage loss and delay coverage. However, it may also offer additional benefits, such as coverage for missed connections or travel delays, which can be particularly useful for frequent travelers who may encounter more travel disruptions. This type of insurance is ideal for avid cruisers, business travelers, or individuals who take multiple vacations each year, as it provides comprehensive protection for all their cruise trips at a potentially lower cost than purchasing separate policies for each trip.

Global Cruise Travel Insurance Market Outlook:

Other types of coverage in the Global Cruise Travel Insurance Market may include specialized policies tailored to specific needs or preferences. For example, some insurers offer policies that include coverage for pre-existing medical conditions, which can be crucial for travelers with ongoing health issues. Additionally, there may be options for adventure or sports coverage, which provides protection for travelers who plan to participate in activities like scuba diving or zip-lining during their cruise. Some policies may also offer coverage for travel supplier default, which protects travelers if their cruise line or tour operator goes bankrupt. These specialized policies cater to the diverse needs of cruise travelers, ensuring that they have access to the coverage that best suits their individual circumstances. Overall, the Global Cruise Travel Insurance Market offers a wide range of insurance products designed to provide peace of mind and financial protection for travelers embarking on cruise vacations.

| Report Metric | Details |

| Report Name | Cruise Travel Insurance Market |

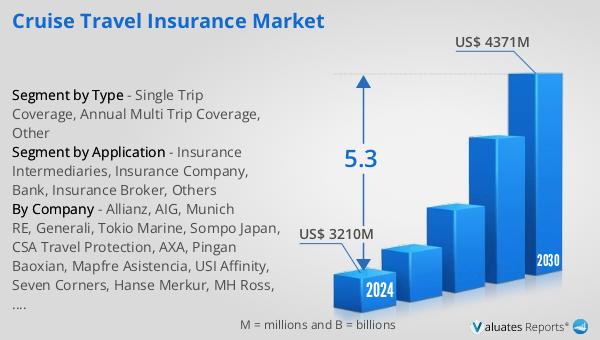

| Accounted market size in 2024 | US$ 3210 million |

| Forecasted market size in 2030 | US$ 4371 million |

| CAGR | 5.3 |

| Base Year | 2024 |

| Forecasted years | 2025 - 2030 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | Allianz, AIG, Munich RE, Generali, Tokio Marine, Sompo Japan, CSA Travel Protection, AXA, Pingan Baoxian, Mapfre Asistencia, USI Affinity, Seven Corners, Hanse Merkur, MH Ross, STARR |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |