What is Global Insurance Franchise Market?

The Global Insurance Franchise Market is a dynamic and expansive sector that encompasses a wide range of insurance services offered through franchise models across the globe. This market involves the distribution of insurance products and services by franchisees who operate under the brand and guidelines of a larger insurance company. The franchise model allows for a standardized approach to offering insurance services, ensuring consistency and reliability for consumers. This market is driven by the increasing demand for insurance products due to rising awareness about financial security and risk management. The franchise model provides a unique opportunity for entrepreneurs to enter the insurance industry with the backing of an established brand, reducing the risks associated with starting a new business. The global reach of this market means that it is influenced by various factors, including economic conditions, regulatory changes, and technological advancements. As a result, the Global Insurance Franchise Market is constantly evolving, adapting to new trends and consumer needs to remain competitive and relevant in the ever-changing landscape of the insurance industry.

Office Agency, Retail Agency in the Global Insurance Franchise Market:

In the context of the Global Insurance Franchise Market, Office Agency and Retail Agency play crucial roles in the distribution and accessibility of insurance products. Office Agencies are typically physical locations where franchisees operate under the umbrella of a larger insurance company. These agencies serve as the primary point of contact for clients seeking insurance services, providing personalized consultations and tailored insurance solutions. The office setting allows for a professional environment where clients can discuss their insurance needs in detail, ensuring they receive the most suitable coverage options. Office Agencies benefit from the brand recognition and support of the parent insurance company, which helps in building trust and credibility with clients. On the other hand, Retail Agencies focus on making insurance products more accessible to the general public. These agencies often operate in high-traffic areas such as shopping malls or commercial districts, where they can reach a broader audience. Retail Agencies aim to simplify the insurance purchasing process by offering straightforward and easy-to-understand products that cater to the everyday needs of consumers. The presence of Retail Agencies in convenient locations encourages impulse purchases and allows consumers to quickly obtain necessary coverage without the need for extensive consultations. Both Office and Retail Agencies contribute significantly to the growth and expansion of the Global Insurance Franchise Market by ensuring that insurance products are readily available to a diverse range of consumers. The synergy between these two types of agencies allows the market to cater to both individual and enterprise clients, providing comprehensive coverage options that meet varying needs and preferences. As the market continues to evolve, the role of Office and Retail Agencies will likely expand, incorporating new technologies and innovative approaches to enhance customer experience and streamline operations. This adaptability is essential for maintaining competitiveness in the fast-paced and ever-changing insurance industry.

Individual, Enterprise in the Global Insurance Franchise Market:

The Global Insurance Franchise Market serves a wide array of users, including individuals and enterprises, each with distinct needs and requirements. For individuals, the market offers a variety of personal insurance products such as life, health, auto, and home insurance. These products are designed to provide financial protection and peace of mind, ensuring that individuals and their families are safeguarded against unforeseen events. The franchise model allows individuals to access these products through local agencies that offer personalized service and expert advice. This localized approach helps build trust and ensures that individuals receive coverage that is tailored to their specific circumstances. For enterprises, the Global Insurance Franchise Market provides comprehensive business insurance solutions that protect against risks such as property damage, liability, and employee-related issues. Enterprises benefit from the expertise and resources of established insurance companies, which help them navigate complex insurance needs and regulatory requirements. The franchise model allows businesses to work with local agencies that understand the unique challenges and opportunities within their specific industry or region. This localized knowledge is invaluable in crafting insurance solutions that are both effective and efficient. Additionally, the franchise model offers enterprises the flexibility to scale their insurance coverage as their business grows, ensuring that they remain adequately protected at all stages of development. Overall, the Global Insurance Franchise Market plays a vital role in providing both individuals and enterprises with the insurance products and services they need to manage risk and achieve financial security.

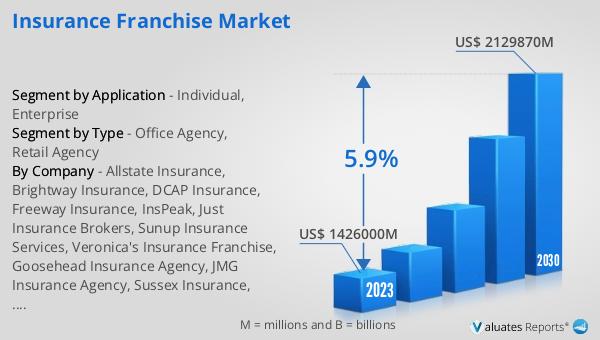

Global Insurance Franchise Market Outlook:

The global market for Insurance Franchise was valued at approximately $1,590,180 million in 2024, and it is anticipated to expand to a revised size of around $2,362,070 million by 2031. This growth trajectory represents a compound annual growth rate (CAGR) of 5.9% over the forecast period. This significant increase in market size underscores the growing demand for insurance services delivered through franchise models. The expansion of this market can be attributed to several factors, including the increasing awareness of the importance of insurance in financial planning and risk management. As more individuals and businesses recognize the need for comprehensive insurance coverage, the demand for accessible and reliable insurance services continues to rise. The franchise model offers a unique advantage by combining the strength and reputation of established insurance companies with the entrepreneurial spirit and local expertise of franchisees. This synergy allows for the efficient distribution of insurance products and services, meeting the diverse needs of consumers across different regions. As the market continues to grow, it is expected to adapt to emerging trends and technologies, further enhancing its ability to serve a wide range of clients effectively.

| Report Metric | Details |

| Report Name | Insurance Franchise Market |

| Accounted market size in year | US$ 1590180 million |

| Forecasted market size in 2031 | US$ 2362070 million |

| CAGR | 5.9% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | Allstate Insurance, Brightway Insurance, DCAP Insurance, Freeway Insurance, InsPeak, Just Insurance Brokers, Sunup Insurance Services, Veronica's Insurance Franchise, Goosehead Insurance Agency, JMG Insurance Agency, Sussex Insurance, Elders Insurance, NFP, Sebanda Insurance, Fiesta Insurance Franchise Corporation, All-Risks Insurance Brokers, Aon Risk Services Australia, Velox Insurance |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |